Table of Contents

Introduction

Imagine a truck full of foreign shoes pulling up to the border. A tax slaps on extra cost before they get to you. That’s a tariff doing its job and it’s not hard to get. Welcome to “What Is a Tariff? Why Does It Matter?” This is your easy pass to understanding tariffs. It’s for students, workers or anyone who likes to know stuff.

Tariffs affect what you pay every day. They make headlines too especially with the US and China clashing in 2025. You’ll learn what tariffs are, why they’re a big deal and what’s happening now. Want to understand money news? The Entri Stock Market Course can teach you fast. Let’s get started and see why tariffs shake up your world!

What Is a Tariff?

1: What is a stock?

A tariff is a tax on goods moving across borders. Countries put it on stuff coming in, sometimes going out. Think of a ship full of cheap clothes from overseas. The tariff adds a fee to each shirt. That’s it, plain and simple but it’s got power.

Two types show up most. A fixed tariff is a flat charge, like $2 per pair of socks. A percentage tariff grows with price, maybe 15% on a $20 toy. Governments pick these to grab cash or help local shops. They set the rate based on what they need. It’s like a fee to play in their market.

Tariffs aren’t hard to get once you see it. Say a country taxes steel coming in. That steel costs more at the store. Local steel makers cheer because they can sell easier. You pay a bit more, but jobs stay around. It’s a trade-off that’s real.

This isn’t just facts. Tariffs affect how much cash you keep. They mess with prices everywhere. Knowing this gives you an edge. The Entri Stock Market Course can show you more trade secrets. Let’s move on and see why tariffs hit hard!

Why Tariffs Matter

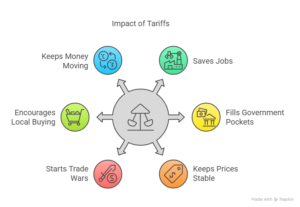

Tariffs aren’t small stuff. They change jobs, prices and how countries get along. You’ll care because this affects your life every day. Here’s why tariffs matter broken down so you feel it.

- Saves Jobs: Tariffs increase foreign goods’ prices. Local companies keep selling and workers keep jobs.

- Fills Government Pockets: That cash adds up quick. It pays for schools, roads or whatever they want.

- Keeps Prices Stable: High tariffs block cheap imports. Your local stores don’t cut prices too low.

- Starts Trade Wars: One country taxes imports. The other taxes back and it’s a tug-of-war.

- Encourages Local Buying: Imports get expensive with tariffs. You buy stuff made closer to home instead.

- Keeps Money Moving: Tariffs can slow trade down. But they keep cash inside the country.

This hits you where it hurts. A tariff on foreign fruit means more for your apples. A factory stays open because steel imports cost extra. Your coffee might go up a buck too. That’s real life, not just numbers.

US-China Tariff Issues in 2025

The US and China are locked in a heated battle in 2025, with tariffs at the forefront. Think of two giants throwing punches—taxes this time. This fight has been going on for years, but it’s really heating up now. Here’s the situation as of April 2025.

It all started in 2018. The US slapped tariffs on Chinese goods like TVs and tools. China retaliated by taxing US crops like corn. Things did ease a bit in 2024 with some talks. But 2025 brings a fresh wave of tension. The US adds 25% tariffs on Chinese tech , chips, phones and all that comes with it.

China doesn’t sit quietly. They hit back with 20% tariffs on US farm products—soybeans and pork. Trade shrinks by 10% between the two, according to a 2025 report. That means gadgets cost more in the US now. Food prices are rising in China too. It’s a standoff, and you’re caught right in the middle.

Why is this happening?

The US says China is taking tech ideas unfairly. China says the US wants to slow its rise. Both sides dig in, and prices shift fast. Your phone bill is going up. Farmers here are feeling the pinch too.

This isn’t just background noise. It changes what you buy every week. Stores pass those costs on to you. Companies are hunting for new suppliers. The Entri Stock Market Course can teach you to navigate these twists and turns. Let’s wrap this up now.

Get Daily updates on the global news and stock market updates here

Final Thoughts

Tariffs aren’t some dusty old tax trick. They move money, jobs and trade. You’ve seen how tariffs work and why they matter. You’ve watched the US-China clash up close. Now you’ve got the know-how to use that.

Understanding tariffs helps you make better business decisions, smarter investments, and more informed political choices. By looking beyond headlines to see how these taxes ripple through the economy, you gain valuable insight into our interconnected world.

|

Related Articles

|

|

| UPI Rule changes from April 1st 2025 | Best Mutual Fund Apps for Investment in India |

| Entri Finacademy is Now SEBI Compliant! | Best Stock Screeners for Traders |

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What does a tariff do to imported goods?

A tariff taxes on things coming into a country. It makes foreign goods cost more at the local store.

Why do countries use tariffs on trade?

Countries tax imports to protect local jobs and make money. It helps their own sellers win.

Who pays tariffs - the foreign company or the consumer?

While foreign exporters are technically responsible for paying tariff fees to customs authorities, the cost is usually passed on to consumers through higher prices. Sometimes companies absorb part of the cost to stay competitive, but studies show consumers bear 80-95% of tariff costs through price increases.

How do tariffs affect the prices I pay for products?

Tariffs directly raise prices of imported goods. When a 25% tariff is placed on steel, products using that steel (cars, appliances, construction materials) become more expensive. Even domestic producers often raise their prices when protected from foreign competition, leading to higher costs across the board.

What's the difference between tariffs and quotas?

Tariffs tax imported goods, making them more expensive but still available. Quotas limit the quantity of a product that can enter a country, regardless of price. Once a quota is filled, no more of that product can be imported until the next period. Both tools restrict trade, but quotas create absolute limits while tariffs work through price mechanisms.

Can companies get exemptions from tariffs?

Yes, most tariff programs include exemption processes. Companies can request exclusions by proving that the goods they need aren’t available domestically or that paying the tariff would cause severe economic harm. However, the process can be complex and time-consuming, with approval rates varying widely based on political factors.

How have the US-China tariffs affected everyday products?

Many common items have seen price increases due to US-China tariffs. Washing machines cost 12% more after tariffs were applied. Electronics, furniture, clothing, and footwear have all seen price hikes ranging from 5-50%. Some products disappeared from shelves temporarily as companies adjusted their supply chains.

How do tariffs bring in government cash?

Governments collect tax on every import. That money pays for roads or schools.

What happens when tariffs go up in 2025?

Prices rise on stuff like phones or food. You feel it when you shop.

How can I learn more about tariffs?

Read this blog or take a course. The Entri Stock Market Course explains it easy.