Table of Contents

Many students dream of joining top global firms. The Big 4 companies are always at the top. They offer great jobs and real career growth. But one question still worries most freshers. How Much Can You Earn as a Fresher in the Big 4? Salaries may vary based on many factors. College, skills, and role matter the most. Knowing the pay range helps you plan better. Let’s break down the real numbers in 2025. This blog makes it easy to understand.

Big 4 firms hire freshers across India every year. These jobs are exciting but also competitive. You need the right skills and good training. There are many ways to increase your chances. Some courses and certifications really make a difference. We’ll also show you how to stand out. From starting salary to future growth, we cover all. Stay with us till the end for tips. This guide is perfect for serious Big 4 aspirants.

Become an Accounting Pro – Learn from Industry Experts!

How Much Can You Earn as a Fresher in the Big 4?: Introduction

Every year, thousands apply to the Big 4. These firms are known for shaping future leaders. They hire freshers from many streams and colleges. Most roles involve finance, tax, or consulting work. Freshers get global exposure from day one. The learning environment is fast-paced and exciting.

Teamwork, deadlines, and growth define the daily routine. But salary remains the biggest curiosity for most. Many wonder if the pay justifies the pressure.

Let’s explore what you’ll really earn in 2025.

What is the Big 4?

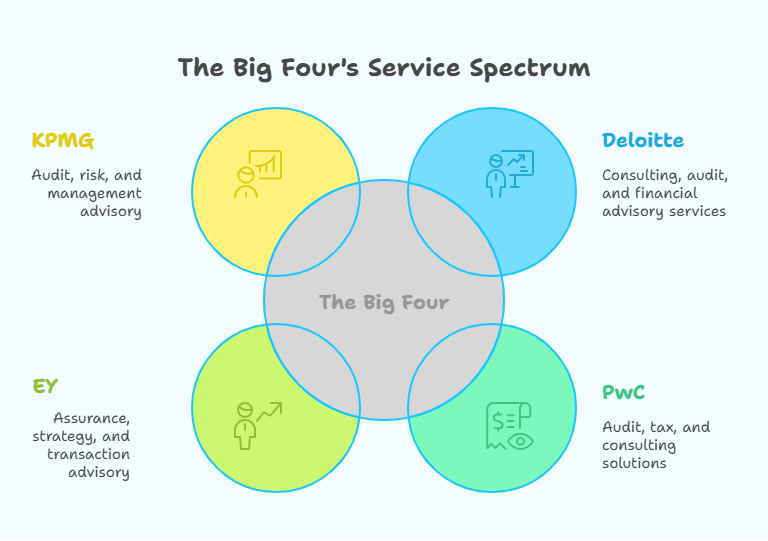

The Big 4 are four major global firms that offer auditing, consulting, tax, and advisory services:

-

Deloitte

Leading in consulting, audit, and financial advisory services. -

PwC (PricewaterhouseCoopers)

Offers solutions in audit, tax, and consulting sectors. -

EY (Ernst & Young)

Works in assurance, strategy, and transaction advisory. -

KPMG

Known for audit, risk, and management advisory services.

These companies serve top clients across many industries.

Why Do Freshers Want to Join the Big 4?

-

Top Industry Exposure

Work with Fortune 500 clients and top industry leaders. -

Structured Career Paths

Clear growth plans with regular appraisals and feedback. -

Skill Development

Learn tools, methods, and global best practices. -

Work Culture

High standards, supportive teams, and continuous learning. -

Strong Resume Value

Big 4 experience helps with future job switches.

How Much Can You Earn as a Fresher in the Big 4?: Typical Fresher Roles in Big 4 Companies

1: Accounting provides information on

Freshers often get confused about Big 4 job roles. Each firm offers many entry-level career opportunities. These roles are both challenging and full of learning. You’ll work with senior teams from the start. Client meetings, project work, and analysis come early. Most roles fall under audit, tax, or consulting. Your job depends on your background and skills. Commerce, finance, and tech students all get placed. Training is provided before actual projects begin. You’re expected to learn quickly and deliver results. These roles shape your foundation in business practices.

Let’s explore the most common roles for freshers.

1. Audit Associate

Audit is one of the biggest entry-level domains.

-

What You Do:

Review client financial records and test controls. -

Key Tasks:

-

Check income, expenses, and financial reports.

-

Work with audit software and documentation tools.

-

Visit client locations during audit periods.

-

-

Skills Needed:

-

Strong knowledge of accounting and auditing basics.

-

Attention to detail and time management.

-

2. Tax Analyst

Freshers in tax help companies manage taxation efficiently.

-

What You Do:

Prepare tax filings and assist in tax planning. -

Key Tasks:

-

Calculate taxes as per current laws.

-

Assist in filing income and indirect tax returns.

-

Help clients reduce tax risks and penalties.

-

-

Skills Needed:

-

Basic knowledge of GST, income tax, and laws.

-

Excel and tax software skills are helpful.

-

3. Consulting Analyst

Consulting analysts support clients with business decisions.

-

What You Do:

Assist in strategy, tech, and operations improvement projects. -

Key Tasks:

-

Collect and analyze business data for insights.

-

Prepare presentations and client-ready reports.

-

Work with clients from different industries.

-

-

Skills Needed:

-

Problem-solving, communication, and data analysis skills.

-

Tools like Excel, PowerPoint, and Tableau.

-

4. Risk Advisory Associate

Risk roles involve helping businesses manage uncertainties.

-

What You Do:

Identify and reduce business, tech, or compliance risks. -

Key Tasks:

-

Conduct risk assessments for processes and systems.

-

Suggest improvements to reduce future problems.

-

Create risk control documentation for clients.

-

-

Skills Needed:

-

Logical thinking, analytical ability, and tech interest.

-

Knowledge of risk tools and frameworks is a plus.

-

5. Deals/Advisory Analyst

This is a core finance and M&A-focused role.

-

What You Do:

Help clients during mergers, acquisitions, and valuations. -

Key Tasks:

-

Perform company and industry research.

-

Build financial models for deal evaluation.

-

Prepare reports on company value and risks.

-

-

Skills Needed:

-

Finance knowledge, Excel modeling, and research skills.

-

Preferred for MBA or finance background candidates.

-

Each role offers something unique for freshers. Pick your path based on interest and strengths.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!How Much Can You Earn as a Fresher in the Big 4?: Fresher Salary Range in India (2025 Estimates)

Salary is one of the biggest concerns for freshers. Everyone wants to know what Big 4 firms pay. In 2025, packages have slightly increased with demand. Each role and firm offers a different salary. Your background and performance can influence the figure. Campus placement packages may differ from off-campus offers. Tier-1 colleges often receive the best salary deals. Roles like consulting usually pay more than audit. Certifications can also boost your entry-level pay. Metro cities offer better packages than smaller towns. The base pay is usually fixed and structured.

Let’s break down the fresher salary trends in 2025.

General Salary Range for Freshers (2025)

Here’s an overview of estimated fresher salary ranges in the Big 4:

-

Minimum Package

₹4.5 LPA for standard audit or tax roles. -

Average Package

₹6.5 LPA across most profiles in top cities. -

Maximum Package

₹9.0–10.0 LPA in consulting, deals, or tech roles.

Salary by Role (Estimate for 2025)

| Role | Salary Range (₹ LPA) | Bonus/Incentives |

|---|---|---|

| Audit Associate | 4.5 – 6.0 | Minimal or project-based |

| Tax Analyst | 4.8 – 6.5 | Annual performance bonus |

| Consulting Analyst | 6.0 – 8.0 | High based on projects |

| Risk Advisory Associate | 5.5 – 7.5 | Medium to high bonus |

| Deals Analyst | 6.5 – 9.0 | High deal-based incentives |

Note: Salaries may vary based on location and college tier.

Salary by Location

-

Metro Cities (Bangalore, Mumbai, Delhi NCR)

Packages are 10–20% higher due to cost of living. -

Tier-2 Cities (Kochi, Pune, Jaipur)

Slightly lower base pay, but similar growth potential.

Salary by Educational Background

-

CA, MBA (Tier-1)

₹8.0 – ₹10.0 LPA at entry level. -

Commerce/Finance Graduates (B.Com, BBA)

₹4.5 – ₹6.5 LPA depending on role. -

Engineering/Tech Graduates

₹6.0 – ₹8.0 LPA in data or tech roles.

Certification Impact

-

With ACCA/CMA/CFA (Entry-Level)

Salary can increase by ₹1.0–₹2.0 LPA more. -

Without Certifications

Base salary applies, fewer niche opportunities.

Big 4 firms offer stable and structured packages. While pay is important, growth matters even more.

Become an Accounting Pro – Learn from Industry Experts!

How Much Can You Earn as a Fresher in the Big 4?: What Factors Affect Your Starting Salary?

Fresher salaries in Big 4 are not fixed. Many factors decide how much you will earn. The same role can pay differently for others. Your college, skills, and certifications all play a role. Firms offer more to students from top colleges. Good communication and interview skills also impact packages. Relevant internships help you stand out from others. Your degree background can shape your salary band. Even the city of joining affects pay. Some roles get better incentives or bonuses too. Understanding these factors helps you plan your path.

Let’s look at them one by one now.

1. College Tier

-

Tier-1 Colleges (IIMs, SRCC, IITs, etc.)

Candidates often get top-end salary offers. -

Tier-2 & Tier-3 Colleges

Salary may be slightly lower, but growth remains strong.

2. Academic Background & Degree

-

Professional Degrees (CA, MBA, CFA)

Higher entry-level salaries and leadership-track roles. -

General Degrees (B.Com, BBA, B.Sc)

Mid-range salary, especially in audit and tax. -

Technical Degrees (B.Tech, M.Tech)

Preferred for consulting, data, or cyber roles.

3. Certifications and Special Skills

-

Popular Certifications

ACCA, CMA, CPA, CFA, or data tools (Excel, Tableau). -

Impact

Can boost starting salary by ₹1.0–2.0 LPA.

4. Internship Experience

-

With Internship Experience

Increases confidence and practical knowledge during interviews. -

Without Internship Experience

You may get the minimum base salary.

5. Communication and Soft Skills

-

Why It Matters

You’ll deal with clients and present work regularly. -

Good Communication

Helps you perform better during interviews and appraisals.

6. Job Location

-

Metro Cities (Delhi, Mumbai, Bangalore)

Higher cost of living = Higher salary offered. -

Tier-2 Cities (Cochin, Pune, Chandigarh)

Slightly lower packages, same learning experience.

7. Role Demand and Business Needs

-

High-Demand Roles (Consulting, Risk, Deals)

Usually pay better due to project pressure. -

Standard Roles (Audit, Tax)

Fixed salary range with less variation.

Salary Influencing Factor Table

| Factor | Impact Level | Explanation |

|---|---|---|

| College Tier | High Impact | Top colleges get better starting salaries. |

| Academic Background | High Impact | Professional degrees earn higher pay. |

| Certifications | High Impact | Relevant certs increase salary offers. |

| Internship Experience | High Impact | Practical experience improves salary. |

| Communication Skills | High Impact | Good communication boosts interview success. |

| Job Location | Moderate Impact | Metro cities offer slightly higher pay. |

| Role Type | High Impact | High-demand roles usually pay more. |

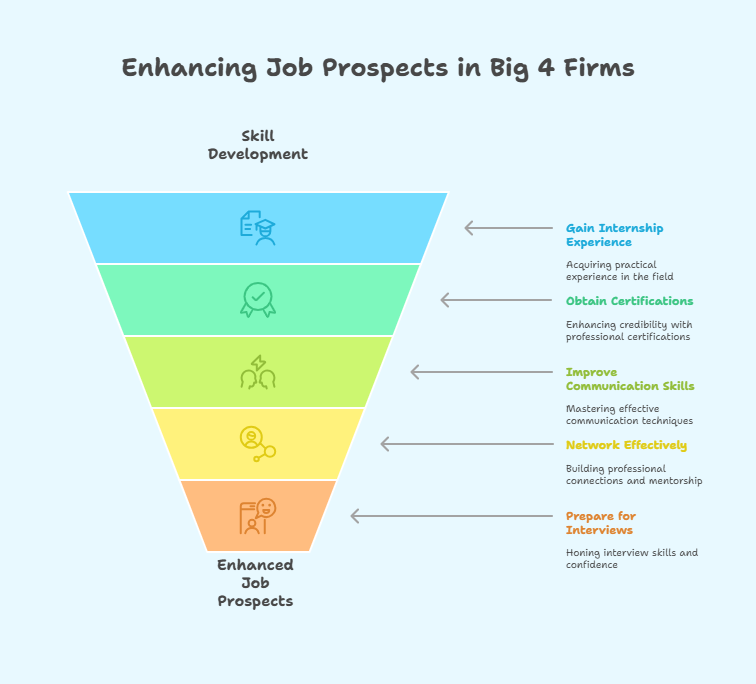

How Much Can You Earn as a Fresher in the Big 4?: How to Improve Your Chances of a Better Offer

Landing a better offer requires focused preparation. Big 4 recruiters look for skills and attitude. Only good marks won’t guarantee a high package. You must develop relevant skills and practical knowledge. Soft skills like communication are equally important. Internships show you understand real work challenges. Certifications demonstrate your commitment and expertise. Networking helps you learn and get referrals. Preparing well for interviews boosts your confidence. Practice case studies and technical questions regularly. Demonstrate teamwork and problem-solving during group discussions.

Let’s explore key ways to improve your chances.

1. Build Relevant Skills

-

Technical Knowledge

Understand basics of accounting, finance, or consulting.

Learn Excel, PowerPoint, and data analysis tools. -

Industry Awareness

Stay updated on current financial and business trends.

Read reports, news, and company case studies.

2. Gain Internship Experience

-

Apply Early

Target internships with Big 4 or similar firms. -

Show Initiative

Take responsibility and ask for challenging tasks. -

Learn Soft Skills

Improve communication, teamwork, and client handling.

3. Get Certifications

-

Popular Certifications

Pursue ACCA, CFA, CMA, or data analytics certificates. -

Benefits

Certifications can boost your salary and profile.

Show recruiters your serious commitment to growth.

4. Improve Communication Skills

-

Practice Speaking

Join clubs like Toastmasters or debate teams. -

Mock Interviews

Regular practice reduces nervousness and improves clarity. -

Active Listening

Helps in understanding questions and responding well.

5. Network Effectively

-

Attend Industry Events

Meet professionals and recruiters in person or online. -

LinkedIn Presence

Build a strong profile and connect with Big 4 employees. -

Seek Mentorship

Guidance from seniors can improve preparation.

6. Prepare Thoroughly for Interviews

-

Study Common Questions

Know technical, HR, and case study questions well. -

Work on Group Discussions

Show leadership, clarity, and teamwork skills. -

Be Honest and Confident

Authenticity impresses recruiters more than rehearsed answers.

Boost Your Big 4 Career with the Entri PwC Edge Programme

This specially designed course sharpens your technical and soft skills. Get industry-focused training aligned with PwC’s hiring needs. Mock interviews and case studies improve your confidence. Learn from experts who guide you step-by-step. Certification from Entri enhances your resume’s value. Join now to stand out in Big 4 recruitment. Gain the edge every fresher needs to succeed.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!How Much Can You Expect to Earn After 1–2 Years?

After 1–2 years, your salary can rise. Performance, role, and location strongly influence increments. Big 4 rewards consistent hard work and learning.

Promotions typically happen after annual performance reviews. Salary hikes depend on individual and team success. Specialized skills can lead to higher pay raises. Consulting and advisory roles usually get faster growth. Audit and tax see steady but slower increases. Bonuses and incentives add to overall compensation. Some get international opportunities boosting their earnings. Keeping certifications updated supports better salary growth.

Let’s explore expected salary ranges after 1–2 years.

Expected Salary Growth by Role (After 1–2 Years)

| Role | Average Salary at Entry (₹ LPA) | Expected Salary After 2 Years (₹ LPA) | Comments |

|---|---|---|---|

| Audit Associate | 4.5 – 6.0 | 6.0 – 8.0 | Growth steady with certifications. |

| Tax Analyst | 4.8 – 6.5 | 6.5 – 8.5 | Gains from tax law expertise. |

| Consulting Analyst | 6.0 – 8.0 | 8.5 – 11.0 | Faster growth due to project demands. |

| Risk Advisory Associate | 5.5 – 7.5 | 7.5 – 10.0 | Strong demand for risk management skills. |

| Deals Analyst | 6.5 – 9.0 | 9.0 – 12.0 | High increments linked to deal closures. |

Factors Influencing Salary Growth

-

Performance Ratings

High performers get better increments and bonuses. -

Skill Upgradation

Learning new skills can lead to faster promotion. -

Client Feedback

Positive client reviews boost your appraisal scores. -

Additional Responsibilities

Taking leadership or complex tasks can increase pay.

Career Path Impact

-

Promotions

From Associate to Senior Associate in 1–2 years.

Salary hikes come with new responsibilities. -

Lateral Moves

Switching to specialized teams or consulting boosts pay. -

Certifications and Education

CA, CFA, or MBA after joining can increase salary.

Location and Market Trends

-

Metro Cities

Annual hikes usually 10–15% higher than smaller cities. -

Emerging Cities

Slower but steady growth with improving business.

Growing your career in Big 4 is rewarding. Focus on skill development and consistent performance.

How Much Can You Earn as a Fresher in the Big 4?: Conclusion

Starting a career in the Big 4 is exciting. Fresher salaries vary based on role, skills, and location. With dedication, your salary can grow steadily in years. Improving soft skills and certifications increases your value. Internships and networking give you a competitive edge. The Entri PwC Edge Programme helps you prepare better. Focus on continuous learning for long-term career success.

Key Takeaways

-

Fresher salaries typically range between ₹4.5 to ₹10 LPA.

-

College background and certifications greatly affect starting pay.

-

Strong communication and internship experience improve your offer.

-

Salary growth after 1–2 years depends on performance.

-

Consulting roles often see faster salary increments.

-

Location influences both starting salary and increments.

-

Programs like Entri PwC Edge boost readiness for Big 4.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What is the average starting salary for a fresher in the Big 4?

The average fresher salary ranges from ₹4.5 LPA to ₹7.0 LPA.

Which Big 4 company pays the highest starting salary?

Salaries are similar, but consulting roles in PwC and Deloitte tend to pay more.

Does location affect the fresher salary in the Big 4?

Yes, metro cities usually offer 10–20% higher salaries than smaller cities.

How much can I expect my salary to grow after 2 years?

Typically, salaries increase by 20–40% depending on performance and role.

Which roles offer the best salary growth in the Big 4?

Consulting, deals, and risk advisory roles generally have faster salary growth.

Do internships influence the salary offer in Big 4?

Yes, relevant internships improve your chances of a better salary package.

How important are certifications for fresher salary in Big 4?

Certifications like CA, CFA, or ACCA can increase starting salary by ₹1–2 LPA.

Can soft skills impact my Big 4 salary offer?

Strong communication and leadership skills positively affect your salary offer.

Are bonuses a significant part of fresher compensation in Big 4?

Bonuses vary by role and firm but can add 10–20% to total compensation.

How can the Entri PwC Edge Programme help in securing a better offer?

It provides industry-focused training, mock interviews, and skill development to boost your chances.