Table of Contents

Being a freelancer, this particular question must have found its way into your brain:

Do I have to pay taxes?

Well, there is only one answer, and that is yes! Regardless of not getting a paycheck every month, the government considers you a tax-paying citizen. So, is there any difference in filing an ITR if I’m a freelancer? If so, how do I file the ITR? This blog provides you with answers on how to file ITR for freelancers, tax-free!😉

Check out this video by Entri in Malayalam!

Key Takeaways:

- Freelancers = self-employed = need to pay tax

- You need to track all your income and expenses for ITR filing.

- You can deduct the expenses as they are for your professional cause.

- File ITR-4 or ITR-3 based on how your income is categorised.

- Consider advance tax if your income is high, and the self-assessment fee, if applicable.

- Unlike salaried professionals, freelancers cannot change their tax regimes annually if they have a business income.

Introduction: Do Freelancers Pay Taxes in India?

Let’s face it, freelancers may not have work around the month as it is solely based on the projects they sign up for. When compared to salaried individuals, even the payments can be somewhat erratic due to a certain level of uncertainty. Therefore, it’s only natural for one to assume that taxes and ITR filing do not apply to the humble yet impactful freelancers. However, that is not the case.

If you have taken on freelance gigs, such as content writing, design, coding, consulting, or photography, you are considered self-employed. Though that’s not the case, the government finds freelancers as gaining “Income from Business or Profession” and thus makes them eligible for tax. To put it in simple terms, the government sees you as a one-person business similar to a small shop owner.

According to the recent update, individuals with an income of up to 12 lakhs do not need to pay any taxes under the new regime for the financial year 25-26.

So, what income counts?

To put it simply, any income that you gain from doing freelance work is considered income that can make you eligible to pay taxes. This includes:

- Payments received from Indian/foreign clients

- Gigs and income from projects taken up through various platforms like Upwork, Fiverr, Behance, etc.

- Money credited to your bank account, UPI, NEFT, etc.

Remember that if it’s coming into your account, it is counted. This even applies when your employer doesn’t provide you with a Form 16 or any such valid tax forms.

Types of ITR Forms

1: Accounting provides information on

Most people are either unaware or confused about which ITR form they should choose to file. If you choose the wrong form, it may lead to the rejection of the ITR file. Here is a detailed list of the types of ITR forms for individuals to choose from according to their eligibility:

ITR 1

Specifies to salaried individuals, including pensioners and those who have one house property.

ITR 2

Specifies to individuals with capital gains, such as salary, pension, foreign income, interest, dividends, etc. Additionally, the aggregate must be above 50 lakhs in a financial year.

ITR 3

Specifies individuals who have income from businesses, a profession, or even from being a freelancer. If you are a trader, the income you obtain from trading, such as intraday trading, makes you eligible for this ITR form.

ITR 4

Specifies individuals with presumptive income, not exceeding more than 50 lakhs per financial year.

Pro tip: Use Presumptive Taxation (Section 44ADA) if you earn under ₹50 lakh. It lets you just declare 50% of your income as profit and pay tax on that. This makes it super simple without any detailed expense tracking needed.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Easy Step-by-step Guide on How to File ITR for Freelancers

When compared to ITR filing for salaried individuals, the procedure for freelancers is different and may seem a bit difficult. But, with the required documents and by following the detailed step-by-step guide provided below, you can submit your filing as easily as a walk in the park. Read and understand each step to identify which steps apply to you.

Step 1: Calculate Your Income

Your total income earned in a single financial year can be divided into two as a freelancer:

-

Income

This is your main income that you receive from all your clients, including domestic and international. This would be under the “Income from Profession or Business” head, showcasing it as your primary source of livelihood. The parallel incomes that you receive, such as bank interests, FD interests, etc., need to be included under the “Income from Other Sources” section.

-

Expenses

These expenses are those that you have accumulated within the financial year that are allowed as deductions. Maintain records of these expenses to showcase that your:

Net income = Gross receipts – Allowed Business Expenses

The allowed expenses include:

-

Office rent or home-office expenses (partial)

-

Internet, mobile, and electricity bills

-

Travel expenses

-

Hardware/software purchases

-

Depreciation of assets

-

Professional fees (e.g., CA, legal)

-

Subscription to tools/platforms

-

Advertisement or marketing costs

Step 2: Collect the required Documents

-

PAN & Aadhaar card

-

Bank account details

-

Form 26AS

-

AIS (Annual Information Statement) and TIS

-

Invoices issued to clients

-

Expense receipts

-

TDS certificates (Form 16A)

-

Advance tax paid or self-assessment tax challans

What is TDS and TCS? TDS is the Tax deducted at Source, which is paid by you when you receive an income. TCS is Tax Collected at Source, that is, deducted when you buy a product like a house, a car, etc. Both these taxes can be claimed back with ITR filing.

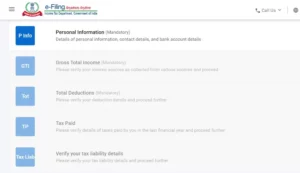

Step 3: Log in to the Portal

Visit https://www.incometax.gov.in/iec/foportal/. Click on the login button or the register button if you are new to this site. You can log in and register using your PAN or Aadhaar. Fill in the required details to get started on ITR filing.

Step 4: Assessment Year and ITR Form

Once you have registered and logged in, you will be required to select the assessment year (25-26), followed by the ITR form (ITR-3 or ITR-4). Choose them accordingly.

Latest Update: Income Tax Return Forms of ITR-1 and ITR-4 are enabled to file through the Online mode with prefilled data at the e-filing portal. Excel Utilities of ITR-1 and ITR-4 for AY 2025-26 are also available for filing.

Step 5: Provide the required details

-

Personal details

-

Nature of business/profession code (e.g., 0701 for software development)

-

Income from profession

-

Expenses (if not under presumptive)

-

Other sources of income

-

Deductions (under 80C, 80D, etc.)

Step 6: Compute the Tax and Claim Deductions

Compute the total taxable income and apply the eligible deductions (e.g., 80C for LIC/PPF, 80D for medical insurance). Next, compute the final tax liability and check if you have paid excess tax. If so, it will be shown as a refund. Make sure to cross-check the bank details as the refund will be credited to that account.

Step 7: Verify and Submit ITR

Submit the ITR and remember to e-verify within 30 days. You can e-verify using Aadhaar OTP/net banking/DSC.

Additional Steps (if applicable)

These are some of the steps that are additionally applicable based on certain criteria and conditions. Make sure to go through them carefully and proceed with them if any of them is applicable to you.

-

Advance Tax

If tax liability exceeds ₹10,000 in a financial year, pay advance tax quarterly.

Due dates:

-

-

15th June – 15%

-

15th Sept – 45%

-

15th Dec – 75%

-

15th Mar – 100%

-

If you have missed it, you can pay with interest under sections 234B & 234C.

-

Self-assessment Tax

If any tax remains payable after TDS and advance tax, generate a challan (ITNS 280) from TIN NSDL and pay using net banking or UPI.

Also read: How to Save Tax in India – Tax Saving Options and Tips

How Much Tax Do Freelancers Have to Pay in India?

Now that we’ve established the fact that taxes apply to freelancers as well, let us have a look at the various tax slabs that are implemented under the old and new tax regimes.

Old Tax Regime

| Income Range | Tax Rate |

|---|---|

| Up to ₹2.5 lakh | Nil |

| ₹2.5 – ₹5 lakh | 5% |

| ₹5 – ₹10 lakh | 20% |

| ₹10 lakh and above | 30% |

New Tax Regime

|

Income Range |

Tax Rate |

|

Up to ₹3 lakh |

0 |

|

₹3 – ₹6 lakh |

5% |

|

₹6 – ₹9 lakh |

10% |

|

₹9 – ₹12 lakh |

15% |

|

₹12 – ₹15 lakh |

20% |

| Income above ₹15 lakh |

30% |

Based on the income tax slabs above, freelancers can either choose the old tax or the new tax regime. Claiming the new tax regime is preferable if you don’t want to claim deductions. Additionally, when compared to the old tax regime, it has lower tax slabs but fewer tax-saving options.

⚠️Important:

Most freelancers overlook the fact that there are some conditions for selecting the regimes. Based on how your income is categorised, you get to choose the appropriate ITR file as well as the tax regime.

- If a freelancer has no business income and only professional income, they can choose the preferred tax regime and can change it every year. This is possible when they declare their income as “Income from profession” in the ITR 3 or ITR 4 form. For example, if you selected the old tax regime for the FY 23-24, you can select the new tax regime for FY 24-25.

- Suppose a freelancer has a business income, i.e., income reported under “Profits and Gains from Business or Profession,” the rule changes. You can only opt for the new regime once. If you wish to switch to the old regime in the later years, you cannot opt back in unless you stop having business income altogether. Summing up, if you are a freelancer who also qualifies as a “business” (e.g., using ITR-3 for business income), then switching is limited.

- If you use presumptive taxation, which is for income less than ₹50 lakh, you can switch regimes without any hassle.

It’s always best to carefully review these details so that you don’t get caught up in any sort of mishaps or negligence.

What about Deductions?

Being a freelancer generally allows you to work from the comfort of your choice without any sort of hassle or sense of pressure. However, in the case of the bills that keep piling up, there isn’t much choice. A reasonable amount of your earnings goes into paying bills for various miscellaneous stuff that helps you to do your work efficiently. Fortunately, freelancers can reduce their taxable income by claiming expenses, similar to what businesses do.

Here are some examples of expenses that you could claim while filing.

- Laptop, printer, phone

- Internet bills

- Rent (if you work from home)

- Office furniture

- Travel (for shoots, meetings, etc.)

- Software subscriptions (Adobe, Canva, Notion, Zoom, etc.)

Final Thoughts

ITR filing for freelancers may seem like an uncoquered mountain, but once you get the hang of it, you will be able to run through the procedure as easily as making a chai. However, if not made properly, even a simple chai can turn out to be a disaster. It is pretty common for one to wonder whether all of this hassle is worth it or not. The benefits of filing ITR are many, including claiming TDS/TCS refunds and visa processing, as the ITR file actually serves as proof of income.

The bottom line is that this is the ultimate proof of being a tax-paying citizen of India, with the added benefit of getting back extra taxes that you had to pay. By following the mentioned steps and common mistakes to avoid, you can make your ITR filing a seamless process. So, start the process now, and forget about penalties!

|

Courses Offered |

|

|

AI Powered Business Accounting and Finance Certification Programme |

SAP FICO Course |

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Do freelancers in India need to pay income tax?

Yes. Freelancers are considered self-employed individuals under the Income Tax Act and must pay tax on income earned from freelance work, whether from Indian or foreign clients.

What is the minimum income limit for freelancers to file ITR?

You must file ITR if your total income exceeds:

-

₹2.5 lakh (Old Regime)

-

₹3 lakh (New Regime)

Even if your income is not consistent month-to-month.

Which ITR form should freelancers use?

-

ITR-3: For freelancers maintaining books of accounts.

-

ITR-4: For freelancers using Presumptive Taxation under Section 44ADA (income ≤ ₹50 lakh).

What is presumptive taxation (Section 44ADA)?

It allows eligible professionals (like freelancers) to declare 50% of their total income as profit and pay tax only on that amount. No need to maintain detailed books of accounts or an audit.

What types of income are taxable for freelancers?

-

Payments from Indian or international clients

-

Gigs or project income via platforms (Upwork, Fiverr, Behance, etc.)

-

Payments received via UPI, NEFT, IMPS

-

Any income shown in bank statements, even without a formal invoice

Can freelancers claim expenses as deductions?

Yes. Freelancers can deduct legitimate business-related expenses such as:

-

Internet, rent, and electricity bills

-

Laptop/software costs

-

Travel and marketing expenses

-

Subscription services (e.g., Adobe, Zoom)

-

Depreciation of business assets

Is TDS applicable to freelancers?

Yes. Clients may deduct TDS @10% under Section 194J before paying you. You can claim credit for this when filing ITR.

What is Form 26AS and AIS? Why are they important?

-

Form 26AS: Shows TDS deducted, advance tax paid, and other details.

-

AIS (Annual Information Statement): Provides a detailed record of all financial transactions (income, investments, etc.).

You must match your declared income with these documents.

Do freelancers need to pay advance tax?

Yes. If your tax liability exceeds ₹10,000 in a financial year, you’re required to pay advance tax in four installments (June, Sept, Dec, March).

Can freelancers switch between the old and new tax regimes every year?

Only if you don’t declare business income (i.e., use ITR-4 for presumptive or ITR-3 for profession only). If you declare business income, switching is allowed only once—after that, reverting is restricted.