Table of Contents

Experts in accounting and finance all throughout the world regard the ACCA (Association of Chartered Certified Accountants) credential as proof of their competence. A variety of auditing, tax, financial, risk management, and consulting jobs become available to ACCA members in India. Financial reporting, compliance, and strategic decision-making skills are in high demand among ACCA professionals in India because of the country’s booming MNC, fintech, and shared service centre industries. Earning the ACCA credential makes one more marketable in India’s competitive financial employment market by increasing one’s technical skills and providing one with foreign experience.

Enroll for ACCA Course! Download Entri App!

Why ACCA Is in High Demand Across India

India is increasing its ACCA experts. Most of this is due to the increased need for standardised financial competence created by global corporate development. For jobs, firms need ACCA certification because of their expertise in audits, risk management, taxation, and international accounting standards. Financial experts are needed due to the expansion of shared service centres, fintech businesses, and worldwide corporations. Compliance, strategic decision-making, and corporate growth depend on these experts. The global corporate boom has necessitated this. Companies across sectors want ACCA graduates. Their agility, leadership, and worldwide financial system expertise are valued. Emphasis on ethics also boosts ACCA grads’ attractiveness.

Top Big 4 Companies Hiring ACCA Professionals

1: Accounting provides information on

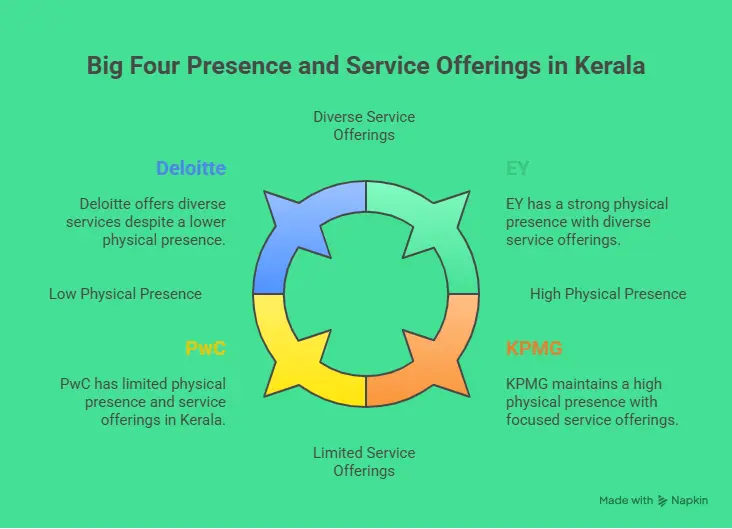

ACCA professionals in India have a strong preference for working with the “Big Four” accounting and consulting companies, which are Deloitte, PwC, KPMG, and EY. In addition to providing strong career advancement prospects, exposure to foreign customers, and the opportunity to acquire expertise in auditing, taxes, advising, and risk management, these businesses are well-known for their influence on a worldwide scale and the high quality of their services. These firms are often considered by graduates of the ACCA to be perfect for building a solid foundation in finance while also acquiring practical experience across a variety of sectors.

1. Deloitte India

Audit, consulting, financial advising, and taxes are some of the areas in which Deloitte provides opportunities for ACCA professionals. The opportunity to work here provides applicants with the opportunity to manage complicated financial projects, develop abilities in analysis and problem-solving, and acquire experience working with customers from across the world. One of the most notable aspects of Deloitte is the culture of mentorship and the organised training programs that it offers.

2. PwC India

ACCA graduates are sought after by PwC for positions in assurance, advising, tax, and compliance responsibilities. It is the responsibility of employees to work on projects including auditing, financial reporting, risk assessment, and consulting across a variety of industries. When it comes to delivering possibilities to work on demanding financial assignments and significant global exposure, PwC is well acknowledged as a service provider.

3. KPMG India

Within the realm of risk consulting, internal auditing, taxes, and financial advising, PMG offers employment opportunities. In the course of their work at KPMG, ACCA professionals build knowledge in areas such as compliance, financial analysis, and organisational strategy. In addition to providing possibilities to collaborate with prominent local and international customers, the company places a strong emphasis on ethical business methods.

4. EY India (Ernst & Young)

A talent pool of ACCA professionals is sought out by EY for employment in advising, audit, transaction advice, and taxes. The auditing of international organizations, the implementation of financial plans, and the management of mergers and acquisitions are all areas in which professionals acquire expertise. A worldwide platform that may help expedite an ACCA career is provided by EY, which places a strong emphasis on leadership development.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Leading MNCs Offering Roles for ACCA Graduates

To handle its financial, accounting, and strategic business responsibilities, a significant number of multinational companies (MNCs) in India actively seek for people who are certified by the ACCA profession. Students who graduate from the ACCA program are highly valued by these businesses because of their knowledge in international financial standards, compliance, and analytical abilities, which makes them excellent for worldwide operations. Working for a multinational corporation (MNC) provides prospects for professional advancement, as well as exposure to worldwide business methods and varied teams.

1. Microsoft India

In the areas of finance operations, treasury management, and financial planning, Microsoft is looking to employ ACCA experts for several positions. Employees are given the opportunity to develop expertise in global accounting standards, budgeting, and strategic decision-making while working in an environment that is driven by technology.

2. Google India

ACCA graduates are employed at Google in a variety of areas, including those involving company finance, risk assessment, and financial planning and analysis. In addition to offering insights that affect important business choices, the organization places a strong emphasis on analytical problem-solving and innovative thinking.

3. Amazon India

Professionals with ACCA certification may find employment prospects at Amazon in the areas of financial operations, taxes, auditing, and risk management. The fast-paced atmosphere of e-commerce provides individuals with the opportunity to build abilities in efficiency, precision, and decision-making that is driven by data.

4. IBM India

IBM is actively seeking qualified individuals to fill positions in the areas of accounting, internal auditing, financial reporting, and consulting services. At IBM, professionals are given the opportunity to develop experience in sophisticated technological solutions for financial operations while working on large-scale finance projects.

5. Other MNCs

Apple, HP, Oracle, and Cisco are some of the other famous multinational corporations that are employing ACCA experts. These firms provide positions at their Indian operations in the areas of corporate finance, accounting, taxes, and compliance.

Start your ACCA Preparation Now! Download Entri App!

Major Indian Corporates Recruiting ACCA Talent

In order to effectively handle intricate company operations, India’s most prominent corporations are in need of qualified individuals in the fields of finance and accounting. As a result, ACCA professionals are becoming more in demand. College of Chartered Certified Accountants (ACCA) graduates provide worldwide knowledge that is well aligned with the objectives of major Indian enterprises. This expertise is based on a strong emphasis on compliance, strategic planning, and financial management.

1. Tata Group

A number of ACCA professionals are employed by the Tata Group for positions in the areas of finance, auditing, corporate planning, and risk management. As a result of working here, you will have the opportunity to get experience in a variety of sectors, such as the hotel industry, the information technology industry, the steel industry, and the automotive industry.

2. Reliance Industries

ACCA-qualified candidates are sought by Reliance for positions in the areas of accounting, taxes, financial planning, and compliance. Professionals get expertise in managing large-scale financial operations, corporate reporting, and strategic investment choices across a variety of industries, including petrochemicals, retail, and telecom, among others.

3. Aditya Birla Group

Internal auditing, corporate finance, and financial analysis are all areas in which the Aditya Birla Group provides employment possibilities. When working in a diverse industrial conglomerate, ACCA professionals here build experience in areas such as budgeting, risk management, and corporate governance because of their work environment.

4. Mahindra & Mahindra

It is common practice for Mahindra & Mahindra to employ graduates of the ACCA for positions in corporate finance, accounting operations, and auditing. Through their work in the automotive, agricultural, and technological industries, employees are given the opportunity to get experience in global business processes, strategic planning, and financial management.

5. Infosys & Wipro (Finance Divisions)

Professionals with ACCA certification are highly sought after by leading information technology corporations such as Infosys and Wipro for positions in finance, accounting, and risk management, particularly in their shared services and worldwide operations.

FinTech & Startup Ecosystem Hiring ACCA in India

ACCA professionals have the opportunity to take advantage of intriguing prospects via India’s flourishing fintech and startup environment. The competence that graduates of the ACCA possess in areas including financial management, compliance, risk assessment, and strategic decision-making is highly valued by starting businesses. Because of the dynamic nature of this environment, professionals have the opportunity to obtain practical experience, collaborate closely with leadership, and make direct contributions to the expansion of the organization.

1. Razorpay

Professionals with ACCA certification are sought after by Razorpay for positions in the areas of accounting, financial planning, taxes, and compliance. In the fast-paced atmosphere of the fintech industry, candidates are given the opportunity to obtain experience in digital payments, transaction management, and financial reporting.

2. Paytm

ACCA graduates are employed at Paytm in a variety of activities, including auditing, budgeting, taxes, and finance operations. By providing chances to manage large-scale financial transactions and providing assistance for strategic decision-making across fintech and e-commerce businesses, the organization offers potential prospects.

3. PolicyBazaar

PolicyBazaar brings in ACCA professionals to fill positions in the areas of accounting, financial analysis, and compliance. Professionals make contributions to the operations of insurance and financial services by focusing on risk management and financial reporting.

4. Ola, Swiggy & Zomato

ACCA graduates are sought after by these rapidly expanding startups for entry-level positions in finance, accounting, budgeting, and internal auditing. In the field of fast-moving consumer services, professionals gain experience in operational finance, strategic planning, and cost optimization.

5. Other Startups

Startups in the financial technology and technology industries, such as CRED, Groww, PhonePe, and Upstox, are rapidly employing ACCA professionals for jobs in finance, accounting, and analytics. These positions provide opportunities to get experience in technology-driven financial operations and unconventional business models.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Top Shared Service Centers (SSCs) and Global Capability Centers (GCCs)

Shared Service Centers (SSCs) and Global Capability Centers (GCCs) in India have emerged as prominent employers for ACCA experts in recent years. In addition to providing possibilities to work on large-scale projects, process standardization, and financial reporting, these centers are responsible for managing worldwide finance and accounting operations for multinational organizations. Their knowledge in International Financial Reporting Standards (IFRS), risk management, and compliance, all of which are essential for international operations, makes graduates of the ACCA highly recognized.

1. HSBC, Citi, and JPMorgan Chase

ACCA experts are employed by these multinational financial institutions for tasks including transaction processing, financial reporting, internal auditing, and compliance. Employees are given the opportunity to obtain experience in large-scale operations and international financial procedures.

2. Accenture & Capgemini

In India, leading consultancy and information technology companies run SSCs and GCCs, and they are looking for graduates of the ACCA program to work in financial transformation, analytics, budgeting, and reporting. Process enhancements, automation, and consulting services are all areas of focus for professionals who engage with customers all around the world.

3. IBM Global Services & HP Enterprise

Accounting, internal auditing, tax compliance, and financial operations are some of the occupations that are available at these facilities. ACCA professionals acquire the knowledge and skills necessary to manage international operations and become familiar with worldwide accounting standards.

4. Other Notable SSCs/GCCs

Opportunities for ACCA experts to work in financial operations, compliance, and strategic reporting are available in India via the operations of SSCs and GCCs that are managed by other firms such as Microsoft, Oracle, Dell, and Cisco.

Popular Job Roles for ACCA Professionals in India

In India, ACCA professionals have the opportunity to explore a diverse range of responsibilities across a variety of industries, including corporates, multinational corporations, financial technology companies, and shared service centres. In addition to giving potential for both technical and management advancement, these jobs allow candidates to capitalise on their experience in areas such as accounting, taxes, financial analysis, and compliance.

1. Financial Analyst

In charge of preparing budgets, creating projections, and conducting analyses of financial data in order to provide support for strategic decision-making. It is common practice for financial analysts to collaborate with management in order to enhance financial performance and locate chances for development.

2. Management Accountant

Focuses on the reporting of internal financial information, the study of costs, and the assessment of performance. Accountants that specialize in management assist organizations in optimizing their operations and making choices based on data.

3. Internal Auditor

Enhances the efficiency of risk management, control, and governance procedures by evaluating and enhancing their efficacy. Internal auditors are responsible for ensuring that organizational rules and regulations are followed.

4. Tax Consultant

Offering guidance on corporate and indirect taxes, as well as compliance and planning related to these areas. The primary objective of tax advisors is to minimize tax obligations while simultaneously ensuring compliance with both domestic and international tax regulations.

5. Risk & Compliance Officer

Oversees the monitoring of internal controls, regulatory compliance, and financial risks. Individuals who work in this capacity provide assistance to businesses in mitigating risks and adhering to legal norms.

6. Finance Manager

Manages the day-to-day reporting, budgeting, and planning of the financial operations. Finance managers often take charge of teams, put plans into action, and direct the choices that businesses make.

7. Treasury Analyst

Controls the flow of funds, investments, and the danger of debt. It is the responsibility of Treasury analysts to assure liquidity, maximize financing, and keep financial operations in good condition.

8. Audit Associate/Manager

Manages both internal and external audits, as well as the verification of financial reporting and the enhancement of current processes. Graduates of the ACCA program often find themselves in auditing positions inside corporations and the Big Four organizations.

Average Salary Range for ACCA Across Major Cities

ACCA professionals in India earn varying salaries, which are determined by factors such as their level of experience, location, and the kind of firm they work for. Multinational enterprises, the Big Four firms, and shared service centers are concentrated in major cities like Mumbai, Bengaluru, and Delhi, National Capital Region (NCR), which results in higher pay scales in these areas. Entry-level professionals often begin with competitive compensation packages; however, members of the ACCA who are in mid-level and senior positions have the potential to earn considerable wages as they advance into management and leadership positions.

| City | Entry-Level (0–2 yrs) | Mid-Level (3–7 yrs) | Senior-Level (8+ yrs) | Top Hiring Sectors |

|---|---|---|---|---|

| Mumbai | ₹6–10 LPA | ₹12–20 LPA | ₹20–35 LPA + | Big 4, MNCs, Banking, Finance |

| Bengaluru | ₹5.5 – 9 LPA | ₹10–18 LPA | ₹18–30 LPA + | IT, FinTech, Consulting |

| Delhi / NCR | ₹5–9 LPA | ₹10–17 LPA | ₹18–28 LPA + | Consulting, Manufacturing, Big 4 |

| Hyderabad | ₹4.5–8 LPA | ₹9–15 LPA | ₹16–27 LPA + | SSCs, IT, Pharma |

| Pune | ₹4–7 LPA | ₹8–14 LPA | ₹15–25 LPA + | Shared Services, MNCs |

| Chennai | ₹4–7 LPA | ₹8–13 LPA | ₹14–22 LPA + | Manufacturing, IT, Audit |

| Other Cities | ₹3.5 – 6 LPA | ₹7–12 LPA | ₹13–20 LPA + | Regional Firms, SMEs |

Skills & Competencies Employers Look For in ACCA Candidates

In order to distinguish themselves in the very competitive employment market for finance professionals in India, ACCA professionals need to exhibit more than just technical knowledge; they must also display the ability to analyze, adapt, and have good business acumen. Potential candidates who are qualified by the ACCA and who are able to handle complicated financial operations, comprehend worldwide accounting standards, and contribute to strategic decision-making are sought after by employers. ACCA professionals are able to achieve success in a variety of fields, including banking, technology, consulting, and finance, thanks to the combination of technical competence and soft skills of the organization.

| Skill Category | Key Competencies | Why It Matters |

|---|---|---|

| Technical Skills | – Financial reporting & analysis- IFRS & Ind AS proficiency- Taxation & audit expertise- Risk & compliance management | Ensures accurate reporting, legal compliance, and effective financial control. |

| Analytical Skills | – Data interpretation- Budgeting & forecasting- Problem-solving- Financial modeling | Helps in identifying business trends, improving profitability, and supporting data-driven decisions. |

| Technology Proficiency | – ERP systems (SAP, Oracle)- Advanced Excel- Power BI / Tableau- Automation tools | Modern finance roles require digital fluency for efficient financial operations and reporting. |

| Communication Skills | – Written & verbal clarity- Presentation skills- Cross-functional collaboration | Enables effective teamwork and the ability to explain financial insights to non-finance stakeholders. |

| Leadership & Ethics | – Decision-making- Time management- Professional integrity- Ethical judgment | Builds trust, accountability, and long-term credibility within an organization. |

| Adaptability & Learning Mindset | – Continuous professional development- Industry awareness- Openness to change | Keeps ACCA professionals relevant in a fast-changing business and regulatory environment. |

How to Improve Your Chances of Getting Hired as an ACCA

It is a significant accomplishment to get the ACCA certificate; but, in order to distinguish oneself in India’s highly competitive employment market, it is necessary to do more than just pass tests. Employers are looking for people that have a combination of technical knowledge and practical experience, as well as communication skills and a proactive commitment to learning that is ongoing. There are a number of practical strategies to improve your employability and gain excellent career prospects with the ACCA, including the following:

- Gain Practical Experience

- Master Accounting Software & Tools

- Stay Updated with Global Accounting Standards

- Build a Professional Network

- Strengthen Soft Skills

- Obtain Additional Certifications

- Prepare for Interviews Strategically

- Customise Your Resume & LinkedIn Profile

Start your ACCA Preparation Now! Download Entri App!

Conclusion

As businesses in India continue to adopt global accounting standards and grow their operations in foreign markets, there has been an increase in the need for ACCA experts and their services. Possibilities are many and varied for applicants who are qualified by the ACCA. These possibilities range from the Big Four organizations and international enterprises to fintech startups and shared service centres. ACCA professionals have the capacity to develop satisfying professions that give both local stability and worldwide reputation if they possess the appropriate combination of technical competence, analytical abilities, and professional ethics throughout their careers. As India continues to improve its position as a global finance center, the future seems to be especially bright for graduates of the ACCA who are prepared to lead, innovate, and drive excellence in the financial sector.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Can ACCA professionals work abroad after qualifying in India?

Yes. The ACCA qualification is globally recognized in over 180 countries, allowing professionals to work in regions like the UK, UAE, Singapore, and Canada with minimal additional requirements.

Is ACCA recognized by Indian employers and government bodies?

Yes. ACCA is increasingly recognised by leading Indian companies, accounting firms, and global organisations. Additionally, ICAI and ACCA have a mutual recognition agreement that enhances credibility in India.

How can I improve my chances of being hired after completing ACCA?

Gaining internship experience, learning software tools like Excel and SAP, networking with professionals, and updating your LinkedIn profile can significantly boost employability.

Is ACCA recognized by Indian employers and government bodies?

Yes. ACCA is increasingly recognized by leading Indian companies, accounting firms, and global organizations. Additionally, ICAI and ACCA have a mutual recognition agreement that enhances credibility in India.

Is ACCA a good career option in India?

Yes, ACCA is an excellent career choice in India. It offers global recognition, diverse job opportunities in finance and accounting, and access to top employers like Big 4 firms, MNCs, and Indian corporates.

Do ACCA professionals need additional qualifications to work in India?

No, ACCA is recognized by many Indian employers on its own. However, some professionals choose to pursue CFA, CPA, or MBA (Finance) alongside ACCA to specialize or improve career prospects in niche areas.

Can ACCA members sign audit reports in India?

Currently, ACCA members cannot sign audit reports independently in India. However, they can work in senior positions within audit firms or collaborate under an Indian Chartered Accountant (CA).

What kind of work-life balance can ACCA professionals expect?

It depends on the organization and role. Corporate finance and SSC roles often offer regular working hours, while audit and consulting positions may involve longer schedules during peak seasons.

Is there a growing demand for ACCA in smaller Indian cities?

Yes. As more Global Capability Centers (GCCs) and startups expand into Tier-2 cities like Pune, Coimbatore, and Ahmedabad, the demand for ACCA professionals is steadily increasing beyond major metros.