Table of Contents

Are you an accounting and finance student looking to learn more about how government salary structures impact your future career and the economy? Or are you just trying to be more knowledgeable about the 8th Pay Commission in India? The upcoming Pay Commission in India is not just a salary revision for central government employees; it is a detailed case study in public sector accounting, taxation, and financial planning. Preparing for a government exam, pursuing a career in finance or just curiosity to understand real-world applications of accounting principles better, whatever your reasons might be, this is not a topic you can afford to skip. So let us learn more about the 8th Pay Commission in India in this blog.

8th Pay Commission in India: Introduction

The 8th Pay Commission is one of the most anticipated and awaited government decisions for central government employees and pensioners in India. The 7th Pay Commission can come into effect in the year 2016. Since then, expectations are building around the 8th Pay Commission. There have been no official statements or press releases as of now. But it is a major topic of discussion in many areas. Employees are waiting in keen anticipation to know what changes they can expect. We will try to provide a comprehensive overview of how the 8th Pay Commission is going to affect India’s workforce and the broader economy.

What Is a Pay Commission? (Quick Recap)

1: Accounting provides information on

A Pay Commission is a government-constituted body tasked with reviewing and recommending changes to the salary structure of central government employees, armed forces personnel, and pensioners. These commissions are generally set up every 10 years and aim to bring fairness and parity to government salaries in line with inflation and economic growth.

Before moving forward, you should understand what a pay commission is first. A pay commission is a government-constituted body. Its function is to review and recommend changes to the salary structure of the following citizens:

- Central government employees

- Armed forces personnel

- Pensioners

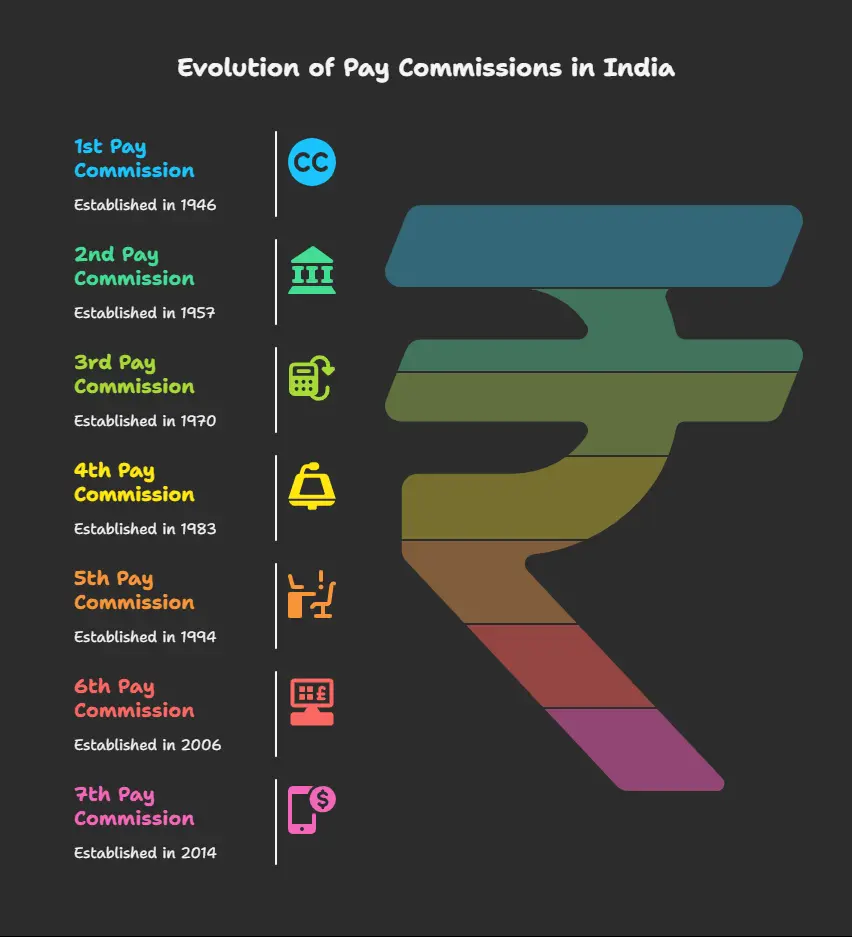

This commission is set up every ten years, and its aim is to bring fairness and parity to government salaries in accordance with inflation and economic growth of the present time. There have been 7 pay commissions since independence. They are briefly mentioned in the table below.

| Pay Commission | Year Constituted | Year Implemented |

| 1st Pay Commission | 1946 | 1946 |

| 2nd Pay Commission | 1957 | 1959 |

| 3rd Pay Commission | 1970 | 1973 |

| 4th Pay Commission | 1983 | 1986 |

| 5th Pay Commission | 1994 | 1997 |

| 6th Pay Commission | 2006 | 2008 |

| 7th Pay Commission | 2014–2015 | 2016 |

You can learn all of these if you join an online accounting course. Have you heard of Entri Elevate’s Accounting course? They offer the best study materials, flexible class schedules, experienced mentors and much more.

Want to know more about Entri Elevate’s online accounting course? Click here now!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Timeline and Current Status of 8th Pay Commission

Based on the previous timelines, it is expected that the 8th Pay Commission in India will be set up around 2024 and implemented by January 1, 2026. But the status has deviated massively from all these expectations. We have already reached the middle of 2025, and still, there has been no formal announcement from the Government of India regarding its constitution. News and reports suggest that employee unions are lobbying strongly for it. There have been many political discussions going on about this, too.

Expected Salary and Pension Hike

While we have no exact report on the content of the 8th Pay Commission in India, there are many educated guesses experts and analysts are making on it. Some of them are listed below. Please be mindful that these are just speculations and could be totally off from what the official report might contain.

| Component | Expected Change and Explanation |

| Minimum Basic Pay | · Likely to increase from ₹18,000 (7th CPC) to ₹26,000–₹27,000.

· This increase would benefit Group C & D employees the most. · Affects all linked allowances like HRA, TA, and DA. |

| Fitment Factor | · Expected to rise from 2.57 to 3.0 or more.

· Determines how your old pay is multiplied to get the new pay. · A rise to 3.0 could mean a 17–20% jump in gross salary. |

| Pension Revision | · Pensioners to receive parallel revisions.

· Dearness Relief (DR) may be merged into the basic pension. · Likely hike in family and commuted pension as well. |

| Allowance Revisions | · Allowances like HRA, DA, and TA to be recalibrated.

· HRA may be revised based on city classification (X, Y, Z cities). · Cumulative salary increase may reach 25–30%. |

| DA Reset | · DA will be reset to 0% after the new pay scales are implemented.

· DA will then continue with biannual revisions based on the inflation index (CPI-IW). |

| Tax Implications | · A higher salary means a possible shift to a higher tax slab.

· Important to plan under Section 80C, 80D, and NPS for savings. · Pensioners may see higher taxable income, too. |

| Location-Based Impact | · Impact will vary based on employee location and pay level.

· Metro city employees may see higher HRA. · Remote and rural postings may benefit from special allowances. |

Why is it delayed?

As we discussed in previous sections, the commissioning of the 8th Pay Commission in India is very delayed as of right now.

| Reason | Explanation |

| Fiscal Pressure | Post-COVID recovery and rising fiscal deficit make salary hikes harder to fund. |

| Inflation Concerns | Sharp salary increases may worsen inflation, especially in essential goods. |

| Alternative Proposals | Some experts suggest replacing pay commissions with automatic DA or performance-based revisions. |

| Political Timing | With general elections over and state polls ongoing, the decision may be delayed for strategic reasons. |

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Impact Beyond the Paycheck

The 8th Pay Commission in India can have wider implications that go beyond just affecting the salary structure of the central government employees. Look at the table below.

| Area | Effect |

| Private Sector | Govt pay hikes often influence PSU & private salaries. |

| Consumption | Higher income may boost spending on homes, cars, and goods. |

| Real Estate & Banking | More savings and credit demand can fuel housing and loan markets. |

| Inflation Risk | Salary hikes may raise prices if not backed by productivity. |

Key Questions to Answer

There are some key questions we should answer to get a complete idea of the 8th Pay Commission in India. Some of them are given below.

- Will the 8th Pay Commission be implemented in the expected time frame?

- What will be the exact fitment factor in the 8th Pay Commission?

- Will the structural changes in salary be applicable to contractual and temporary workers as well?

- Is a new structure for future pay revisions being planned by the government?

What You Can Do Now

All of us are waiting in anticipation for any official announcements on the 8th Pay Commission in India. Some measures that can be taken by government employees and pensioners are given below.

| What You Can Do Now | Actions |

| Financial Planning | · Plan for arrears

· Check tax changes · Adjust the monthly budget |

| Track Updates | · Follow govt. websites

· Watch union news · Join news alerts |

| Engage with Unions | · Attend meetings

· Share concerns · Stay updated on talks |

| Document Readiness | · Update service records

· Keep pension papers ready · Collect proofs |

Learn accounting from expert teachers in the field! Join Entri’s online accounting course now!

8th Pay Commission in India: Conclusion

The 8th Pay Commission in India is something that can reshape the salary and pension structure of millions of central government employees and military service members. They also have the ability to impact the salaries of private sector employees as well as the overall economic state of the country in an indirect manner. But the uncertainties around its setup and implementation remain. Many expect the government to honour the time cycle and make announcements by 2026. Employees and pensioners should remain informed, prepare for changes and engage in collective advocacy.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Will state government employees benefit from the 8th pay commission?

The 8th Pay Commission of India is only directly applicable to central government employees and pensioners. But historically it is seen that state governments have adopted similar recommendations with modifications within 6 to 12 months of implementation of the Pay Commission by the central government. Variations in fitment factors, allowances, and effective dates are entirely dependent on the fiscal capacity of the states concerned. State employees should track announcements from their respective finance departments for confirmation.

What are the Implications for tax, savings, and retirement planning after the 8th Pay Commission?

When salary increases, so does the taxable income. Here is where updated financial planning is needed. Some things to consider are given below.

| Aspect | What to Do |

| Tax Bracket Shift | · Review if you’re moving to a higher tax slab

· Maximize 80C, 80D, NPS |

| Retirement Contributions | · GPF and Pension contributions will increase

· Boosts retirement corpus |

| Investment Rebalancing | · Allocate surplus to PPF, SIPs, and Mutual Funds

· Aim for returns + tax savings |

| Expert Advice | · Consult a tax advisor post-revision

· Avoid unexpected tax liabilities |

What are the differences between the 7th and 8th Pay Commission recommendations?

To understand the differences between the 7th and 8th Pay Commission recommendations better, a comparison table is provided below.

| Criteria | 7th Pay Commission | Expected 8th Pay Commission |

| Year of Implementation | 2016 | Likely 2026 |

| Minimum Basic Pay | ₹18,000 | ₹26,000–₹27,000 (Expected) |

| Fitment Factor | 2.57 | 3.0 or more (Expected) |

| DA Merger in Pay | No | Likely |

| Pension Revision | Yes | Yes |

| Performance-Based Pay | Proposed (limited) | Likely emphasis |

| Frequency of Review | Every 10 years | May switch to dynamic adjustment |

How can we estimate our new salary, which might come into play after the 8th Pay Commission?

An official calculator for doing this is not available yet. The only way we can calculate the revised salary after commission is by using the expected fitment factor. The formula is:

Revised Basic Pay = Current Basic Pay × Expected Fitment Factor

Now take a look at the table below to understand things more clearly.

| Component | Calculation | Amount (Rs) |

| Current Basic Pay | — | 18,000 |

| Fitment Factor | Expected: 3.0 | — |

| Revised Basic Pay | 18,000 × 3.0 | 54,000 |

| Dearness Allowance (50%) | 50% of Basic | 27,000 |

| House Rent Allowance (20%) | 20% of Basic | 10,800 |

| Other Allowances | Estimated | 3,000 |

| Estimated Total Monthly Salary | Sum of all above | 94,800 |

Please keep in mind that these figures are just illustrative. The actual figures will depend on location, grade, and role.

How does the 8th Pay Commission affect your take-home salary?

The 8th Pay Commission is expected to bring changes to the basic pay scale as well as allowances of central government employees. This means that there will be a change in the take-home salary as well. The following table will help you understand the expected changes better.

| Expected Changes | Details |

| Fitment Factor Increase | · May rise from 2.57 to 3.0 or more

· Leads to higher gross pay |

| Allowance Adjustments | · HRA, TA, and DA are likely to be revised

· Increases overall monthly earnings |

| Tax Implications | · Higher income may raise tax liability

· Tax planning becomes important |

| Example Calculation | · Current Basic: ₹25,000

· New Fitment Factor: 3.0 · Revised Basic: ₹75,000 (approx.) |