Table of Contents

Recessions are the economic storms that can hit your wallet hard. And right now, with trade fights like US-China adding heat, they’re big news. In that storm, markets tank and your wallet takes a hit. You want to know what a recession is, how it slams stocks and what to do about it.

Every aspect of the economy suffers during a recession, as jobless rates rise and consumer spending wanes. The stock market may fall even merely because investors anticipate reduced profits and consumers restrict their spending in anticipation of a recession. Keeping that in mind, we can state straight away that stock market declines can be caused by recessions, albeit the opposite is occasionally also true. In this article we are discussing about recession and its impact on stock market.

What Is Recession?

According to the National Bureau of Economic Research (NBER) “A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales” is the official definition of a recession. Two quarters in a row with negative real GDP are commonly used to characterize a recession as a period of poor economic performance. Stock prices will decline until the economy finds equilibrium again and we move on to the next phase of the economic cycle, as recessions are frequently the result of economic imbalances that need to be fixed.

You can see the signs of trouble coming. In 2025, spending dipped, jobs got shaky and stocks wobbled. It’s not random—it’s a sign of bigger issues. Knowing the basics of recession and the stock market helps you spot what’s coming.

An Examination of Past Recessions by the NBER

1: What is a stock?

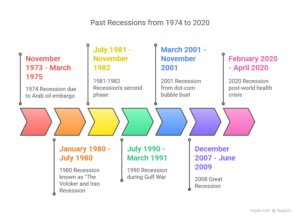

Even though many individuals find the thought of a recession terrifying, it’s necessary to take historical recessions and their consequences into consideration in order to get perspective. There have been variations in the origins and lengths of each recession.

Using statistics from the NBER, here is a brief summary of the last eight recessions.

2020: This recession, which ran from February to April, started just after the world health crisis.

2008: From December 2007 to June 2009, there was an eighteen-month recession.

2001: The bust of the dot-com bubble caused the recession, which lasted eight months from March to November of that year.

1990: This recession took place during the Gulf War and lasted eight months, from July 1990 to March 1991.

1981: This peculiar second phase of the recession, which lasted from July 1981 to November 1982, came after the first phase the previous year.

1980: The year 1980 was known as “The Volcker and Iran Recession.” It lasted for six months, from January 1980 to July 1980.

1974: The recession, which lasted from November 1973 to March 1975, was caused in large part by the Arab oil embargo.

Take A Crash Course On Stock Marketing!

How Recession Impact Stock Market?

Stock values will often decline during a recession. Numerous factors can lead to this. As previously noted, during economic downturns, consumer confidence falls. Financial expenditure by individuals is declining, resulting in lower profits for firms.

Additionally, businesses are frequently compelled to reduce expenses such as payroll and employee layoffs during a recession. Reducing research and development expenditures is one way to do this, but doing so may harm prospects for long-term growth. For the time being, at least, the combination of all these reasons suggests that stock values are more likely to decline than rise.

Every rule has an exception, of course. Even though the stock market will usually fall during a recession, certain businesses will always succeed. Because some of your stocks may be performing well even while others are struggling, it is crucial to have a varied portfolio.

It is indisputable that consumer perceptions of the state of the economy affect stock market performance. A thriving economy results in higher consumer and company expenditure as well as higher earnings for firms. Companies’ stock prices naturally rise when they disclose increased earnings because investors become more upbeat.

On the other hand, when the economy contracts, as it can as a result of the Fed hiking interest rates in an effort to combat inflation, consumer and company spending begins to decline. This reduces profits and drives down stock values.

Historically, a recession’s beginning coincides with the stock market’s fall down. Then, prior to an improvement in the economy, the stock market surges.

When There Is a Recession, How Should You Invest?

Recessions shouldn’t cause you to give up on stock market trading. Neither should your dread of one. It makes sense that a market collapse would entice you to sell assets or remove your investment in a riskier company. You should understand the Recession and its impact on the stock market. However, keep in mind the widely recognized proverb in the investment world: patience in the market outweighs timing it. It is impossible to predict when it will be best to sell your investments. Because of this, it’s critical to invest with a long-term perspective.

A recession doesn’t have to be the time to panic and sell your stocks cold. Think of it as an opportunity—if you play your cards right. You might want to sell when prices crash, but waiting it out often pays off better than jumping ship. Here’s how to navigate a stock market crash recession like a seasoned pro.

That means holding on for the long haul. When the market slumps, stocks will bounce back. Locking in your losses by selling now just isn’t a good idea. Patience usually beats trying to guess when the market will hit rock bottom. Diversify your stocks, too. Some, like grocery brands, can keep doing just fine even when others are sinking.

You should put some of that cash into safe spots. Bonds or steady companies can ride out the storm. Don’t put all your eggs in the basket of high-risk investments. Trade wars like the US-China tensions we saw in 2025 can put pressure on the market, spiking costs and hurting stocks. You can still come out on top with the right moves.

The Entri Stock Market Course can teach you about Recession and its impact on the stock market and how to pick winners. It has the kind of practical advice you need to keep your money growing. Smart traders in 2024 made money even when the market dipped. You can do the same—with a plan that lasts. What’s happening in America right now is just one part of the picture.

Enroll in our Stock Market course!Get Free Demo!

Current Recession Scenario in America

Right now America is on the edge in 2025 and recession talk is loud. Picture a tightrope with tariffs and job cuts pushing it down. Experts see trouble coming fast. Here’s what’s happening as of April 8, 2025.

Growth is about to tank. A big bank says first quarter GDP could drop 3% this year. That’s a red flag after 2024 growth. Trade wars with China heat it up more. US taxes tech like chips at 25%. China hits back with 20% on farm goods like pork.

People are feeling gloomier too. Surveys show folks expect worse times ahead. Consumer confidence is at a low not seen in years. Spending holds for now but cracks are showing. High prices from tariffs are scaring off buyers. Stocks are wobbling as investors pull back quick.

Jobs are okay for now but not for long. Unemployment is at 4% still low. But trade wars and rate hikes could spike it. Companies are cutting plans and waiting out the storm. A 2025 report says 60% chance of recession. You see it in empty stores soon. Let’s get to it!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreCONCLUSION

Many individuals are perplexed as to whether a recession precedes or follows a decline in the stock market. Although it is possible for a stock market decline to trigger a recession, it is more common for stock performance to decline during a recession. This is so because people’s investment decisions can be directly impacted by both the environmental variables that create recessions and the fear of them. In order to combat inflation, the Federal Reserve raised interest rates repeatedly. These increased borrowing costs and promoted saving. Prices and business earnings fell as less money entered the system. Investors may have a difficult times during a recession. However, you can still profit from the stock market if you know how to put together a portfolio that is recession-proof and how to handle difficult circumstances. Investing during a recession is, therefore not a bad idea, especially if you can time the market.

Recessions aren’t just something you hear and forget. They hit the economy and the stock market every time. This blog has the whole story of the recession and its impact on stock market. You know what a recession is from how it cuts jobs and cash. You’ve seen how it crashes stocks when people stop buying and companies lose money. Past slumps like 2020 and 2008 show it’s a cycle that keeps coming back. The US and China fighting over trade in 2025 makes it worse right now. You’re not in the dark anymore; you’ve got the facts.

This hits you fast and hard. Stocks go down and your savings might dip a bit. Prices go up at stores because trade wars like the one on Chinese chips mess with supply. The US taxes tech, China hits farm goods and you pay more for phones or food. It’s not all bad, though. You can stay calm and keep your money working. Smart moves beat panic every day. The Entri Stock Market Course has easy lessons to figure this out fast. You’ll learn how to find good stocks and hold on through tough times. Get in now and take control of your cash!

| Achieve Financial Freedom with these courses? | |

| Stock Market Trading Course | |

| Forex Trading Course | |

| Mutual Funds Course |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is a recession in easy words?

A recession is when the economy shrinks for months, cutting jobs and cash. Growth drops two quarters straight, says experts. You see less money moving. It’s a slump that hits hard.

How does a recession hurt stocks?

Stocks fall in a recession because people stop buying stuff. Companies make less money, so investors sell fast. Prices drop quick. It’s a rough ride for your savings.

Why do recessions happen at all?

Recessions start when debt or trade gets messy, slowing everything down. People spend less, and jobs dry up. It’s a cycle fixing imbalances. You feel it everywhere fast.

What’s the current recession risk in America 2025?

America’s at risk in 2025 with growth maybe dropping 3%, says a bank. Trade wars push prices up. People feel gloomy now. It could hit soon.

How did the 2020 recession affect stocks?

The 2020 recession tanked stocks fast when a health crisis hit. Stores closed, and people stopped spending. Markets fell hard for two months. Then they climbed back up.

Can some stocks do okay in a recession?

Yes, stocks like food or cheap goods can hold up in a slump. People still buy basics when cash is tight. Others flop bad. It’s a split deal.

What should I do with stocks in a recession?

Hold stocks long-term instead of selling when they crash. Mix safe ones in, like bonds. Patience beats panic every time. You can win if you wait.

How does the US-China trade war tie into 2025 recession?

The US taxes Chinese tech, and China hits US farms in 2025. Prices rise, and spending drops. It pushes America closer to a slump. You pay more now.

Why do prices go up in a recession?

Prices jump when trade wars, like US-China, add taxes to goods. Supply shrinks, and costs climb fast. Banks raise rates too. You feel it at stores.

How can I learn to handle recession stock drops?

Learn recession tricks with the Entri Stock Market Course; it’s easy stuff. Watch stocks and wait smart. You’ll keep cash growing. It’s a quick way to win.