Table of Contents

Key Takeaways:

- GCC countries like the UAE, Saudi Arabia, Qatar, Oman, Kuwait, and Bahrain show strong and growing demand for skilled accounting professionals due to rapid economic diversification and reforms.

- The introduction of VAT and upcoming corporate tax laws across GCC nations significantly increase the need for accountants with taxation and compliance expertise.

- Key industries driving accounting job growth include oil & gas, real estate, banking and financial services, global capability centres, retail, and tourism.

- Mastery of international accounting standards (IFRS), ERP software familiarity, and strong business acumen are critical to succeed in the GCC accounting job market.

- Competitive salaries and attractive benefits make GCC accounting roles lucrative for skilled expatriates, creating excellent career growth prospects.

Introduction

The Gulf Cooperation Council (GCC) countries—including the UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman—are fast emerging as some of the most lucrative destinations for accounting professionals. With thriving business environments, growing foreign investments, and the implementation of new tax regulations like VAT, these countries offer unmatched opportunities for accountants willing to upgrade their skills and navigate this evolving landscape.

For Indian accountants and finance professionals, GCC represents both a career growth hub and a gateway to international experience. The flourishing economies and rising corporate demand push the requirement for experts proficient in accounting standards, taxation, and financial compliance. This blog explores the countries with the highest demand for accountants in GCC, key industries fueling this demand, preparation tips, salary expectations, and resources like Entri’s courses that can accelerate your path to success.

Learn more at Accounting Career Path – Everything You Need to Know

Countries with the Highest Demand for Accountants in GCC

1: Accounting provides information on

United Arab Emirates (UAE)

-

Dubai, Abu Dhabi, and Sharjah fuel massive growth in accounting jobs, especially with VAT introduction and global business hubs expanding.

-

Demand for accountants skilled in IFRS, VAT compliance, corporate taxation, and accounting software like QuickBooks and Tally is high.

-

Widely recognized certifications, including CPA, ACCA, and region-specific GCC VAT certifications, further boost chances in UAE’s competitive market.

You might find this useful: How to Get an Accountant Job in Dubai: Complete Guide

Saudi Arabia

-

Vision 2030 economic reforms drive high demand for accounting talent in sectors like oil & gas, construction, and financial services.

-

Strong focus on audit, compliance, financial reporting, and tax management roles—accountants familiar with GCC taxation standards are highly sought after.

-

Average salary ranges from SAR 100,000 to SAR 240,000 annually, with experienced professionals earning premium packages.

Qatar

-

Increasing investment in infrastructure and financial services boosts demand for professional accountants capable of handling diverse accounting tasks.

-

Compliance with international accounting standards and GCC VAT is critical.

-

Salaries for chartered accountants range roughly QAR 120,000 to QAR 300,000 per annum, varying by experience and industry.

Oman, Kuwait, and Bahrain

-

Though smaller in scale compared to UAE and Saudi Arabia, these countries maintain steady demand for accountants in banking, retail, and government sectors.

-

Professionals with ERP software skills and taxation knowledge are preferred.

-

Growth is anticipated alongside infrastructure and economic diversification initiatives.

Enroll in the PwC Strategic Accounting Course to Get a Career in the Big 4!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Why GCC Countries Are Seeking Accountants

-

Economic Diversification and Growth:

GCC countries are rapidly diversifying away from oil dependency to sectors like technology, finance, tourism, and manufacturing, fueling demand for skilled accountants who can manage complex financial operations in varied industries.

-

Introduction of VAT and Tax Reforms:

With the implementation of VAT across GCC states and plans for corporate taxation, there is a pressing need for accounting professionals knowledgeable in regional tax laws, ensuring businesses maintain compliance and optimize their tax liabilities.

-

Rise of Global Capability Centres (GCCs):

The growth of global capability centres, which act as strategic hubs for multinational companies, intensifies demand for high-skilled accountants who understand international accounting standards, data analytics, and digital finance tools.

-

Shortage of Qualified Local Professionals:

Despite increasing education efforts, GCC countries still face a shortage of skilled accounting professionals locally. Many companies rely on expatriates, especially from India, to fill roles requiring certifications and digital competency.

-

Stringent Regulatory Environment:

GCC governments are enforcing stricter financial reporting, auditing, and corporate governance standards in line with international norms like IFRS. This raises demand for accountants who can navigate regulatory compliance across borders.

-

Growing Foreign Investments and Infrastructure Projects:

Expanding infrastructure projects and foreign direct investments require skilled accountants to handle budgeting, audit controls, and risk management, supporting large-scale ventures critical to GCC’s economic goals.

-

Technological Advancements:

Drive for digital transformation in finance functions calls for accountants comfortable with ERP systems, automation, and emerging fintech applications to improve efficiency and decision-making.

-

Increased Role of Accountants in Business Strategy:

Beyond traditional bookkeeping, accountants in GCC now participate in strategic financial planning, business partnering, and cost optimization, adding significant value in fast-changing markets.

Read more at Accounting Courses – Career Scope & Subjects

Key Industries Driving the Demand for Accountants in GCC

The continuous expansion of various industries within GCC countries underlines the growing requirements for accounting professionals. Below are the key sectors contributing significantly to this heightened demand:

1. Oil & Gas Sector

Although GCC countries are diversifying, oil and gas remain vital economic pillars. The complexity of cost accounting, project finance, and regulatory compliance in extraction and refining processes requires highly skilled accountants. They oversee budgeting, auditing, taxation, and financial risk assessments critical for sustaining profitability and adhering to environmental and governmental regulations.

2. Real Estate and Construction

The real estate boom in cities like Dubai, Riyadh, and Doha creates a constant need for accountants to manage property acquisitions, project financing, contract management, and taxation. Fixed asset accounting and budgeting expertise are crucial to support these capital-intensive projects.

3. Banking and Financial Services

GCC’s growing financial sector, driven by digital banking advancements and regional investment initiatives, demands accountants for auditing, financial reporting, risk management, and ensuring compliance with anti-money laundering (AML) and other financial regulations. Accurate financial analysis supports strategic decision-making within these institutions.

4. Global Capability Centres (GCCs)

As GCC-based global capability centres expand, particularly those operated by Indian companies, there is a rising demand for accountants familiar with cross-border finance, international accounting standards, and ERP systems. These centres handle multi-jurisdictional finance functions, including shared services, tax compliance, and payroll processing.

5. Retail and Consumer Goods (FMCG)

The booming retail and FMCG markets require accounting specialists to handle procurement costs, inventory finance, pricing strategies, and payroll. Financial transparency and audit readiness are critical as these sectors navigate evolving consumer patterns influenced by regional and global trends.

6. Tourism and Hospitality

With the GCC’s substantial investments in tourism infrastructure, including hotels and entertainment complexes, accountants manage revenue cycles, taxation, and compliance with government incentives and subsidies designed to attract travelers and support local businesses.

Get a head start by exploring our free materials platform now!

How to Prepare for an Accounting Career in GCC Countries

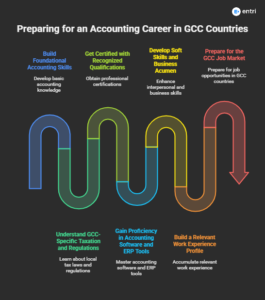

Achieving success in GCC’s competitive accounting job market requires methodical preparation. Here’s a step-by-step approach to help aspiring accountants tailor their skills and profiles for the GCC region:

Step 1: Build Foundational Accounting Skills

-

Master core accounting principles, including bookkeeping, financial accounting, management accounting, and auditing.

-

Pursue formal education such as a Bachelor’s degree in Accounting, Finance, or related fields.

-

Strengthen knowledge of international accounting standards, especially IFRS, which is widely adopted across GCC countries.

Step 2: Understand GCC-Specific Taxation and Regulations

-

Learn about VAT laws introduced in GCC countries, including filing procedures, compliance requirements, and penalties.

-

Familiarize yourself with regional corporate tax regulations, payroll taxes, and customs duties.

-

Entri’s GCC VAT, UAE VAT, and Accounting courses provide focused learning modules and simulated filings to build practical expertise.

Also read: Entri GCC Accounting Course: Frequently Asked Questions

Step 3: Get Certified with Recognized Qualifications

-

Obtain globally recognized certifications such as CPA (Certified Public Accountant), ACCA (Association of Chartered Certified Accountants), or CMA (Certified Management Accountant).

-

Supplement with regionally relevant certifications like Entri’s GCC VAT Certification Course to boost your employability.

Know more at ACCA Career Path – Everything You Need to Know & How Much Do ACCA Professionals Earn in Dubai

Step 4: Gain Proficiency in Accounting Software and ERP Tools

-

Acquire hands-on experience using widely used ERP and accounting software such as Tally, QuickBooks, SAP FICO, Oracle Financials, and Zoho Books.

-

Entri’s AI-Powered Practical Accounting courses include training on these tools alongside real-world scenarios and project assignments.

People also read: Top Online Accounting Courses in Kerala

Step 5: Develop Soft Skills and Business Acumen

-

Enhance communication, negotiation, and leadership skills critical in multinational and culturally diverse workplaces.

-

Cultivate analytical thinking, attention to detail, and the ability to work under evolving regulatory frameworks.

Step 6: Build a Relevant Work Experience Profile

-

Pursue internships or entry-level roles that provide exposure to GCC regulatory environments or multinational finance functions.

-

Volunteer for audit or compliance projects, tax filing, and financial reporting duties to build a robust professional portfolio.

Step 7: Prepare for the GCC Job Market

-

Create tailored resumes highlighting GCC-specific certifications, software proficiency, and regional taxation knowledge.

-

Engage in mock interviews, attend GCC-focused job fairs, and network within professional groups and alumni communities.

-

Utilize online job platforms catering to GCC recruitment, including LinkedIn, GulfTalent, Bayt, and Entri’s placement assistance programs.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Salary Expectations for Accountants in GCC Countries

-

UAE: AED 80,000 to AED 615,000 per year, depending on experience and company.

-

Saudi Arabia: SAR 100,000 to SAR 240,000 annually.

-

Qatar: QAR 120,000 to QAR 300,000 yearly.

-

Others (Oman, Bahrain, Kuwait): Competitive salaries aligned with market demand and roles.

| GCC Country | Entry-Level Salary (Annual) | Experienced Accountant Salary (Annual) | Senior/Chartered Accountant Salary (Annual) | Approximate USD Range* |

|---|---|---|---|---|

| United Arab Emirates (UAE) | AED 80,000 – AED 150,000 | AED 150,000 – AED 350,000 | AED 350,000 – AED 615,000 | $21,800 – $167,700 |

| Saudi Arabia | SAR 70,000 – SAR 130,000 | SAR 130,000 – SAR 180,000 | SAR 180,000 – SAR 240,000 | $18,600 – $64,000 |

| Qatar | QAR 60,000 – QAR 130,000 | QAR 130,000 – QAR 220,000 | QAR 220,000 – QAR 300,000 | $16,400 – $81,900 |

| Oman | OMR 9,000 – OMR 15,000 | OMR 15,000 – OMR 25,000 | OMR 25,000 – OMR 35,000 | $23,400 – $90,900 |

| Kuwait | KWD 6,000 – KWD 12,000 | KWD 12,000 – KWD 24,000 | KWD 24,000 – KWD 30,000 | $19,800 – $98,900 |

| Bahrain | BHD 6,500 – BHD 14,000 | BHD 14,000 – BHD 22,000 | BHD 22,000 – BHD 28,000 | $17,200 – $74,500 |

*Conversion rates are approximate and may vary.

Additional Benefits:

-

Most packages are tax-free or low-tax.

-

Housing allowances, health insurance, travel allowances, and performance bonuses are common.

-

Expatriates often receive education allowances for children.

Conclusion

GCC countries stand out as top destinations globally for accounting professionals seeking rewarding career opportunities and international exposure. The rapidly evolving economic landscape, regulatory reforms, and global business integration make accountants indispensable assets across GCC industries.

For those aiming to capitalize on this demand, acquiring the right skills is non-negotiable. Entri’s specialized courses, with their UAE and GCC-specific modules, hands-on VAT filing simulations, and mentorship, provide a direct pathway to be job-ready in this competitive market. With placement support and recognized certifications, Entri empowers accountants to confidently pursue lucrative roles in the GCC. Start your journey today to tap into the GCC’s booming financial sector and unlock your full career potential.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Which GCC country offers the highest salary for accountants?

The UAE generally offers the highest salary packages, followed by Saudi Arabia and Qatar, with tax-free benefits included.

Is knowledge of GCC VAT mandatory for accounting jobs in GCC?

Yes, understanding VAT compliance is essential due to recent regulatory implementations across GCC countries.

Can I work in GCC accounting roles without internationally recognized certifications?

While possible, certifications like CPA, ACCA, and region-specific courses such as Entri’s GCC VAT course greatly improve job prospects.

What ERP software should I learn for a GCC accounting career?

Tally, QuickBooks, Zoho Books, and SAP FICO are widely used. Entri’s courses provide hands-on training with these tools.

Does Entri provide placement support for GCC accounting roles?

Yes, Entri offers personalized mentorship, mock interview sessions, live profile building, and a strong recruiter network suited for GCC job markets.