Table of Contents

If you are in your 30s, you’re probably living in one of the most financially complex decades of your life. You’re dealing with home EMIs, raising kids, supporting aging parents, and somehow trying to build wealth for your own retirement – all while inflation quietly eats away at your purchasing power.

But there is good news! You have career stability, higher income, and life experience that Gen Z lacks. You understand the value of money, have seen multiple market cycles, and can make more informed investment decisions. This guide will show you exactly how to navigate investing during your peak earning years while managing multiple financial responsibilities.

Start investing like a pro. Enroll in our Stock Market course!

Why Millennials Must Take Investing Seriously

Although millennials have decades to retirement, the earlier you start investing, the more “compounding advantage” you get. This section explains the core reasons why investing is non-negotiable:

- Inflation Is a Silent Wealth Killer

- If inflation is 6% per year in India, your ₹1,00,000 will lose 50% of its value in about 12 years.

- Parking money in a regular savings account (interest ~3-4%) means your money is actually shrinking in real terms.

- Job Market Volatility

- The gig economy, freelancing and start-up culture means careers are more flexible but less secure.

- A well diversified investment portfolio can be your safety net in periods without a fixed income.

- Changing Life Goals

- Unlike earlier generations, millennials prioritize travel, side hustles, advanced studies and early retirement. These goals require a robust and flexible investment strategy.

- Rising Cost of Aspirations

- Buying a home, sending kids abroad for education or even affording high quality healthcare is far more expensive today than a decade ago. Only disciplined investing keeps you on track.

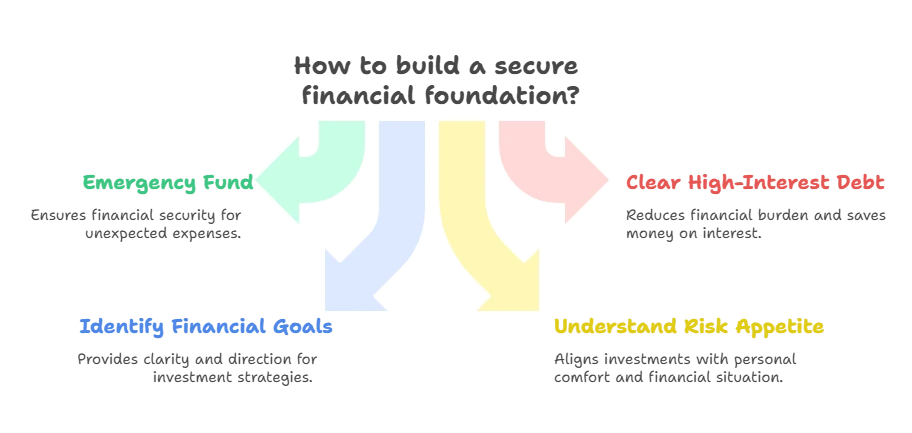

Laying Your Financial Foundation

1: What is a stock?

Before you chase high returns, ensure your foundation is secure.

1. Build an Emergency Fund

-

Keep 6–9 months’ worth of expenses in a safe, liquid tool like a high-interest savings account, sweep-in fixed deposit, or liquid mutual fund.

-

Avoid locking this money in volatile or long-term products, it’s meant for sudden needs (medical bills, job loss, urgent repairs).

2. Clear High-Interest Debt

-

Credit card interest can be 30–40% annually, which no investment can outpace consistently.

-

Pay down personal loans, BNPL dues, and any consumer debt before investing aggressively.

-

Student loans and home loans can be slower to repay if their interest rates are below portfolio growth expectations.

3. Identify Financial Goals and Time Horizons

Break your goals into:

-

Short-term (0–3 years): Travel fund, small business startup, gadgets.

-

Medium-term (3–7 years): Wedding, car, post-graduate education.

-

Long-term (7+ years): Retirement, child’s education, real estate investment.

Clear goals allow you to assign appropriate investment types (e.g., equities for long-term, debt for short-term).

4. Understand Risk Appetite

Risk tolerance is personal, it depends on:

-

Income stability

-

Financial dependents

-

Existing savings

-

Psychological comfort with market volatility

A simple rule: the younger you are, the more allocation to equities makes sense since you have time to recover from downturns.

Invest Smart, Learn Faster – Mutual Fund Course for Kerala

Top Investment Options for Millennials in India

Below is a deeper dive into popular investment avenues, their advantages, risks, and suitability.

| Investment Type | Risk Level | Est. Returns p.a. | Liquidity | Tax Treatment | Ideal For |

|---|---|---|---|---|---|

| Equity Stocks | High | 10–15%+ | High | 15% LTCG (above ₹1 lakh) | Wealth growth |

| Equity Mutual Funds (SIP) | Moderate-High | 8–12% | Medium | LTCG same as above | Busy professionals |

| Index Funds/ETFs | Moderate | 8–10% | High | Low cost, LTCG applies | Passive investors |

| Debt Mutual Funds / Bonds | Low-Mod | 6–8% | High-Med | Taxed as per holding period | Capital preservation |

| Fixed Deposits (FDs) | Low | 5–7% | Medium | Interest taxable | Risk-averse |

| Public Provident Fund | Low | 7–8% (tax-free) | Low (15 yrs) | EEE (fully tax-exempt) | Retirement savings |

| Employee Provident Fund | Low | 8.15% p.a. | Low (till retire) | EEE | Salaried individuals |

| Real Estate | Mod-High | Rental + 7–12% | Very Low | Various taxes apply | Diversification |

| Gold / SGBs | Low-Mod | 6–8% + growth | High | LTCG with indexation (SGB: tax-free on maturity) | Inflation hedge |

| Cryptocurrency | Very High | Highly volatile | High | 30% flat + cess/surcharge | Speculative only |

Use the Entri financial tools to calculate the returns of your investment.

For long-term growth, equities remain unmatched. But success in the stock market requires discipline:

-

Start with Blue-Chip Stocks

-

Examples: HDFC Bank, TCS, Infosys, Reliance Industries.

-

These offer more stability than small, speculative names.

-

-

Go Systematic with Equity Mutual Funds (SIPs)

-

Invest a fixed amount monthly to average your cost over time.

-

Popular categories: Large-Cap Funds, Flexi-Cap Funds, Index Funds.

-

-

Index Funds for Beginners

-

Nifty 50 Index Fund or Sensex ETFs for low-cost, diversified exposure.

-

-

Don’t Try to Time the Market

-

Even experts get it wrong often. Consistency beats perfect timing.

-

Mutual Funds: Millennial-Friendly Investing

Mutual funds pool money for professional management. They’re ideal for those without the time or expertise to pick individual stocks.

-

Equity Funds – Higher risk, higher return potential; best for long-term goals.

-

Debt Funds – Lower volatility; good for short-term needs or portfolio stability.

-

Hybrid Funds – Mix of both; a balance between risk and return.

-

International Funds – Exposure to global markets (e.g., US tech stocks).

Pro Tip: Always compare Expense Ratios; lower costs mean higher net returns over time.

Tax-Smart Investing

Make your money work harder by reducing tax outgo:

-

Equity Linked Savings Scheme (ELSS)

-

Qualifies for ₹1.5 lakh deduction under Section 80C.

-

Only 3-year lock-in (shortest among tax-saving instruments).

-

-

PPF (Public Provident Fund)

-

15-year lock-in, government-backed, tax-free interest.

-

-

National Pension System (NPS)

-

Allows additional ₹50,000 deduction over section 80C.

-

Invests in a mix of equity, bonds, and govt securities.

-

-

ULIPs – Beware

-

Often have high fees; better to keep insurance & investment separate.

-

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreLeveraging Digital Finance Tools

Millennials have unprecedented access to financial technology:

-

Brokerage Platforms: Zerodha, Groww, Upstox for low-cost trading and SIPs.

-

Portfolio Tracking: INDmoney, ET Money for a consolidated investment view.

-

Budgeting Tools: Walnut, Money Manager for expense control.

Automation (like SIP auto-debits) turns investing into a habit rather than a chore.

Step-by-Step Wealth Plan for Millennials

-

Build a fund for emergencies (6–9 months expenses).

-

Get adequate health and term life insurance.

-

Pay off high-interest debt.

-

Begin investing at least 20–30% of income.

-

Allocate:

-

70–80% equities (long-term)

-

20–30% debt/gold/other safer assets

-

-

Review holdings every 6–12 months.

-

Increase SIPs with every salary hike.

-

Diversify across asset classes, avoid “all eggs in one basket”.

Beyond Traditional Assets

-

Skill Upgrades: The best “investment” often is in education or certifications.

-

Side Hustles: Freelancing, e-commerce, consulting, all build additional income streams.

-

REITs (Real Estate Investment Trusts): Offers real estate exposure without the cost of buying property outright.

Insurance: Your Shield Before Growth

Never skip insurance; it protects the asset-building journey. It helps you cover your sudden medical emergencies.

-

Health Insurance: Minimum ₹5–10 lakh coverage.

-

Term Life Insurance: 10–15× annual income coverage.

-

Avoid investment-linked insurance products.

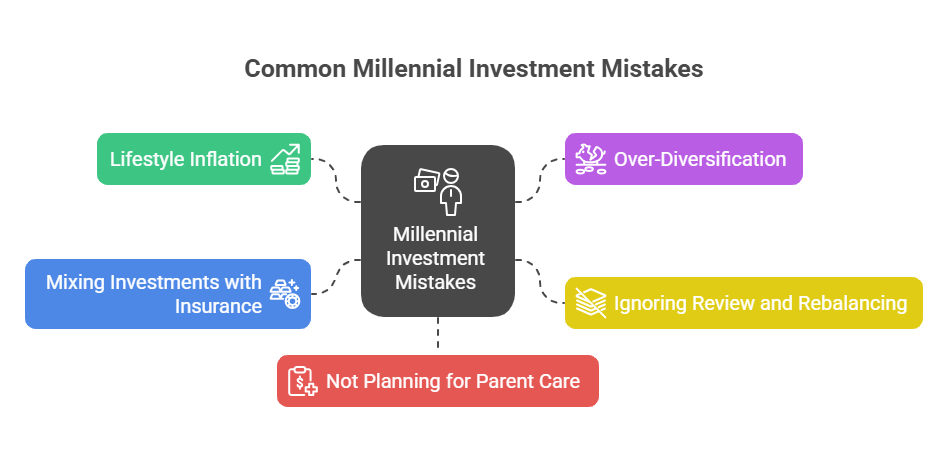

Common Millennial Investment Mistakes

Lifestyle Inflation Without Investment Scaling

As your income grows, so do your expenses. But many millennials increase their lifestyle without scaling their investments. If your salary doubles, your investments should more than double to account for future responsibilities.

Over-Diversification

Having 15-20 mutual funds doesn’t make your portfolio better – it makes it unmanageable. Focus on 6-8 well-chosen funds across categories rather than trying to own every good-performing fund you read about.

Ignoring Regular Review and Rebalancing

Your investment portfolio needs attention. Review quarterly and rebalance annually to ensure your asset allocation is in line with your goals. Life changes like a job switch, a salary hike, or a family addition should trigger portfolio review.

Mixing Investments with Insurance

ULIPs and endowment policies are so tempting for millennials because they seem to solve multiple problems. But these products provide inadequate insurance coverage and poor investment returns. Keep investments and insurance separate for better outcomes.

Not Planning for Parent Care

Many millennials underestimate the cost of parent care. Healthcare inflation is 15% annually and your parents will need significant financial support for medical expenses. Factor this into your financial planning early.

Final Words: The Millennial Advantage

As a millennial investor, you’re tackling the most financially complicated decade of your life and simultaneously creating generational wealth. You’re making peak salaries but also dealing with peak expenses. The trick is to strike a balance between your present needs and long-term security.

Keep in mind, wealth building is a marathon, one that requires patience, discipline, and consistent tuning. The investments you make in your 30s will dictate financial freedom in your 50s and 60s. Begin now, be consistent, and let compound interest work its magic as you concentrate on your career and kids.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Why should millennials start investing early?

Starting early helps millennials harness the power of compounding, allowing investments to grow significantly over time and beat inflation.

How much should a millennial invest each month?

It’s recommended to invest at least 20–30% of monthly income, after accounting for essentials, insurance, and emergency savings.

What is the best first investment for beginners?

Equity mutual funds (especially index funds via SIPs) are beginner-friendly, offering diversification, professional management, and relatively low risk.

How do I build an emergency fund and where should I keep it?

An emergency fund should cover 6–9 months of expenses and be kept in a high-interest savings account, fixed deposit, or liquid mutual fund for easy access.

Are fixed deposits still a good investment option?

FDs are safe and suitable for conservative savers but usually don’t beat inflation. Balance them within a diversified portfolio.

What is SIP and how does it help millennials?

SIP (Systematic Investment Plan) allows automatic, regular investing in mutual funds, making wealth-building effortless and reducing market timing risks.

What kind of insurance should millennials prioritize?

Health and pure term life insurance are crucial to protect against medical and financial emergencies; avoid investment-linked policies.

Should I consider investing in gold or cryptocurrencies?

Gold can hedge inflation but should be a small portion of the portfolio. Cryptocurrencies are highly speculative and risky; invest only what you can afford to lose.

What are tax-saving investment options for millennials?

ELSS mutual funds, PPF, NPS, and select insurance offer tax deductions under Section 80C and other sections of the Income Tax Act.

How can millennials avoid common investment mistakes?

Diversify your investments, avoid following social media “tips” blindly, don’t stop SIPs during market corrections, and regularly review your portfolio to stay aligned with goals.