Table of Contents

Oman is a great place to work and grow. Many people move there for stable accounting careers. Getting an Accountant Job in Oman can bring good pay and experience. The country has many job openings for skilled accountants. Firms need people who can manage their finances well. With proper skills, one can easy to get hired. You just need to know where to start. You just need to know where to start. This blog will guide you through every step.

Oman welcomes skilled workers from different countries. Accountants are highly needed across all sectors. With right education and training, you can succeed. Learning about local rules and job requirements helps a lot. You also need to understand the visa process. Applying through right portals makes the journey easier. With preparation and patience, one can get a good job. Let’s look at what you need to do first.

Before applying, keep these points in mind:

- Check your education and experience.

- Get accounting certifications if needed.

- Learn Oman’s accounting and tax rules.

- Create a simple, clear resume.

- Apply on trusted job websites.

- Understand work visa requirements.

- Stay updated with new job rules.

- Improve your English communication.

- Research companies offering visa support.

Become an Accounting Pro – Learn from Industry Experts!

Introduction

Oman is a growing hub for accounting professionals. Many people seek to build a secure career there. Getting an Accountant Job in Oman offers good income and steady growth. The country’s economy is expanding across multiple industries. This builds a need for skilled experts. Accountants help firms manage money, plan budgets, and ensure compliance. With the right skills and guidance, one can easily qualify. Let’s explore how to begin your accounting career in Oman.

Why Choose Oman for Accounting Jobs?

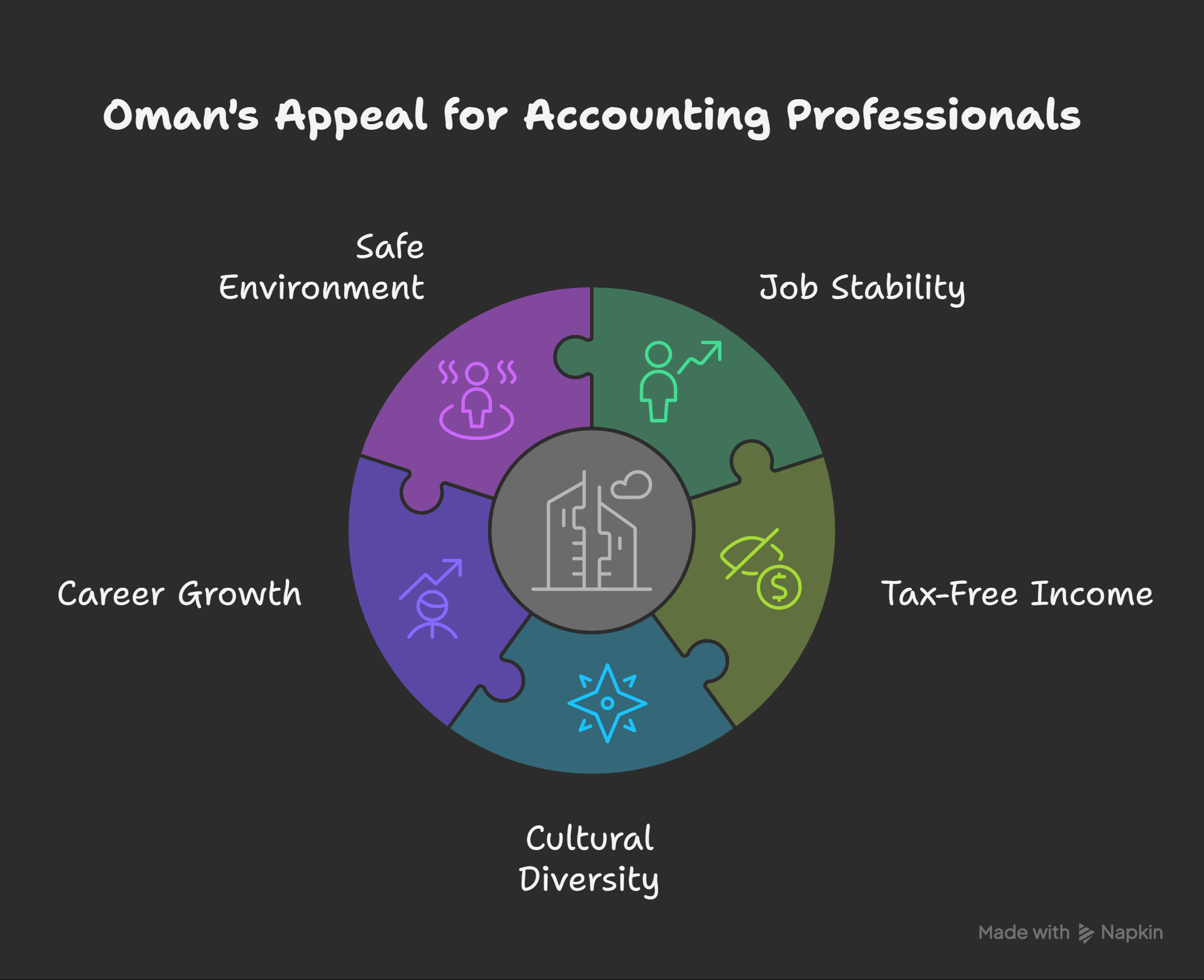

Oman offers many benefits for accounting professionals. Its job market is growing each year. Salaries are competitive compared to other Gulf countries. The cost of living is also reasonable. Foreigners can work and live comfortably here. Let’s see some main reasons below.

| Benefits | Description |

|---|---|

| Job Stability | Growing private sector ensures continuous demand. |

| Tax-Free Income | No personal income tax for most workers. |

| Cultural Diversity | Work with professionals from various countries. |

| Career Growth | Opportunities in multiple industries and firms. |

| Safe Environment | Peaceful and welcoming for foreign professionals. |

What Makes an Accountant Job in Oman Attractive?

Accountants play key roles in every Omani business. From small firms to large companies, they are essential. Let’s look at what makes these jobs appealing.

- High demand: Every sector needs skilled accountants.

- Good pay: Salaries are fair and tax-free.

- Learning scope: Exposure to GCC accounting practices.

- Growth chances: Promotions come with consistent performance.

- Job security: Financial roles are always necessary.

Who Can Apply?

Anyone with a background in accounting or finance can apply. However, some criteria make you more eligible.

Basic Requirements:

- A bachelor’s degree in accounting or finance.

- Knowledge of accounting software like Tally or SAP.

- Good English communication skills.

- Work experience in accounting tasks.

Preferred Qualifications:

- Professional certificates like ACCA, CPA, or CMA.

- Training in GCC VAT or taxation.

- Understanding of Omani business rules.

Quick Facts About Oman’s Accounting Market

| Aspect | Detail |

|---|---|

| Job Titles |

|

| Average Salary (Monthly) |

|

| Top Sectors |

|

| Work Hours |

|

| Language Needed |

|

Getting an Accountant Job in Oman is achievable with preparation. You need the right qualifications and updated skills. Understanding visa and work rules is also important. Building a professional resume helps attract employers. By following the correct steps, you can start soon. Oman rewards dedication and skill in every profession.

Essential Qualifications and Skills

1: Accounting provides information on

To get an Accountant Job in Oman, the right qualifications matter most. Employers look for people who can manage accounts correctly. Below are the key requirements that one may need.

1. Educational Requirements

A strong educational base is the first step. Most employers need at least a degree in accounting or finance.

Basic Requirements:

- Bachelor’s degree in accounting, finance, or commerce.

- Master’s degree adds more value.

- Business or management graduates can also apply.

Additional Courses Help:

- Short courses in bookkeeping or auditing.

- Training in taxation or GCC VAT systems.

- Entri’s GCC VAT Course can boost your profile.

| Degree Level | Recommended Field | Benefit |

|---|---|---|

| Bachelor’s | Accounting or Finance | Basic entry qualification |

| Master’s | Business or Commerce | Higher-level job options |

| Diploma | Tax or Audit | Adds technical skill advantage |

2. Professional Certifications

Certifications increase your job chances and salary. Many Omani firms prefer certified professionals.

Top Certifications:

- ACCA (Association of Chartered Certified Accountants)

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- CIMA (Chartered Institute of Management Accountants)

Why Certifications Matter:

- Show global accounting knowledge.

- Improve analytical and audit skills.

- Make you eligible for senior roles.

| Certification | Focus Area | Benefit |

|---|---|---|

| ACCA | Financial reporting | Global recognition |

| CPA | Auditing and taxation | U.S. standard expertise |

| CMA | Management accounting | Planning and control |

| CIMA | Business strategy | Leadership development |

3. Technical Skills

Modern accountants must know software and digital tools. Oman’s firms use updated systems for finance work.

Key Software to Learn:

- Tally ERP

- QuickBooks

- SAP or Oracle

- MS Excel (Pivot, VLOOKUP, charts)

- Odoo for business automation

Practical Accounting Skills:

- Journal entries and ledger posting.

- Payroll and expense tracking.

- Preparing trial balances and cash flows.

- Handling accounts receivable and payable.

- Creating financial reports and statements.

4. Knowledge of Omani Accounting Standards

Oman follows the International Financial Reporting Standards (IFRS). You must know these standards for accurate reporting.

Focus Areas:

- IFRS for SMEs.

- VAT rules under GCC system.

- Omani labour and tax compliance.

- Annual audit and financial disclosure laws.

Extra Tip:

Completing a GCC VAT course gives a practical edge. It helps handle taxation work for Omani firms.

5. Soft Skills for Accountants

Soft skills matter as much as technical ones. They help you work better with teams and clients.

Essential Soft Skills:

- Communication and presentation skills.

- Accuracy and attention to detail.

- Problem-solving mindset.

- Time management during audits.

- Ethical and honest behaviour.

Work Habits to Develop:

- Double-check every report before submission.

- Keep financial data confidential.

- Maintain good records for easy audit.

6. Language and Cultural Awareness

English is widely used in Omani workplaces. Arabic helps but isn’t always required.

Language Tips:

- Write clear reports in English.

- Learn basic Arabic greetings for clients.

- Understand cultural etiquette and respect norms.

Example:

Greeting senior managers with respect is important in meetings. It shows professionalism and cultural understanding.

To succeed in Oman, combine education, skill, and professionalism. Employers prefer accountants who are certified and detail-oriented. Software skills and IFRS knowledge make you stand out. Communication and ethics complete your professional image. With these skills, you can confidently apply for accounting jobs in Oman.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Finding Job Opportunities

Once you have the right skills, start your job search. Finding an Accountant Job in Oman takes planning and patience. You need to look in the right places and apply smartly. Oman has many openings in private companies and firms. Let’s look at the best ways to find your ideal accounting job.

1. Use Trusted Job Portals

Most accounting jobs in Oman are listed online. You can apply directly through reliable websites.

Top Job Portals:

- Indeed Oman – Lists daily job updates.

- Naukri Gulf – Popular among Indian job seekers.

- Bayt – Offers detailed listings for finance roles.

- GulfTalent – Known for verified employers.

- LinkedIn Jobs – Great for direct company hiring.

Tips for Applying Online:

- Create a strong, clear profile.

- Use accounting-related keywords.

- Upload a neat and recent resume.

- Apply early before job posts close.

- Follow companies for future updates.

| Portal Name | Best For | Job Type |

|---|---|---|

| Indeed Oman | Daily updates | Junior to senior |

| Bayt | Regional roles | Finance and audit |

| GulfTalent | Verified listings | Mid to senior |

| Naukri Gulf | Expat positions | Indian candidates |

2. Try Local Classifieds and Websites

Some Omani companies post jobs on local sites. These are good for entry-level roles.

Popular Local Sites:

- OpenSooq Oman

- Oman Observer classifieds

- Muscat Daily job section

Advantages:

- Easier to contact local employers.

- Sometimes direct interviews are offered.

- Suitable for small and medium firms.

3. Use LinkedIn for Networking

LinkedIn helps you connect with employers and accountants in Oman. Many companies post openings directly there.

How to Use LinkedIn Effectively:

- Update your headline to include “Accountant | Open to work in Oman.”

- Follow Omani accounting firms.

- Engage with posts and share finance insights.

- Send polite connection requests to HR managers.

- Join Oman or GCC job groups.

Example LinkedIn Headline:

“Certified Accountant | Experience in VAT & Auditing | Seeking Opportunities in Oman”

4. Connect with Recruitment Agencies

Many Gulf recruitment agencies assist in placements. They match your profile with employer needs.

Trusted Recruitment Agencies:

- Al Naba Recruitment Services

- Bahwan International Group

- MENA Recruiters

- Jobskart Oman

Benefits:

- Help with visa and interview guidance.

- Access to non-advertised job openings.

- Support during relocation to Oman.

| Agency Name | Service Type | Location |

|---|---|---|

| Al Naba | Job placement | Muscat |

| Bahwan Group | Recruitment | Muscat |

| MENA Recruiters | Expat placement | GCC region |

5. Attend Career Fairs and Networking Events

Career fairs allow face-to-face contact with employers. Oman hosts such events regularly.

Where to Find Them:

- Muscat Exhibition Center

- University career fairs

- Chamber of Commerce events

Tips for Success:

- Carry printed resumes.

- Dress neatly and professionally.

- Ask about hiring requirements.

- Collect contact details for follow-ups.

6. Check Company Websites

Many large companies post jobs on their own sites. Always check their “Careers” section.

Top Employers for Accountants:

- Oman Oil Company

- Lulu Group International

- Bank Muscat

- Omantel

- OQ Group

Why Visit Company Sites:

- Find latest openings directly.

- Avoid fake listings.

- Apply with official company HR.

7. Explore Government and Semi-Government Roles

Government jobs in Oman offer job stability and benefits. However, most are reserved for locals. Some semi-government firms hire foreign accountants.

Examples:

- Oman Investment Authority

- Muscat Municipality

- Oman Airports Management Company

Benefits:

- Longer contracts.

- Retirement benefits and allowances.

- Work-life balance.

Finding an accounting job in Oman takes smart searching. Use online portals, agencies, and LinkedIn effectively. Keep your profile updated and apply regularly. Focus on genuine listings and official websites. With consistent effort, you can soon secure your ideal role.

Become an Accounting Pro – Learn from Industry Experts!

Crafting Your Application

A well-prepared application helps you stand out from others. To get an Accountant Job in Oman, you must present your skills clearly. Employers notice neat resumes and focused cover letters. Highlighting your experience and qualifications builds a strong impression. Let’s learn how to make your application simple yet effective.

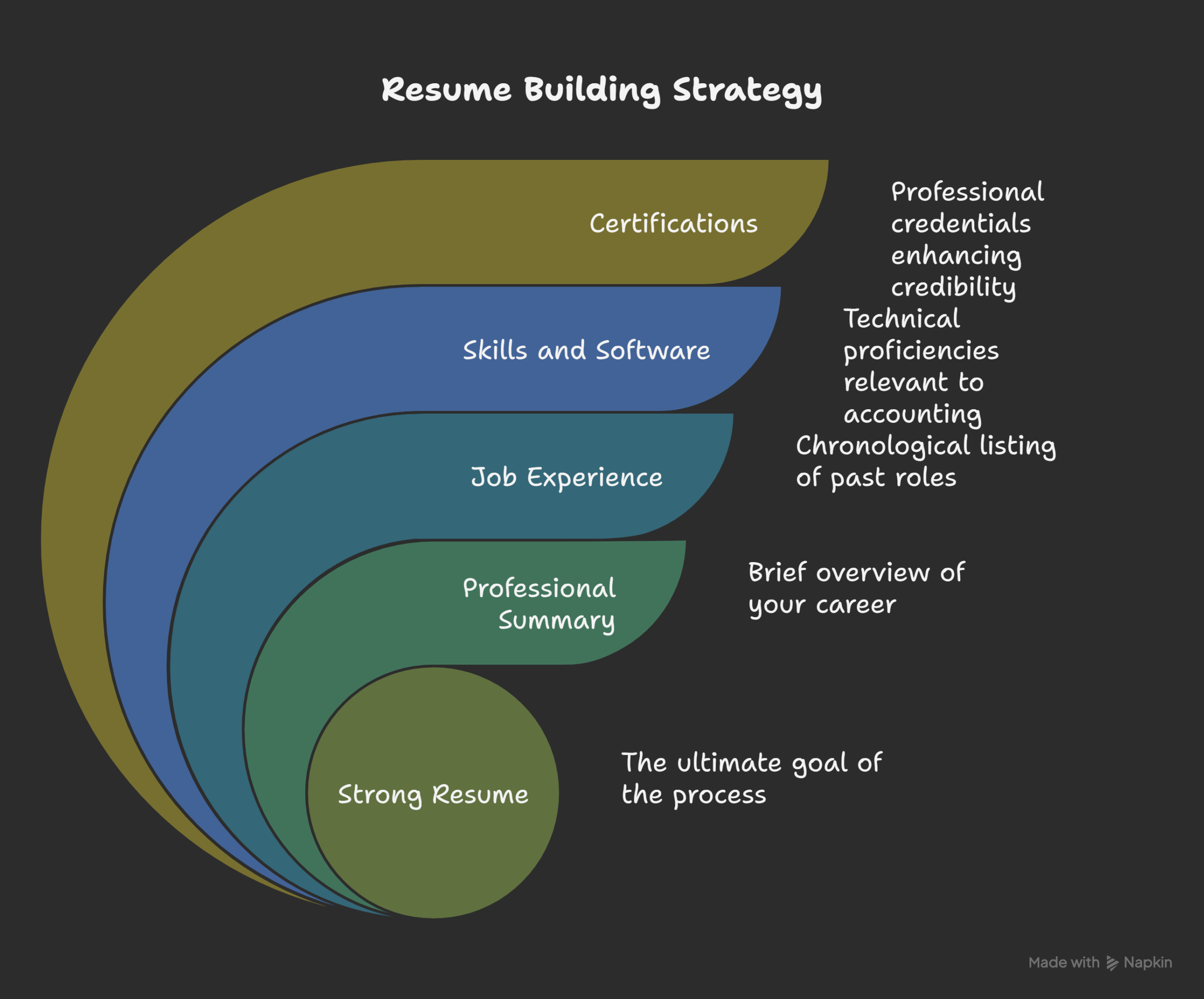

1. Build a Strong Resume

Your resume is the first thing employers see. It must be short, clear, and organized.

Basic Resume Tips:

- Keep your resume within two pages.

- Use a clean, readable font.

- Start with a short professional summary.

- Mention your latest job experience first.

- List key accounting skills and software knowledge.

- Add certifications like ACCA, CPA, or CMA.

- Avoid spelling or grammar mistakes.

Example Resume Sections:

- Contact Details

- Career Summary

- Education and Certifications

- Work Experience

- Key Skills

- References (if required)

Sample Resume Headline:

“Experienced Accountant | Skilled in VAT & Financial Reporting”

| Section | What to Include | Example |

|---|---|---|

| Summary | Brief profile | “Accountant with 3 years GCC experience.” |

| Education | Degree and university | “B.Com – University of Kerala” |

| Skills | Tools and expertise | “Excel, SAP, Tally, QuickBooks” |

2. Write a Focused Cover Letter

A cover letter shows your interest and understanding. It explains why you fit the job.

Cover Letter Tips:

- Address the letter to the HR manager.

- Write in simple, clear English.

- Mention your accounting experience.

- Highlight software and finance skills.

- Show knowledge of Omani accounting rules.

- Keep it one page long.

Cover Letter Example (Short):

Dear Hiring Manager,

I am writing to apply for the Accountant position at your firm. I have a Bachelor’s degree in Accounting and two years of VAT handling experience. I am skilled in SAP and Tally software and familiar with GCC finance practices. I believe my experience matches your requirements well.

Sincerely,

[Your Name]

3. Add Supporting Documents

Employers may ask for verified documents before hiring. Keep all your papers ready and scanned.

Documents to Prepare:

- Copy of passport and photo.

- Degree and transcript certificates.

- Experience letters from past jobs.

- Accounting certification copies (ACCA, CPA, CMA).

- Reference letters (if available).

Tip:

Keep both soft and printed copies ready for interviews.

4. Show Relevant Accounting Skills

Your skills must match the job description. Use short points to highlight them.

Key Technical Skills:

- Bookkeeping and journal entries.

- Account reconciliation and reporting.

- Payroll and tax calculation.

- Budgeting and variance analysis.

- Audit preparation and compliance.

Soft Skills:

- Attention to detail.

- Time management.

- Teamwork and communication.

- Problem-solving under deadlines.

5. Tailor Your Application for Each Job

Never send the same resume to all companies. Customize your profile based on the job post.

How to Tailor:

- Match skills with the job ad.

- Mention company name in cover letter.

- Focus on required software knowledge.

- Highlight experience relevant to their business.

Example:

If the job is in retail, focus on sales accounting experience.

6. Prepare for Interviews

Once shortlisted, be ready for a professional interview.

Common Interview Topics:

- Accounting cycle steps.

- Financial statement preparation.

- VAT and tax knowledge.

- Audit process and reporting.

- Accounting software usage.

Interview Tips:

- Dress formally and arrive on time.

- Speak clearly and confidently.

- Bring original documents and copies.

- Ask polite questions about the role.

7. Follow Up After Applying

Following up shows professionalism and interest.

Follow-Up Steps:

- Wait a week after applying.

- Send a polite email asking for an update.

- Thank them for considering your profile.

Example Message:

Dear [Name],

I recently applied for the Accountant role at your company. I wanted to check if there’s any update on my application. Thank you for your time and consideration.Regards,

[Your Name]

A strong application increases your chances of getting hired in Oman. Keep your resume clean and cover letter short. Focus on relevant accounting experience and certifications. Prepare for interviews with confidence and knowledge. With these steps, you’ll move closer to your dream accounting job in Oman.

Visa and Immigration Process

Getting a visa for Oman is very important. You cannot work without a legal visa. The process is simple if you follow all steps. Most employers help you with visa arrangements. Let’s look at how the process usually works.

1: Employer Sponsorship

- You need a job offer first.

- The employer acts as your visa sponsor.

- They apply for a work permit on your behalf.

- The Ministry of Manpower approves the application.

- After approval, your visa process starts.

2: Entry Visa Application

- The employer applies for an employment visa.

- You must submit your passport and documents.

- This includes photos and a medical certificate.

- Once approved, you receive the entry visa.

- You can now travel to Oman.

3: Medical and Residency Permit

- After arrival, you must take a medical test.

- It ensures you are fit to work in Oman.

- Then, apply for a residence card.

- The residence card is your official ID in Oman.

- Keep it safe and renew before expiry.

Required Documents for the Visa

| Document Type | Description |

|---|---|

| Passport | Valid for at least 6 months |

| Employment Contract | Signed by you and the employer |

| Photographs | Passport-size, recent photos |

| Medical Certificate | From an approved health center |

| Educational Certificates | Attested by the Oman Embassy |

| Visa Application Form | Filled and signed correctly |

Tips for a Smooth Process

- Keep all original documents ready.

- Double-check your passport validity.

- Follow your employer’s guidance carefully.

- Be honest during the medical test.

- Apply for renewal before your visa expires.

Once your visa and residence card are ready, you can start working legally in Oman. This process ensures compliance with Omani labor laws and secures your job position safely.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Conclusion

Starting a career in Oman can be a great step. The country values skilled professionals and offers good job stability. With the right qualifications and preparation, you can grow quickly. Learning about local work rules helps you adjust easily. Always keep your documents ready and stay updated on visa policies. This will make your move smoother and stress-free. Patience and planning are key to a successful career abroad.

Getting an Accountant Job in Oman needs focus and dedication. From building skills to completing visa steps, every stage matters. Choose trusted job platforms and verified employers for better security. Keep improving your accounting knowledge and communication skills daily. Once settled, you can enjoy both work and lifestyle benefits. With hard work, you can build a lasting career there.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What qualifications are needed for an accountant job in Oman?

A bachelor’s degree in accounting or finance is essential. Professional certifications like ACCA, CPA, or CMA help. Knowledge of accounting software is highly preferred. Experience in VAT or GCC tax systems is useful. Employers also value good communication and analytical skills.

Which certifications increase job chances in Oman?

ACCA, CPA, CMA, and CIMA are highly recognized. They show expertise in accounting and finance. Employers often prefer certified candidates for senior roles. Certification boosts salary and career growth opportunities. Short courses in VAT or audit can also help.

Do I need work experience to apply?

Yes, most firms prefer at least 1–2 years of experience. Practical exposure to accounting tasks matters. Experience with accounting software is valuable. Internships or training programs can also help. Fresh graduates may get entry-level roles with strong skills.

How can I find accountant jobs in Oman?

Use trusted job portals like Indeed, Bayt, and GulfTalent. LinkedIn helps connect with HR and companies. Recruitment agencies can assist with placements. Check company websites for openings. Local classifieds and career fairs are also useful.

Is English enough, or do I need Arabic?

English is widely used in most companies. Arabic is not mandatory but considered a plus. Learning basic Arabic greetings helps in professional settings. It improves communication with clients and colleagues. Many multinational firms operate mainly in English.

What software skills do I need?

Tally ERP, SAP, QuickBooks, and MS Excel are important. Knowledge of Odoo or other ERP systems helps. Excel skills like pivot tables and formulas are essential. Ability to generate reports and statements is required. Software proficiency strengthens your job application.

How does the visa process work for accountants?

You need a job offer first to get a sponsor. The employer applies for the work permit. After approval, an employment visa is issued. Medical tests and residence card follow. Keep all documents ready for smooth processing.

Are there any special requirements for working in Oman?

Yes, as of 2025, a professional classification certificate is mandatory. It applies to accounting, finance, and auditing roles. Educational and certification documents must be attested. Employers may guide you through the process. Compliance with Omani labor laws is required.

How should I prepare my resume and cover letter?

Keep your resume short, clear, and focused on accounting skills. Include education, certifications, and software knowledge. Highlight work experience relevant to Omani companies. Tailor your cover letter for each application. Proofread to avoid errors before sending.

What are the average salaries for accountants in Oman?

Salaries range from OMR 400 to 900 monthly on average. Entry-level roles pay lower, senior positions higher. Certification and experience can increase pay. Some firms provide allowances and benefits. Salary also depends on sector and company size.