Table of Contents

When you think of a wise way to manage your finances, the best one is to give equal importance to saving on taxes and earning returns on your investments. In India, many taxpayers rush to invest at the end of the financial year. They overlook smarter, long-term strategies that help you earn returns from investments as well as save taxes. Mutual funds are such an opportunity. Specifically, the subcategory Equity Linked Savings Scheme (ELSS). But how exactly do they help us in tax savings? Are they better than traditional ideas like PPF or FDs? In this blog let us learn more about mutual fund tax savings.

Click here to learn more about mutual funds and ELSS from expert investors! Join Entri now!

Mutual Fund Tax Saving: Introduction

You might find it difficult to believe, but it is true! Mutual funds can not only help us build wealth but also help us save taxes. Equity Linked Savings Scheme (ELSS) is one of the schemes that stands out among other tax-saving mutual funds in India. As we discussed above, this scheme comes with dual benefits. They are:

- Tax deductions under Section 80C

- Potential market-linked growth

ELSS has soon become a favored choice among investors in India, especially after India’s new tax regime. In this blog, we will dive deep into mutual fund tax savings, what ELSS is, how it works, its advantages, and comparisons with other instruments. We will also discuss practical steps for starting your investment journey.

Can Investing in Mutual Funds Help You Save Taxes in India? (Complete Guide)

1: What is a stock?

This is a very important question that comes to the mind of every beginner investor. Let us tackle this question from the very base level. Let us learn what mutual funds are first.

What Are Mutual Funds?

Mutual funds are pooled investment vehicles. Here the money is pooled from different investors to invest into a diversified portfolio. These are often managed by professional fund managers. First, the investors pool money. Then they deploy it across a mix of assets—equities, debts, or both. That decision depends on the strategy chosen. These instruments play a huge role in democratizing access to financial markets. For example, platforms like Systematic Investment Plans (SIPs) make markets accessible even with small, regular sums. Now that we understand what a mutual fund is, we can move to the next part of our Mutual Fund Tax Saving Ideas blog, which is ELSS.

What is ELSS (Equity Linked Savings Scheme)?

Equity Linked Savings Scheme (ELSS) is a category of equity mutual fund. It is specially designed for achieving the purpose of tax savings. Let us learn more about the ELSS instrument.

| Feature | Details |

| Investment Focus | Invests at least 80% in equities

Diversified across sectors and market caps |

| Lock-in Period | Fixed 3-year lock-in

Shortest among Section 80C options |

| Tax Deduction | Up to ₹1.5 lakh deductible under Section 80C

Max tax savings: ₹46,800 (30% slab) |

| Investment Modes | Lump sum or SIP options available

Flexible for all types of investors |

How Does ELSS Help You Save Tax?

Now you might be wondering, how does ELSS help us save tax? We will explain it in the simplest way possible. ELSS investors can claim deductions of up to ₹1.5 lakh per financial year under Section 80C of the Income Tax Act. This reduces taxable income and hence lowers tax liability. For example, up to ₹46,800 saved at a 30% tax rate, including cess. Then there is the fact that gains up to ₹1 lakh are completely tax-free. After the 3-year lock-in, long-term capital gains (LTCG) beyond ₹1 lakh in a year are taxed at 10% (no indexation benefit).

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

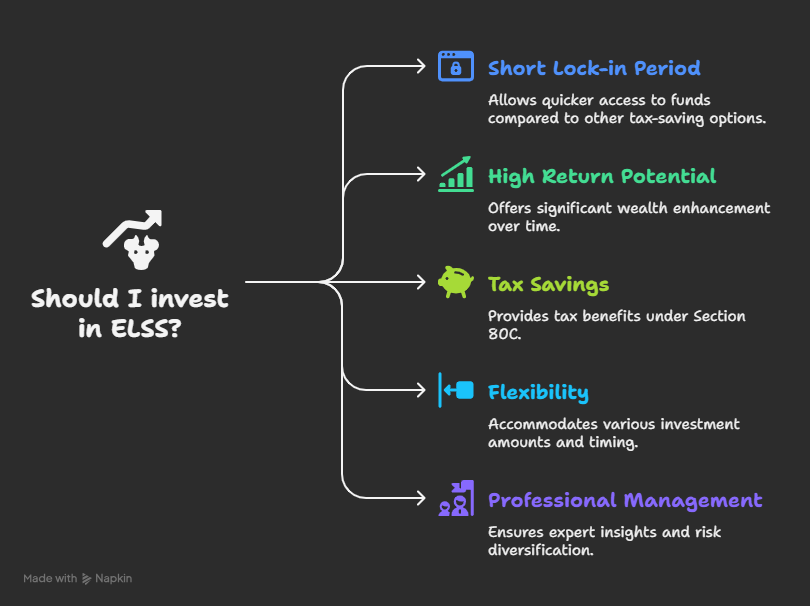

Know moreBenefits of Investing in ELSS

Let us take a look at some benefits of investing in ELSS.

| Benefit | Details |

| Shortest Lock‑In | Only 3-year lock-in period

More liquid than PPF (15 years) and FDs/NSC (5 years) |

| High Return Potential | 7, 10, and 15-year average returns ~15%

Some reports show ~16.26% average returns |

| Dual Benefit | Saves tax under Section 80C

Offers market-linked growth for long-term wealth creation |

| Flexibility | Choose between SIP or lump sum

Open-ended; invest any time- SIPs support cost averaging |

| Professional Management and Diversification | Run by experienced fund managers

Diversified across sectors and market caps- Lowers concentration risk |

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Things to Keep in Mind Before Investing

Even with all these benefits, there are some things that you should keep in mind while investing in ELSS. Some of them are discussed below.

| Consideration | Details |

| Market Risk | Equity-heavy; returns may fluctuate

Suitable for investors with risk tolerance |

| Due‑Diligence | Review past fund performance

Check fund manager’s track record Evaluate expense ratio, Sharpe ratio, alpha & beta |

| Lock‑In Clarity | Each SIP installment is locked in for 3 years

Plan withdrawals accordingly |

| Tax Regime Shift | New tax regime excludes Section 80C benefits

ELSS less attractive if you’ve opted for the new regime |

| LTCG Implication | Gains above ₹1 lakh/year taxed at 10%

Consider tax while planning redemptions |

ELSS vs Other Tax-Saving Instruments

A table that compares ELSS vs other traditional tax-saving instruments is given below so that you can understand the concepts discussed in this blog better.

| Investment Option | Lock‑in Period | Risk Level | Returns | Tax Deduction (80C) | Taxation on Gains |

| ELSS | 3 years | High (Equities) | ~12–16% historically | Up to ₹1.5 lakh | LTCG > ₹1 lakh taxed at 10% |

| Public Provident Fund (PPF) | 15 years | Low | ~7–8% (EEE) | Up to ₹1.5 lakh | Fully tax-exempt |

| Fixed Deposits (5‑yr Tax FD) | 5 years | Low | ~6–7% | Up to ₹1.5 lakh | Interest fully taxable |

| National Savings Certificate (NSC) | 5 years | Low | ~7–8% | Up to ₹1.5 lakh | Interest is taxable (and reinvested) |

| National Pension System (NPS) | Until retirement | Moderate–High | Market-linked (~7–8%) | Up to ₹1.5 lakh | Tax on 60% of corpus at withdrawal |

How to Start Investing in ELSS?

Now that we understand both benefits and risks involving ELSS, you must be wondering how you can start investing in ELSS. We have an answer for this question too. Learn how mutual fund tax savings through ELSS can help you reduce taxable income under Section 80C while building long-term wealth.

| Step | Details |

| Determine Your Investment Strategy | Choose between lump sum or SIP

SIPs start as low as ₹500/month Promote discipline and cost averaging |

| Research Fund Options | Compare past fund performance

Evaluate fund manager’s track record Check risk measures and expense ratio |

| KYC First | Complete Know-Your-Customer (KYC) process

Mandatory for all mutual fund investments |

| Choose a Platform | Invest through AMC websites, aggregators, or mobile apps

Pick between growth and dividend options |

| Monitor & Hold | Stay invested even after lock-in for better returns

Regularly monitor fund performance and rebalance if needed |

You can learn how to effectively do all these steps if you learn stock trading with an experienced investor as your mentor. And this is exactly what Entri has to offer you through their online stock trading course!

Click here to learn more about the Entri Elevate stock trading course! Join now!

Mutual Fund Tax Saving: Conclusion

ELSS combines tax savings under Section 80C with equity-based growth, offering a short lock-in, higher historical returns, professional management, and flexibility. However, market volatility and the new tax regime’s diminished deduction benefits warrant a thoughtful approach. If you’re aligned with equity investing and can stay invested long-term, ELSS remains a compelling instrument in India’s wealth creation and tax planning toolkit.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Can I invest more than ₹1.5 lakh in ELSS?

Yes—you can. But only up to ₹1.5 lakh qualifies for tax deduction under Section 80C.

What are typical returns from ELSS?

Historically, ELSS funds have delivered around 12–16% average returns, varying by period and fund choice.

Is ELSS still attractive under the new tax regime?

Its appeal has decreased for investors who now prefer the simplified (no‑deduction) tax structure; ELSS outflows and reduced inflows indicate this trend.

Are SIP investments individually locked for 3 years?

Yes—each installment in a SIP is locked for 3 years from its own investment date.

Is the 10% LTCG on ELSS applicable immediately after 3 years?

Yes—post lock-in, LTCG beyond ₹1 lakh in a financial year is taxed at 10%.