Table of Contents

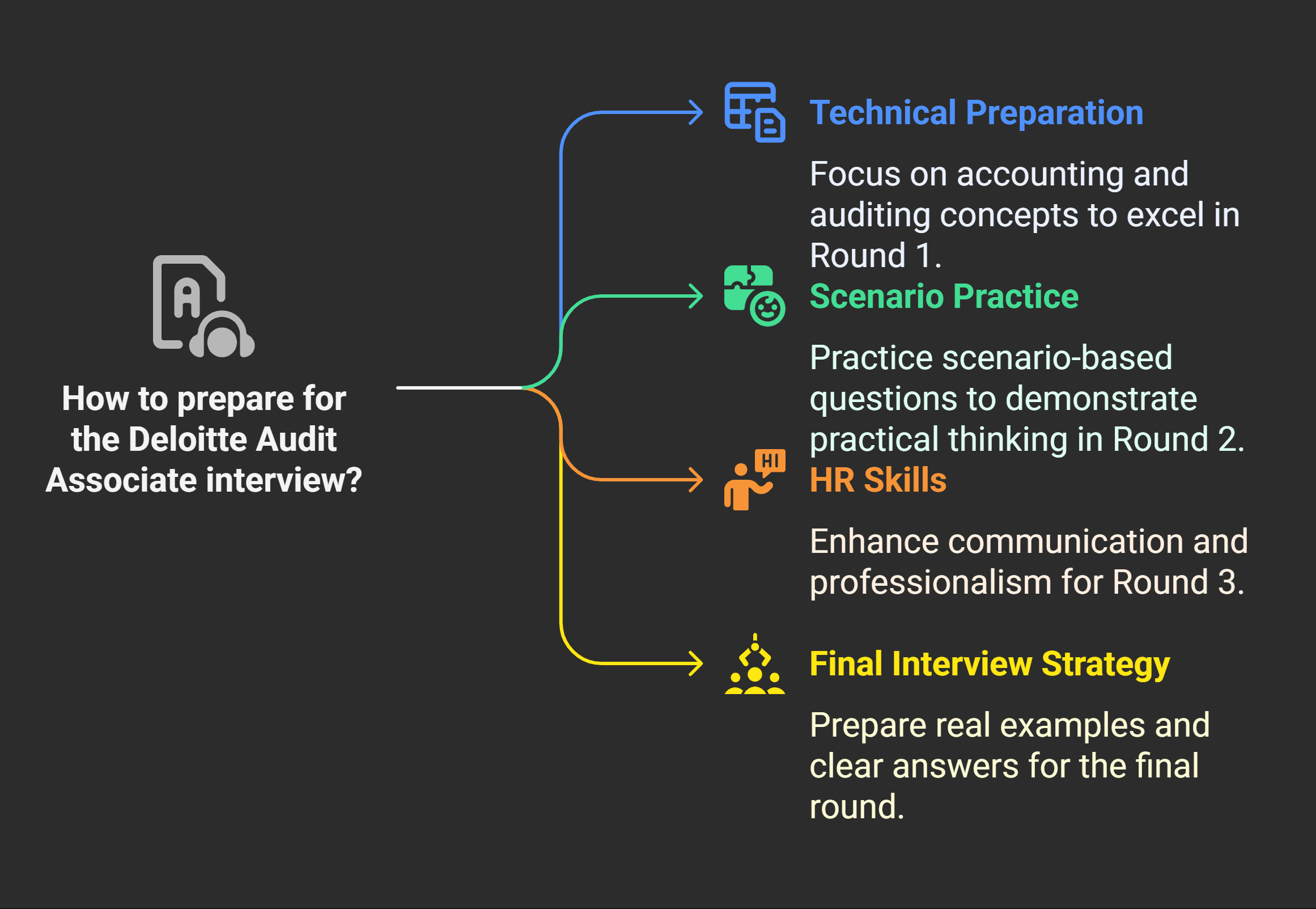

Preparing for a Deloitte Audit Associate interview takes effort. The process can seem challenging at first. You need to be ready for multiple interview rounds. Each stage focuses on different skill sets and knowledge. Understanding common Deloitte Audit Associate interview questions is important. It helps you feel confident and stay organized. Knowing what to expect makes a big difference. This blog will guide you through the key questions.

Whether you’re a student or recent graduate, this will help. We’ll cover technical, practical, and behavioral question types. You’ll also learn what to expect in each round. Sample answers are provided to guide your preparation. Simple tips will help you avoid common mistakes. Let’s get started with your interview prep journey.

Become an Accounting Pro – Learn from Industry Experts!

Deloitte Audit Associate Interview Questions & Answers: Introduction

Getting a job at Deloitte is a big achievement. As an Audit Associate, you join a respected global firm. Deloitte offers great training, learning, and career growth opportunities. The interview process tests both knowledge and soft skills. You need to prepare for different types of questions. These include technical, practical, and behavioral interview questions. Knowing Deloitte Audit Associate interview questions builds your confidence. It also helps you give clear and structured answers. Each interview round has a specific focus and goal. You may be asked about accounting standards and scenarios. There will also be HR and managerial questions to answer. You should explain your thinking in a clear way. Deloitte looks for strong communication and problem-solving skills. They also value ethics, teamwork, and attention to detail. This blog covers all interview stages with sample questions. Use it to prepare and perform well in your interview.

Deloitte Audit Associate Interview: Accounting Concept Questions and Technical Questions

1: Accounting provides information on

1. What is an audit?

An audit is an independent review of financial statements. It ensures accuracy, transparency, and compliance with standards. Auditors collect evidence and evaluate internal controls. Their goal is to provide a true and fair opinion.

2. What are the types of audit opinions?

-

Unqualified: Clean report with no major issues

-

Qualified: Minor issues but overall fair presentation

-

Adverse: Major misstatements in financial statements

-

Disclaimer: Auditor couldn’t obtain sufficient evidence

Each opinion affects stakeholder trust differently.

3. What is materiality?

Materiality relates to the significance of an error or omission. If an error changes user decisions, it’s considered material. Auditors decide materiality based on size and context. Materiality guides audit procedures and reporting decisions.

4. What are audit assertions?

-

Existence: Assets or liabilities exist on the date

-

Completeness: All transactions are fully recorded

-

Rights and obligations: Entity legally owns reported assets

-

Valuation: Items are correctly valued and recorded

-

Presentation: Items are properly classified and disclosed

Auditors test each assertion for reliability.

5. What is internal control?

Internal controls help reduce risk and prevent fraud. They support accuracy in financial reporting processes. Auditors assess these systems during planning. Weak controls require more audit testing.

6. What are substantive procedures?

Substantive procedures verify the accuracy of reported data. They include detailed testing and analytical reviews.

These are essential when control risks are high. They help confirm balances and transactions.

7. Define audit risk.

Audit risk is the chance of a wrong opinion. It includes inherent, control, and detection risks. Auditors reduce risk through planning and evidence collection. Risk assessment guides the audit approach.

8. What is vouching?

Vouching verifies recorded transactions with original documents. It checks the authenticity of books of accounts. Examples include invoices, contracts, and payment records. It’s a fundamental part of audit procedures.

9. Difference between GAAP and IFRS?

-

GAAP: Rules-based, more detailed, used in the U.S.

-

IFRS: Principles-based, flexible, used internationally

Both aim to present fair financial information.

Differences exist in recognition and measurement.

10. What is the matching principle?

It matches expenses with related revenues. This ensures profit is measured correctly per period. Used widely in accrual accounting. Prevents misstatement of net income.

11. Explain depreciation.

Depreciation spreads asset cost over useful life. It reflects usage, wear, and tear. Reduces asset value gradually over time. Recorded as an expense in statements.

12. What is a trial balance?

It lists all ledger balances in debit or credit. Used to check mathematical accuracy of accounts. Essential step before preparing financial statements. Helps identify errors or imbalances.

13. What are contingent liabilities?

These are potential obligations from past events. Payment depends on future uncertain outcomes. Examples: lawsuits or tax assessments. Disclose when probable and measurable.

14. What is a ledger?

A ledger contains all account-wise transaction summaries. It collects entries from the journal. Used to prepare trial balance and statements. Important for tracking individual account balances.

15. What are journal entries?

Journal entries record all financial transactions chronologically. They include debit and credit with narration. Every entry follows double-entry bookkeeping rules. These feed into the ledger accounts.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Deloitte Audit Associate Interview: Scenario-Based / Practical Questions

1. What if a client delays document submission?

First, follow up professionally and remind them. Second, escalate if delays continue after reminders. Third, update audit plan timelines accordingly. Meanwhile, complete areas with available data.

2. You detect a large error in inventory. What next?

I double-check the supporting documents immediately. Then inform my senior with proper notes. Suggest adjusting entries after confirmation. Ensure it’s reflected in the final report.

3. What if a senior gives unclear instructions?

Ask clarifying questions until you’re sure. Restate what you understand for confirmation. Request samples or checklists if available. Avoid assuming anything uncertain.

4. Describe a time you missed a deadline.

During internship, I missed a review deadline once. I underestimated the time required for documentation. I informed my senior, then worked extra hours. Learned to plan better and ask early.

5. How do you handle multiple tasks?

-

Make a to-do list

-

Set priorities

-

Use calendar alerts

-

Ask for support when overloaded

-

Update progress daily

Multitasking requires structure and focus.

6. What if the client is uncooperative?

Maintain professionalism in all communication. Document all interactions for audit trail. Report the issue to your senior promptly. Try alternative evidence if possible.

7. You’re asked to audit a new sector. How do you prepare?

I start with basic industry research. Next, I review previous audit files. Then, I study relevant accounting standards. Finally, I clarify risks with the team.

8. You suspect fraud during testing. What’s your action?

-

Collect evidence

-

Avoid alerting the client

-

Inform the manager discreetly

-

Do not confront alone

Follow firm protocols for fraud reporting.

9. What would you do if audit software fails?

Use manual documentation or spreadsheets temporarily. Inform the IT team about the issue. Continue critical work offline where possible. Save backup copies regularly.

10. Describe a situation where client gave wrong data.

I noticed mismatched invoice dates during testing. Asked the client to recheck records. Confirmed the correct figures using external sources. Flagged the issue and added notes.

11. You receive last-minute adjustments. How do you manage?

Verify all new data carefully. Update working papers accordingly. Ensure documentation is clear and complete. Inform your senior before finalizing reports.

12. How do you plan your audit work?

-

Understand the scope

-

Break into phases

-

Allocate days per section

-

Keep time for review

A plan keeps audit smooth and timely.

13. A client refuses to give access. Now what?

Stay calm and explain the requirement. Seek alternate documents if available. Inform senior for support or escalation. Document the denial clearly.

14. You’re given work outside your comfort zone. What’s your approach?

Start by learning basic concepts quickly. Ask seniors for guidance when stuck. Refer to manuals or past audits. Try to deliver with accuracy and clarity.

15. How do you ensure audit quality under time pressure?

Stick to checklist and procedures strictly. Prioritize high-risk and material items first. Avoid skipping required documentation steps. Review work before submission always.

Deloitte Audit Associate Interview: HR & Behavioral Round Questions

Disclaimer:

The following answers are example responses meant to guide your preparation. You should tailor your answers based on your personal experiences, strengths, and career goals. Authenticity and self-awareness are key during HR interview.

1. Tell me about yourself.

I studied B.Com with a focus on accounting subjects. Then I interned with a local audit firm for six months. I enjoy learning, analyzing data, and working in teams. My strengths include discipline, communication, and adaptability to challenges. I want to grow professionally in an audit environment.

2. Why Deloitte?

-

Global presence

-

Diverse projects

-

Good learning culture

-

Clear career paths

-

Focus on ethics and quality

Deloitte helps employees grow in a supportive environment.

3. Describe your strength.

I focus well, even under time pressure. Also, I complete my tasks without distractions or delays. I take ownership of all assigned responsibilities.

4. What’s your weakness?

Sometimes I try to perfect every small task. This delays my overall productivity and task completion. I’m learning to balance speed and perfection better.

5. How do you handle stress?

I start by breaking big tasks into smaller ones. Then, I prioritize based on urgency and importance. I take breaks to avoid burnout or overload.

6. Describe a team conflict you resolved.

Two team members disagreed about task division. I suggested a role swap for fairness. Both agreed, and the conflict ended peacefully.

7. Are you a team player?

Yes, I enjoy collaborating and learning from others. I believe teams complete projects faster and better. I also support teammates during tight deadlines.

8. Where do you see yourself in 5 years?

I want to become a senior audit associate. Then I am hoping to lead small teams independently. I also want to finish my CA course.

9. What motivates you?

-

Learning new tools

-

Appreciation from seniors

-

Solving real-world problems

-

Meeting deadlines

All these drive me to improve every day.

10. Describe your work ethic.

I am disciplined and respect all deadlines. Also, I value feedback and try to improve continuously. I believe in delivering quality over quantity always.

11. What do you know about Deloitte’s values?

Deloitte values integrity, teamwork, and client satisfaction. It promotes continuous learning and ethical decision-making. The firm also supports diversity and inclusion actively.

12. What does success mean to you?

Success is achieving goals without compromising values. It also means helping others succeed along the way. Personal growth and learning are important too.

13. Tell me about a time you failed.

I missed a college project deadline once. I underestimated the time needed for research. Now, I plan my work well in advance.

14. Do you prefer independent work or team projects?

I enjoy both types depending on the task. Teamwork brings fresh ideas and shared responsibility. Independent work builds focus and accountability too.

15. How do you accept feedback?

-

Listen fully

-

Reflect on it

-

Apply suggestions

-

Say thank you

Feedback helps me grow and improve continuously.

Become an Accounting Pro – Learn from Industry Experts!

Deloitte Audit Associate Interview: Final Round (Partner/Managerial Questions)

Disclaimer:

The answers provided below are sample responses for practice purposes. In the final round, it’s important to share your real experiences, values, and long-term goals. Customize your responses to reflect your personal journey and aspirations.

1. How do you add value to our team?

I contribute by being detail-focused and reliable. Also, I ask the right questions when I’m unsure. I take initiative without being told every time.

2. Why should we hire you?

-

Strong academic background

-

Good communication skills

-

Eagerness to learn

-

Ethical mindset

-

Interest in audit

I will work hard and stay committed to growth.

3. What’s your understanding of Deloitte’s audit approach?

Deloitte uses a risk-based, client-focused audit methodology. It focuses on critical areas and possible misstatements. The approach is data-driven and supported by technology.

4. How do you handle pressure during busy season?

I use a checklist to organize my work. I also plan short breaks to avoid burnout. Daily progress reviews help me stay on track.

5. Describe a time you took initiative.

I created an audit tracker in Excel. It helped our team monitor status daily. Seniors appreciated the added clarity and efficiency.

6. What do you expect from Deloitte?

Learning, mentorship, and hands-on project experience. Clear feedback to improve continuously. Supportive leadership and long-term growth opportunities.

7. How do you handle mistakes?

-

Acknowledge the mistake

-

Inform senior

-

Correct it

-

Document the fix

Then I try not to repeat it again.

8. What would your previous manager say about you?

Punctual, responsible, and quick to understand instructions. Always willing to support others when needed. Reliable in meeting deadlines without follow-ups.

9. How do you balance speed and accuracy?

I plan buffer time for review. Avoid multitasking on critical parts. Always double-check final numbers before submission.

10. What are your long-term goals?

Finish my CA and earn global exposure. Become a senior audit manager in 7–8 years. Train juniors and lead large audit engagements.

11. Describe a leadership experience.

Led a three-member college audit case study team. Assigned tasks, tracked timelines, and resolved team issues. We completed and presented the project on time.

12. How do you build client trust?

-

Be responsive

-

Deliver work on time

-

Keep commitments

-

Maintain confidentiality

Trust is built with honesty and consistency.

13. What challenges do auditors face today?

-

Remote audits

-

Cybersecurity risks

-

Changing regulations

-

Data overload

Staying updated helps overcome these effectively.

14. What makes Deloitte different from others?

Global exposure, strong ethics, and advanced tools. Deloitte invests in its people’s success. It blends tradition with modern innovation well.

15. Do you have questions for us?

Yes, I’d like to ask about:

-

Team structure

-

Onboarding process

-

Learning tools

-

Global mobility options

Also, feedback frequency during probation period.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Conclusion

Preparing for a Deloitte audit interview requires strong fundamentals. Understand accounting principles and common audit procedures thoroughly. Practice real-world scenarios to improve critical thinking skills. Be honest and confident during HR and behavioral questions. Showcase your motivation and interest in audit work. Customize answers to reflect your own strengths and experiences. Stay updated with current industry trends and auditing standards. Always maintain professionalism, clarity, and attention to detail. With practice, you can confidently face every interview round. Stay calm, focused, and believe in your preparation.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What should I focus on when preparing for a Deloitte Audit Associate interview?

Focus on accounting fundamentals, audit concepts, and practical application. Understand key terms like audit assertions, internal controls, and materiality. Review the company’s values, recent reports, and the Deloitte audit methodology. Prepare examples from past academic or internship experiences. Also, practice speaking clearly and confidently during behavioral rounds.

How is the Deloitte Audit Associate interview structured?

Typically, the interview has multiple stages. It starts with a technical/accounting round. Then, a practical or scenario-based discussion follows. HR or behavioral interviews come next. The final round is usually with a partner or manager. Each stage evaluates different skills and perspectives.

Are the technical questions limited to accounting topics only?

No, they include both accounting and auditing topics. Questions may cover depreciation, journal entries, internal controls, and types of audit opinions. You may also face questions about IFRS, GAAP, or recent changes in auditing standards. Review concepts from your coursework and internship tasks.

How can I prepare for scenario-based questions?

Use the STAR method: Situation, Task, Action, Result. Think of past incidents like missing deadlines, resolving conflicts, or handling multiple tasks. Prepare real examples that reflect your thinking and response. Deloitte values structured, logical, and ethical decision-making in such cases.

What kind of HR questions are commonly asked?

Expect questions about your strengths, weaknesses, goals, and teamwork experience. They may ask how you deal with stress, feedback, or conflicts. Be ready to talk about your motivations and how you align with Deloitte’s work culture. Stay honest and avoid memorized answers.

What is the final round like at Deloitte?

It’s usually taken by a partner or manager. This round focuses on your fit within the team and firm. They’ll assess your communication, commitment, long-term goals, and leadership potential. You might also get client-based or high-level scenario questions. Stay composed and be professional.

Do I need to know specific tools or software for this role?

Basic Excel skills are essential. Knowing audit tools like CaseWare, IDEA, or Deloitte’s proprietary platforms helps but isn’t mandatory for freshers. Be familiar with how digital audits work. Highlight your willingness to learn new tools quickly during the interview.

How important is communication in the Deloitte interview?

Very important. Clear, structured communication reflects your audit-readiness. You’ll often interact with clients and team members in this role. Being able to explain complex topics simply and confidently can set you apart. Always listen carefully before answering.

What should I wear for the Deloitte interview?

Wear formal business attire. For men: collared shirt, trousers, and formal shoes. For women: formal blouse, trousers or suit, and minimal accessories. Dressing professionally shows respect and seriousness. Even for virtual interviews, choose a neat and well-lit environment.

Can I apply again if I don't clear the interview?

Yes, Deloitte allows reapplications after a cooling-off period. Use the feedback from your earlier attempt to improve. Focus on the areas where you struggled before. With better preparation and confidence, many candidates succeed in their second or third try.