Table of Contents

To become a successful investor, you must learn different ways to trade in the market. As the market has developed and is evolving, traditional methods of stock trading are not in the game anymore. If you’re someone who wants to become a trader, you know very well that it’s going to be complex, challenging, and risky. To succeed in this incredibly competitive environment, you will need to develop a set of tools and strategies that you can add to your trading arsenal. In this article we are providing top 10 ways to learn stock trading.

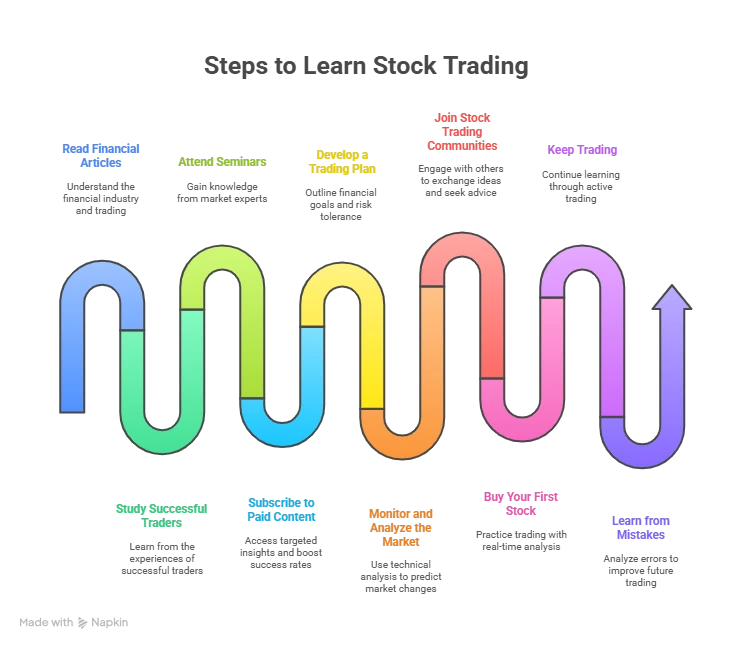

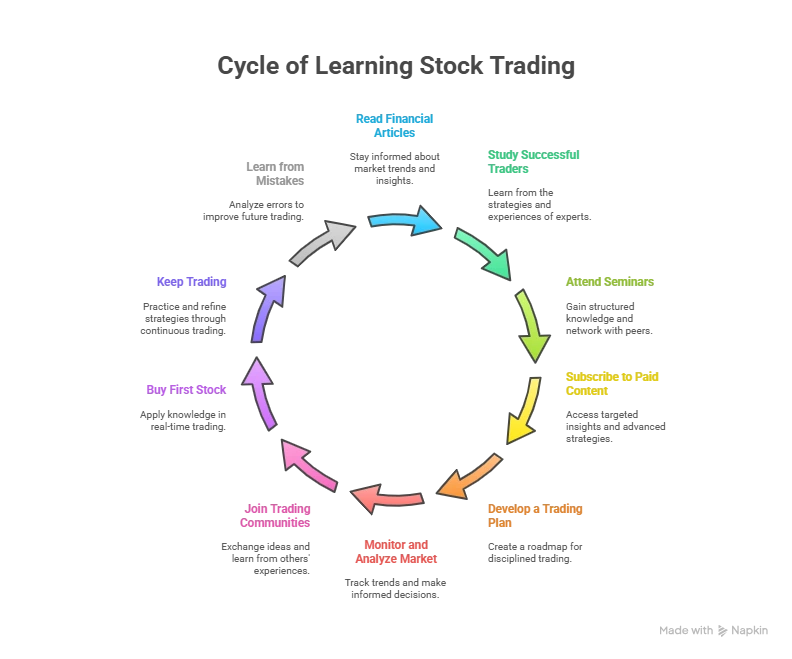

10 Great Ways To Learn Stock Trading

Here are 10 effective ways to master stock trading in 2025:

1. Read Financial Articles

Reading financial articles from newspapers, financial magazines, blogs, or social media posts by a finance analyst or financial institution is a way to understand the financial industry and trading, and gives you insight to make profits.

2. Study Successful Traders

One of the best ways to get information about stock trading is to study the successful traders in the industry. Traders like Jesse Livermore, William Delbert Gann, Nick Leeson, David Tepper, and others are truly inspirational. Reading about them is going to be full of information. Also, every successful person’s narrative contains some tales and valuable lessons regarding market trading. Beginners can learn from the experiences of successful traders and apply them to their stock trading adventure.

3. Attend Seminars, Take Classes

Seminars can give significant knowledge into the general market and specific investment types. Most workshops and seminars will concentrate on one specific part of the market and how the speaker has discovered achievement using their very own procedures throughout the years. Not all seminars are paid. A few seminars are without given which can be a helpful experience, simply be aware of the attempt to close the deal that will quite often come toward the end.

Start Investing Like A Pro! Enroll In Our Stock Market Course!

4. Subscribe To Paid Content

There are many great paid content platforms which you can subscribe to and get the edge needed to boost your success rates. It is more targeted and it teaches you insights that you might have otherwise missed. You should do a proper investigation of the platform offering paid content to ascertain its credibility. Check out the best reliable ways for beginners to learn stock market trading and how to make profits from buying and selling.

5. Develop A Trading Plan

A well-structured trading plan is essential for any trader’s success. It should outline your financial goals, risk tolerance, preferred trading style, and exit strategies. A trading plan acts as a roadmap, helping you stay disciplined and avoid impulsive decisions that can lead to significant losses

6. Monitor And Analyze The Market

There is a tool method called Technical analysis which predicts the change in the market based on the available past data which helps an investor to cut their losses. As a beginner investor, you must try to monitor and analyze the market continuously by way of news or the analysis provided to you by your broker. This will help you to get a general idea of the demand and supply equilibrium and the prevailing market trends, and you will be able to cut your losses by a huge margin.

7. Join Stock Trading Communities

Engaging with a community can help you stay motivated and learn from the mistakes and successes of others. Being part of stock trading communities can offer immense learning opportunities. Forums, online groups, and social media platforms dedicated to trading discussions provide a platform to exchange ideas, seek advice, and learn from the experiences of other traders.

8. Buy Your First Stock

Once you understand the basics of stock trading and you have created a trading strategy it is time to take that giant step by buying your first stock. This way you are practicing what you have learned and you can now analyze real-time trading to keep learning.

9. Keep Trading

Don’t stop at your first stock, make further investments. This way you are continuing the learning curve by practicing; actively trading with a well-thought-out trading strategy is a good way to continue learning how to trade stocks.

10. Learn from your mistakes

Mistakes are the best way to make a person a better investor. You should never be discouraged if you incur a loss in the market but analyze the thing you did wrong in the process. If you can analyze and learn from the previous mistake, you will never commit the same mistake again. And no errors would mean fewer losses and higher profits.

| Achieve Financial Freedom with these courses? | |

| Stock Market Trading Course | |

| Forex Trading Course | |

| Mutual Funds Course |

Top 10 Stock Trading Strategies

1: What is a stock?

Buy and Hold

A buy and hold strategy is a long-term, passive strategy in which investors keep a relatively stable portfolio over time, regardless of short-term fluctuations. That means staying invested even when the markets look uncertain, with the hope that stocks will gradually increase in value over a long period of time.

Swing Trading

This strategy seeks to capture short-term gains over a period of days or weeks. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance.

Value Investing

Aim to identify stocks whose prices don’t reflect what they’re really worth. when the market grasps these stocks’ true value, share prices will shoot up.

Momentum Trading

It aim to capitalize on the continuance of existing trends in the market. Momentum traders usually buy or sell an asset moving intensely in one direction. And exiting when this movement shows signs of reversing. Momentum investing can work, but it may not be practical for all investors. As an individual investor, practicing momentum investing will most likely lead to overall portfolio losses.

Scalping

This involves making multiple trades in a short period of time. This allows traders to take advantage of short-term price movements and volatility in the market. High-frequency trading can also increase the chances of making a profit.

Positions Trading

It is a popular long-term trading strategy that allows individual traders to hold a position for a long period of time, which is usually months or years. Position traders ignore short-term price movements and prefer to rely on more precise fundamental analysis and long-term trends.

Day Trading

In this strategy one can learn how to navigate the trading platform, understand the mechanics of placing trades, and become familiar with the market and its movements. Additionally, it can also help you to develop a risk management plan and to better understand the psychology of trading.

Option Trading

It is a type of trading in which you may bet on the future direction of the price of an asset with the help of something called an options contract. If you’re an options trader, you might buy a “call” option if you believe that the asset will rise in price, or a “put” option if they believe a stock might tank in price.

Positions Trading

It is a strategy in which traders or investors hold a specific position for weeks or months and largely base their decisions on macroeconomic trends and fundamental analysis.

Market Making

It is a strategy used by traders who want to provide liquidity to the market by engaging in traders. In the crypto world, market making can be a profitable strategy because it allows traders to capture the various differences between bid and ask prices.

Master The Art Of Options trading – Enroll In Our Stock Course!!

Tips For Investing In Stock

- Buy the right investment

- Avoid individual stocks if you’re a beginner

- Create a diversified portfolio

- Be prepared for a downturn

- Try a simulator before investing real money

- Stay committed to your long-term portfolio

- Start now

- Avoid short-term trading

- Keep investing over time

Conclusion: Start Small, Learn Smart, Grow Steadily

The road to becoming a skilled trader is not a sprint but a marathon. You don’t need a finance degree to trade smartly. In 2025, the tools, knowledge, and support are at your fingertips, you just need the right mindset and consistency.

Start by choosing one or two methods from this list, invest time daily, and gradually upgrade your skill. Remember, the most successful traders are not those who earn millions overnight, but those who survive and thrive consistently.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is the difference between Stock and Share?

A stock and a share are essentially one and the same. They both represent a part of the capital of a joint stock company. In India it was always called shares whereas in the US they have been referred to as stocks. They essentially mean the same thing.

Where Can I Find Stock Related Information?

There are various sources for finding stock related information like the newspaper, websites, company annual reports etc. Brokerage houses like Tradebulls also provide a plethora of rich stock market content and analytics on the website itself.

How Would You Choose Stock For Your Portfolio?

You choose stock by screening the stocks in the market on profitability, risk, valuations etc. Such analytics are available on the Tradebulls website for traders to easily create a portfolio. It is always advisable to check with your RM or advisor before taking portfolio decisions.

Is stock trading safe for beginners?

Yes, stock trading is safe for beginners if approached with proper education, risk management, and small investments. Start with virtual trading or low-risk stocks and gradually build your experience.

How much money do I need to start stock trading in India?

You can start trading with as little as ₹500. Many discount brokers in 2025 allow zero brokerage and no minimum deposit, making it easy to begin with small capital.

Do I need a background in finance to learn trading?

Not at all. Anyone can learn stock trading with the right guidance, tools, and consistent practice. Many successful traders come from engineering, arts, or even teaching backgrounds.