Table of Contents

Who can Invest in the Stock Market? This is a question that comes to the mind of anyone who is starting their journey into the world of stock trading. This may vary with region. So, we have to limit our answer limited to the India stock trading scenario.

Over the past two decades, there has been a significant evolution in the risk management, operations, and penetration of the Indian stock markets. However, retail participation remains rather low. However, with advancements in technology and infrastructure, it is growing. Indian investors are increasingly leaning towards the belief that stocks are the only assets that can increase wealth over the long run.

But Who can Invest in the Stock Market? Are there any particular eligibility criteria to become a stock trader? Let us look into this subject for more information.

Click here to learn more about the Entri online stock trading course! Join today and start trading!

Who Can Invest in Stock Market: Introduction

Over the past few years, there has been a notable shift in the Indian stock market, characterized by a rise in investor engagement and diversification. By early 2025, the total number of Demat accounts with CDSL and NSDL reportedly exceeds 19 crore, reflecting a sustained upward trajectory. This growth stems from increased financial literacy, easy access to trading platforms, and a shift from traditional savings to equity investments, a trend that gained momentum post-2020.

This change marks a critical turning point in the development of the Indian financial system and demonstrates its growing attraction to a wide range of investors. In terms of accessibility and attractiveness, the Indian stock market has evolved, creating a new standard in its financial history.

Who Are Eligible to Invest in the Stock Market?

1: What is a stock?

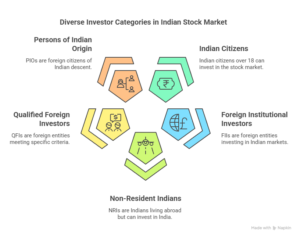

The goal of this blog is to clarify the requirements by providing information on the many investor categories. This can range from domestic individuals to foreign corporations. We also discuss the rules that apply to them. Is It Possible for Anyone to Invest in the Indian Stock Market? This in-depth manual will provide you with an understanding of the various options accessible to prospective investors. The list of people who can trade in India are listed below.

- Indian citizens who are above the age of 18.

- Foreign Institutional Investors (FIIs)

- Non-Resident Indians (NRIs)

- Qualified Foreign Investors (QFIs)

- Persons of Indian Origin (PIOs)

Let us look into each of these cases in detail.

Non-Resident Indians (NRIs)

Indian nationals living overseas for work, business, or other reasons are known as NRIs. They can use the Portfolio Investment Scheme (PIS) to make investments by the Reserve Bank of India’s recommendations. They can purchase and sell Indian company shares and debentures on authorized stock exchanges due to this arrangement.

NRIs had about USD 200 billion invested in Indian equities markets as of 2025. The maximum amount that non-resident individuals can invest through PIS is 5% of their paid-up capital for each investor, and 10% for the total NRI population.

Persons of Indian Origin (PIOs)

People of Indian descent who have foreign citizenship are known as PIOs. When it comes to investment regulations, they receive the same treatment as NRIs. PIOs may use the same PIS approach to participate in Indian stock markets. PIOs have the same investment cap as NRIs, which encourages a sizable foreign investment stream into the Indian markets.

Qualified Foreign Investors (QFIs)

QFIs are individuals, organizations, or national entities that adhere to the global financial standards established by the Financial Action Task Force (FATF). QFIs can make direct investments in corporate bonds, mutual funds, and Indian equities markets. The Indian government developed the QFI framework to streamline the procedure for smaller foreign investors.

Up to 5% of an Indian company’s paid-up capital may be invested by QFIs. The goal of this regulatory action is to preserve an equilibrium between the stability of the domestic market and the entry of foreign investment.

Foreign Institutional Investors (FIIs)

FIIs comprise non-Indian registered entities such as insurance companies, hedge funds, mutual funds, pension funds, and so on. To make investments in India, Foreign Institutional Investors (FIIs) are required to register as per SEBI laws. They are important participants who provide substantial inflows of capital.

For example, As of 2025, FIIs wield immense clout in India’s stock market, with investments likely surpassing USD 700 billion. Their activity, governed by 10% and 24% caps, shapes NSE and BSE trends, balancing volatility with growth potential. For traders keen on understanding FII impacts, the Entri Stock Market Course offers expert insights to navigate this landscape.

Are There Any Restrictions?

There are certain requirements and restrictions when it comes to starting the trading journey. Some of them are listed below.

Age Criteria

In India, the legal adult age of eighteen is when people can begin trading in the stock market.

In the case of minors, they must have a joint Demat account with their guardians if they wish to trade.

Documentation

All the documents provided below are a must-have in hand in your trading journey.

- Any financial transaction, including investing in stocks, requires a PAN card.

- To receive transaction settlements, investors must also have a bank account and proof of address.

- It is necessary to link an Aadhar card to verify identity.

Minimum Sum Required

The Indian stock market provides flexibility for investors with different financial capacities by not imposing a minimum investment amount. As they gain comfort and market understanding, people can progressively increase their investment from a small initial amount.

Trading and Demat Account

It is necessary to have both a trading account and a Demat account to execute transactions and hold shares when investing in the Indian stock market. These accounts are the fundamental requirements for any anyone wishing to engage in stock trading.

All these could be understood if you take a course that teaches you the basics of stock trading. It is even better if you can get the help of a mentor. You might be wondering where you can find stock trading courses that are easily accessible, have mentor support and have flexible timings. There is no need to search for more! Entri app online stock trading course is the best stock trading course that matches all the points on your checklist.

Who Can Invest in the Indian Stock Market: Conclusion

After exploring the Indian stock market’s framework, it’s clear that accessibility defines its appeal in 2025. Domestic investors, NRIs, PIOs, FIIs, and QFIs can all participate, each guided by distinct SEBI regulations. Its no-minimum-investment policy welcomes a diverse range of traders, from small retail players to global institutions. To join, a Demat and trading account is essential for seamless share ownership and transactions. Adults aged 18 and above can invest independently, while minors can do so with a guardian. Overseas investors rely on licensed brokers compliant with jurisdictional laws, ensuring global reach. This inclusivity makes India’s stock market a vibrant hub for all.

Are you passionate about studing more about stock market? Consider the Entri Stock Market Course, offering expert guidance to complement your paper trading journey. Start today with these apps, and let 2025 be the year you transform into a savvy trader, ready to turn virtual wins into real profits. Your Indian market mastery begins now!

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

Can Foreigners Make Stock Market Investments in India?

The Reserve Bank of India has issued regulations that open up the Indian stock market to a broader range of investors. Persons of Indian Origin (PIOs), Non-Resident Indians (NRIs), and Foreign Institutional Investors (FIIs) are included in this. With the Portfolio Investment Scheme (PIS), these groups can participate in India’s primary and secondary capital markets. These investor types can use stock exchanges to buy shares and debentures of Indian companies under this arrangement.

The maximum amount that FIIs can invest is typically set at 24 per cent of an Indian company’s paid-up capital. PIOs and NRIs, on the other hand, are limited to 10%. The State Bank of India and other public sector banks are exempt from this restriction, which comes with a 20% limit.

It’s interesting to note that these ceilings are flexible. If the company’s board and general body approve a special resolution, FIIs’ investment limit may be raised to the sectoral cap or statutory ceiling. Similar to this, the general body of the corporation has the authority to increase the 10% cap for NRIs and PIOs to 24%.

The list of businesses that FIIs, NRIs, and PIOs can invest in, together with the precise investment caps that apply to each organization, is kept up to date by the RBI.

What are offshore derivatives?

Foreign investors can purchase Indian shares through participatory notes (P-notes) or offshore derivatives products if they do not want to register with SEBI. These instruments are those that the FPI issues abroad in exchange for securities that the FPI owns in India, according to SEBI.

Investors can conceal their positions by using P-notes, but taking a short position in India necessitates upfront disclosures.

The approximately 150 American and Global Depository Receipts (ADRs/GDRs) of Indian companies registered on overseas exchanges are also available for investment by foreigners. ADR/GDR has become less popular as a means of funding raising for businesses in recent years.

Persons from how many countries are allowed to trade in the Indian stock market as QFIs? Which are these countries?

Currently, the QFI framework allows people to invest in India from 45 different nations. This list will now be enlarged to 52 nations, with residents of seven countries – Argentina, South Korea, Turkey, Kuwait, Qatar, Ireland, and Latvia – permitted to invest via the QFI module. SEBI will sign bilateral agreements with these nations’ authorities. The present list of 45 nations is provided below.

- Australia

- Belgium

- Canada

- Czech Republic

- Finland

- Greece

- Iceland

- Republic of Korea

- Malta

- New Zealand

- Poland

- Russia

- Slovakia

- Spain

- UAE

- Austria

- Brazil

- China

- Denmark

- France

- Hong Kong

- Italy

- Lithuania

- Mexico

- Norway

- Portugal

- Saudi Arabia

- Slovenia

- Sweden

- United Kingdom

- Bahrain

- Bulgaria

- Cyprus

- Estonia

- Germany

- Hungary

- Japan

- Luxembourg

- Netherlands

- Oman

- Romania

- Singapore

- South Africa

- Switzerland

- USA

Can QFIs invest directly?

Yes! QFIs can invest directly in the Indian stock market. The times in which they could invest only in mutual funds are long gone.

Can Students Invest in Indian Stock Markets? What is the age requirement to buy Indian stocks? Does investing in Indian equities demand a minimum amount of money?

Sure. Should the student be older than eighteen, they will be regarded as an ordinary investor. If the individual is underage, the guidelines for minors will be followed. Eighteen is the minimum age required to invest independently in Indian stocks. Minors may, nevertheless, make investments through an account that is overseen by a guardian.

And No, there isn’t a set minimum investment amount needed to begin trading shares in India.

Who are QFIs?

QFIs are people, organizations, or associations that adhere to the standards mentioned below:

- Be a resident of a nation that belongs to a group that is a member of the Financial Action Task Force (FATF) or a nation that is a member of FATF and

- Be a citizen of a nation that has ratified the IOSCO MMOU or a bilateral MOU with the Securities and Exchange Board of India (SEBI).

- A QFI cannot be an Indian national or have an active SEBI sub-account, be registered as a Foreign Institutional Investor (FII), or be a Foreign Venture Capital Investor.

- To start operations, QFI needs to be established with a Qualified Depository Participant (QDP) who is registered with SEBI. Among other things, the QDP will offer custody services.

Who is eligible to buy RBI bonds?

Individual Indian citizens, including minors (through a guardian-managed account) and Hindu Undivided Families (HUFs), are eligible to purchase RBI bonds. However, these bonds aren’t available for purchase by NRIs.

Can foreign nationals invest in Indian stocks?

The Indian stock market is open to investment by non-resident Indians (NRIs). They can purchase and sell Indian company shares and debentures on accredited stock exchanges by using PIS.

Is it possible for a minor to invest in Indian stocks?

Yes, a minor with a Demat account registered in their name can invest in the Indian stock market. But you can only purchase and retain stocks with this account (equity delivery). Trading in derivatives (such as options or futures) and intraday trading (buying and selling equities on the same day) are prohibited for minors.

Who is eligible to invest in the stock market in India?

Subject to specific terms and regulations, investors who are Indian residents over the age of eighteen, NRIs, PIOs, FIIs, and QFIs are all eligible to make investments.