Table of Contents

Imagine you’re holding a wad of cash, maybe a bonus, a gift, or savings you’ve scraped together over years. Your heart says, “Invest it!” but your head whispers, “How?” Should you throw it all into the market in one bold move or trickle it in steadily like water nourishing a plant? Welcome to the epic face-off: SIP or Lumpsum. This isn’t just about numbers, it’s about your financial destiny in India’s wild investment landscape.

In a country where the Sensex is crossing 80,000 in 2025 and mutual funds are the new gold rush, picking the right strategy feels like a high-stakes game. Do you go big with a lump sum, ride the market’s waves? Or play it cool with a Systematic Investment Plan (SIP), build wealth brick by brick? This blog isn’t a boring lecture, it’s your guide to cracking the code. From risks to returns, beginners to taxes, we’re peeling back the layers to reveal your best move. Hooked yet? Let’s get started!

Introduction

Investing in India today is like standing at a buffet too many options, too little time. The stock market’s buzzing, mutual funds are booming and every rupee you earn wants to grow. But here’s the catch: how you invest matters as much as what you invest in. Enter SIP and lump sum two giants of the investment world, each promising wealth in its own way. One’s a slow burn; the other’s a big bang.

With inflation at 5-6% and dreams like a child’s IIT admission or a peaceful retirement on the horizon, sitting on cash isn’t an option. In 2025, India’s financial scene is electric over 9 crore SIP accounts (AMFI data) and a Nifty 50 that’s making records. So, do you drip-feed your money through SIPs or splash it all in a lump sum? This isn’t just a comparison it’s a showdown to help you win. Stick with me as we break down these behemoths and crown your champion. Ready? Let’s begin with the basics.

Ready to take your Trading skills to the next level? Sign up for a free demo today!

What is SIP (Systematic Investment Plan)?

1: What is a stock?

Think of a SIP as your financial slow cooker steady, reliable and full of flavor over time. A Systematic Investment Plan lets you invest a fixed sum like ₹1,000 into a mutual fund at regular intervals (monthly, quarterly). It’s like paying yourself first, turning small bites into a full meal of wealth. In India, SIPs have become a household name with millions investing crores in equity and debt funds every month.

Why the hype? It’s affordable and disciplined. Start with ₹500 less than a family pizza and let compounding do its magic. Say you invest ₹5,000 monthly in an equity fund at 12% annual returns. In 10 years, your ₹6 lakhs becomes ₹11.6 lakhs. It’s not luck it’s consistency. SIPs also smoothen out market fluctuations by averaging your purchase cost buying more units when the price dips and fewer when it soars. For the salaried Indian juggling bills and dreams, it’s a no-brainer. But is it the only way? Let’s meet its rival.

What is Lump Sum?

Imagine lump sum as a cannonball load it up, fire it off and watch it land. It’s when you invest a big chunk of money like ₹5 lakhs in one go, usually into a mutual fund or stocks. In India, it’s the choice for those with cash to spare think bonuses, property sales, or matured FDs.

Here’s the thrill: lump sums catch market highs fast. If the Nifty jumps 15% in a year, your ₹5 lakhs could swell to ₹5.75 lakhs in a flash. My friend’s uncle did this in 2020 dumped ₹10 lakhs into a large-cap fund post-crash and by 2023 it was ₹16 lakhs. Timing’s the key though nail it and you’re golden; miss it and you’re stuck waiting out a dip. For bold Indians with cash and a market hunch, lump sums are tempting. But how does it stack up against SIP? Let’s break it down.

SIP vs Lump Sum

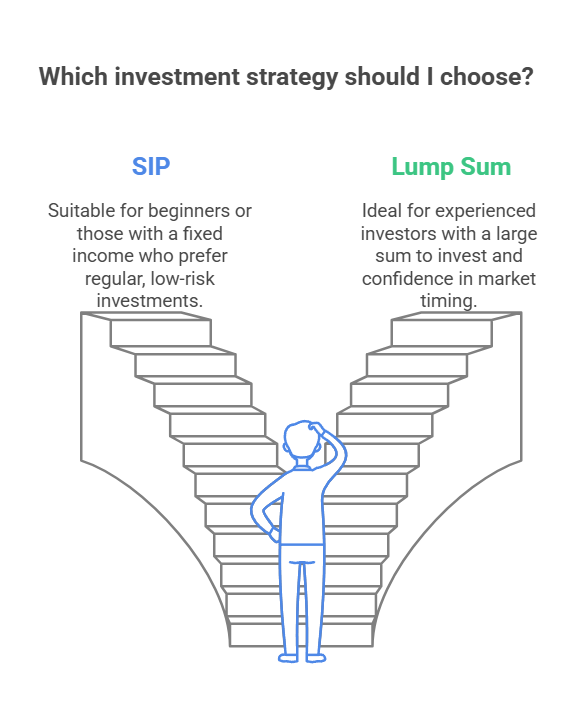

SIP and lump sum are like oil and water both useful but they don’t mix the same way. Here’s the lowdown:

- Investment Style: SIP is gradual ₹5,000 monthly for years. Lump sum is instant ₹5 lakhs today, done.

- Cash Flow: SIP suits regular earners (salaries, small savings). Lump sum needs a fat wallet upfront (windfalls, big profits).

- Market Timing: SIP sidesteps timing invests through ups and downs. Lump sum bets on one entry point hit or miss.

- Flexibility: SIP lets you tweak amounts or stop anytime. Lump sum’s locked in your money’s committed.

- Mindset: SIP’s for planners; lump sum’s for players.

Here’s the hook: SIP’s the tortoise, pacing itself to victory; lump sum’s the hare, sprinting for glory. Which race are you running? Let’s see how risk shakes things up.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

Risk and Market Volatility

The Indian stock market’s a rollercoaster thrills and spills. How do SIP and lump sum ride it? SIP’s your shock absorber. By investing gradually, it averages costs called rupee cost averaging. When the Sensex crashes, you buy more units cheap; when it soars, you buy less. Over time, volatility evens out. A 2023 AMFI study showed SIPs in equity funds weathered 2020’s crash better than one-time bets, delivering 10-12% returns by 2025.

Lump sum? It’s a high-wire act. Invest ₹5 lakhs when the Nifty’s at 20,000 and a 20% drop leaves you at ₹4 lakhs ouch. But catch a bull run like post-2020 and you’re laughing to the bank. Risk is all about timing and India’s market is fickle think Budget shocks or global cues. Lump sums’s bold but SIP’s buffered. Want safety or a gamble? Returns might sway you let’s see.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreReturns Comparison: Which Gives Better Growth?

The returns are the meat of this debate, so let’s get to it. Invest ₹6 lakhs today. In a lump sum equity fund at 12% annual returns (India’s long term average), it’s ₹13.3 lakhs in 10 years. Start an SIP of ₹5,000 monthly (₹6 lakhs total) at the same 12% and you get ₹11.6 lakhs. Lump sum wins—if the market goes up steadily.

But markets aren’t linear. During volatile patches—like 2008-2018—SIPs often win. Why? You buy low, pile up units for the recovery. A ₹5,000 SIP in a Nifty fund from 2015-2025 could turn ₹6 lakhs into ₹12.5 lakhs, beating a lump sum stuck in a mid-cycle dip. Historical data proves this—SIPs shine in choppy markets, lump sum in steady bulls. With India’s growth story unfolding, lump sum gives quick gains, but SIP builds resilience. Growth is your goal, how much risk can you take?

Which is better for Beginners?

New to investing? The Indian market is dazzling but intimidating. SIP is your friendly guide. Start small—₹500—and learn the ropes without breaking the bank. It’s forgiving—market dips don’t hurt as much and discipline becomes a habit. Beginners love SIPs for their low entry and steady hand—over 60% of India’s SIP investors in 2024 were first timers (AMFI).

Lump sum is trickier. Invest ₹5 lakhs as a newbie and a sudden crash could scare you out of investing forever. It demands market savvy—knowing when to jump. My cousin invested a lump sum in 2022, lost 10% in a month and swore off funds. SIPs ease you in; lump sum tests your nerves. For India’s growing investor base, SIP is the smart start. Ready for taxes next?

Tax Implications for SIP vs Lumpsum

SumTaxes can eat into your gains so let’s break it down. In India, mutual fund taxation depends on holding period and type—SIP and lump sum follow the same rules for each unit but timing is different. Equity funds: hold for more than a year and gains above ₹1 lakh are taxed at 10% long term capital gains (LTCG). Sell within a year, it’s 15% short term (STCG). Debt funds? LTCG is 20% with indexation after 3 years; STCG is your slab rate.

SIP’s advantage: each installment has its own time frame. Invest ₹5,000 monthly—units from year one might qualify for LTCG while later ones don’t. Lump sum’s simpler—all units are the same age. Invest ₹5 lakhs in an ELSS fund (tax saving) and both lock you in for 3 years, reducing ₹1.5 lakhs from your taxable income under Section 80C. Tax wise they’re neck and neck—your strategy decides not the taxman. When’s each best? Let’s settle it.

When to Choose SIP or Lumpsum?

This is your moment of truth. Choose SIP if: you’re a regular earner, salary, small savings—and want discipline without timing the market. It’s perfect for long term goals (10+ years)—education, retirement where compounding works. India’s volatile market loves SIPs—steady wins the race.

Pick lump sum if: you’ve got cash burning a hole—bonus, sale proceeds—and the market’s ripe (post-crash, pre-rally). It’s ideal for shorter horizons (3-5 years) or when you’re sure of a bull run. Lump sum’s your rocket fuel—use it right and you’ll soar.

Here’s the twist: why not both? SIP for consistency, lump sum for windfalls. India’s investor boom—9 crore SIPs, crores in lump sums—shows flexibility wins. Your goals, cash flow and risk appetite decide. What’s your move?

Learn Stock Marketing with Share Trading Expert! Explore Here!

Conclusion

SIP or lump sum? It’s not just a choice—it’s your financial signature. SIP is discipline, smoothing out India’s market volatility with growth. Lump sum is punch, if you time it right. In 2025 with Nifty roaring and inflation lurking, sitting idle isn’t an option.

Both can build wealth but one fits you better. Start an SIP with ₹500 or dump a lump sum in a fund today—the Indian market’s waiting. This isn’t about right or wrong, it’s about now or never. Your money’s ready to work—SIP or lump sum, choose your move and hit!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is a Systematic Investment Plan (SIP)?

A SIP is a disciplined investment method where you invest a fixed amount at regular intervals in mutual funds. It helps reduce the impact of market volatility through rupee cost averaging.

What is a Lump Sum Investment?

A Lump Sum Investment involves investing a large amount of money in one go. It is ideal for investors who have a significant sum available and can time the market effectively.

Which is better: SIP or Lump Sum?

SIP is better for beginners and those who prefer a low-risk, disciplined approach. Lump Sum is suitable for experienced investors with a large sum and the ability to time the market.

How does SIP reduce risk?

SIP reduces risk through rupee cost averaging, where you buy more units when prices are low and fewer units when prices are high. This averages out the cost of investment over time.

What are the tax implications of SIP and Lump Sum investments?

Both SIP and Lump Sum investments are subject to capital gains tax. For equity funds, LTCG (above ₹1 lakh) is taxed at 10%, and STCG is taxed at 15%. For debt funds, LTCG is taxed at 20% with indexation.

Can I switch from SIP to Lump Sum or vice versa?

Yes, you can switch between SIP and Lump Sum based on your financial goals and market conditions. Consult a financial advisor to make an informed decision.

What is rupee cost averaging in SIP?

Rupee cost averaging is a strategy where you invest a fixed amount regularly, buying more units when prices are low and fewer units when prices are high. This reduces the average cost of investment over time.

Is SIP suitable for long-term goals?

Yes, SIP is ideal for long-term goals like retirement, child education, or buying a home. It allows you to build wealth gradually and benefit from compounding.

When should I choose a Lump Sum investment?

Choose Lump Sum if you have a large sum of money and believe the market is undervalued. It can yield higher returns if timed correctly.

What are the risks of Lump Sum investments?

Lump Sum investments are riskier as they depend on market timing. If the market declines after your investment, you may face losses.