Table of Contents

Muthoot Finance Ltd is one of India’s leading financial services players, known widely for its gold loan business and trusted brand value. Based in Kerala, this company has expanded phenomenally through the decades, evolving from a tiny local financial institution into a countrywide titan. Its trajectory demonstrates not just the foresight of its management but also its capacity to pivot to changing market demands and financing requirements in India.

In this blog, we’re going to delve into Muthoot Finance’s story, its business model, growth strategy, financial performance, and what made it a success. We will also review the company’s impact on Indian finance and its leadership in the gold loan industry.

Key Takeaways:

- Muthoot Finance Ltd is India’s largest gold financing company, based in Kerala, with a pan-India footprint. Their mainstay is gold loans, individuals and small businesses, and households.

- The company’s growth is due to good management, expansion, customer confidence, and novel financial instruments.

- Muthoot Finance has expanded into other financial services like insurance, remittance, mutual funds, and forex services.

- Its success is a testament to the strength of family-run businesses with a twist of modern corporate governance, and a model for regional companies with their sights set on national growth.

History of Muthoot Finance Ltd

Early Beginnings

Muthoot Finance Ltd was established in 1939 by M. George Muthoot in Kozhencherry, Kerala. First, it was a boutique financial-services business, with mainly local clients. It was a mom-and-pop operation when it got its start, so it was able to garner trust in the community, an important currency in financial services.

In its infancy, the company dealt mostly in gold loans – the old standby in Kerala. Gold has cultural and economic resonance in India, so it was a natural form of security for loans. Muthoot Finance, recognizing this, became a safe and trusted lender.

Transition and Expansion

It was under M.G. George Muthoot’s leadership that the company really transformed. The second generation of the Muthoot family, however, dreamed of growing outside Kerala, to make Muthoot Finance a national player.

Some early growth milestones included:

- To modernize operations and professional corporate governance.

- Expanding the branch network to other states in India.

- Branching into financial services to serve wider customer demand.

By the 1990s, Muthoot Finance was a brand name in the gold loan space, paving the way for growth spurts in the 21st century.

Start investing like a pro. Enroll in our Stock Market course!

Muthoot Finance Ltd Business Model

1: What is a stock?

Core Business: Gold Loans

Gold loans continue to be the mainstay of Muthoot Finance’s business. Customers pawn gold jewelry and get loans instantly. The unique points of their gold loan business are:

- Fast turnaround: less paperwork, immediate loan payments.

- Safe and secure: Full adherence, safe storage, and insurance of pledged gold.

- Flexible repayment: customized to the customer’s needs, accessible to households and small businesses

Gold loans for many Indians are the oxygen of the economy, particularly in its semi-urban and rural parts, where banking services don’t have a strong footprint.

Diversification of Services

Though gold loans make up the majority of its revenues, Muthoot Finance has expanded into other financial services, such as:

- Insurance broking: Life and general insurance products for personal and corporate clients.

- Remittances, forex – domestic and international money transfers.

- Wealth management and mutual funds: Serving urban customers wishing to prosper.

- Microfinance and small business loans: Empowering India’s little guys.

This diversification has enabled the company to minimize the reliance on a single source of income while serving a wider audience.

Revenue Model

Muthoot Finance mainly generates income from:

- Interest income: Levied on gold loans and other credit products.

- Service fees: For insurance broking, remittance and wealth management.

- Investment income: from mutual funds and market-linked products.

This multi-revenue model bolsters the business’s bottom line.

Leadership, Trust & Branding

One of the biggest reasons behind Muthoot Finance’s success is its leadership and governance.

Key People Driving Muthoot Finance

-

Chairman: George Jacob Muthoot

-

Managing Director (MD): George Alexander Muthoot

-

Joint Managing Director: George Thomas Muthoot

This family-led professional management ensures that the company stays true to its legacy while embracing modern business practices.

Branding & Trust

-

A history of over 80 years in finance builds credibility.

-

Transparent operations, RBI compliance, and professional audits boost investor confidence.

-

Customer trust is reinforced by presence in rural/semi-urban India, where Muthoot is often the first financial institution households interact with.

| Gain Financial Literacy in your Mother Tongue | |

| Stock Market Course in Malayalam | Mutual Funds Course in Malayalam |

| Stock Market Course in Tamil | Mutual Funds Course in Tamil |

| Stock Market Course | Mutual Funds Course |

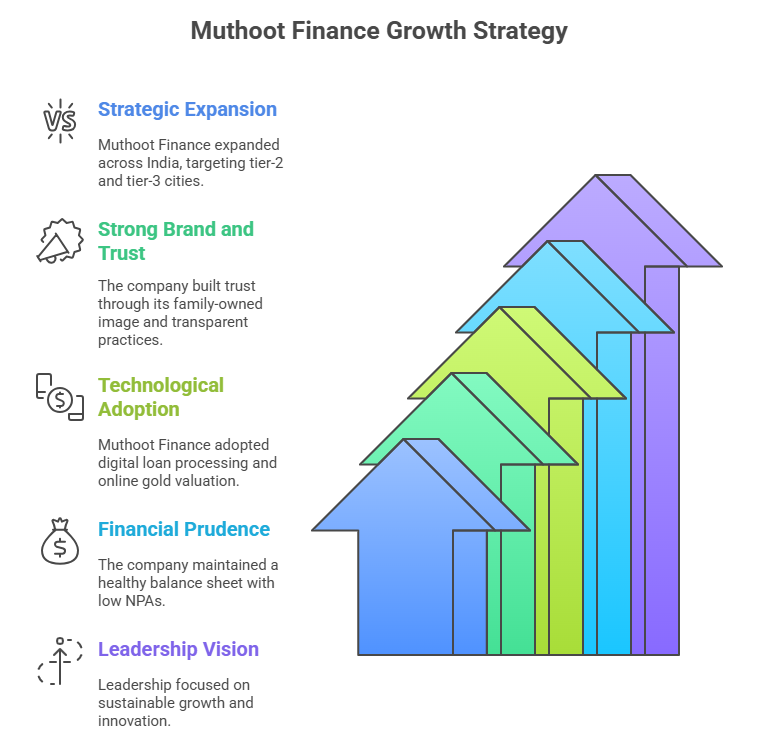

Why Muthoot Finance grew

Strategic Expansion

From its humble base in Kerala, Muthoot Finance has grown across India with more than 4,500 branches. And of course, their strategic targeting of tier-2 and tier-3 cities allowed them to access markets that were still largely unserved by banks.

Strong Brand and Trust

Trust is the foundation of the gold loan business. Muthoot Finance used its family-owned image and transparent practices as a foundation for customer confidence.

Technological Adoption

Muthoot Finance was quick to adopt technology, implementing digital loan processing, mobile applications, and online gold valuation, enhancing operational efficiency and customer convenience.

Financial Prudence

The company has also had a healthy balance sheet with relatively low NPAs compared to the industry. Cautious lending and close collateral control have added to long-term strength.

Leadership Vision

The Muthoot family also had a huge say in the company’s vision. Leadership focused on sustainable growth, not short-term gains, balancing tradition with innovation.

Milestones and Achievements

- 1939: Established in Kerala by M. George Muthoot.

- 1993: Incorporated as Muthoot Finance Ltd, thereby formalizing corporate operations.

- 2007: On BSE and NSE, making it a public company.

- 2010s: Grew to more than 3,000 branches across the country, reached millions of customers.

- 2020: Expanded into fintech, digital gold loans, and mobile banking.

The company’s milestones highlight a relentless customer-centric growth and operational excellence.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreMuthoot Finance Share Details

Muthoot Finance is a listed company with shares on both BSE and NSE. Let’s see the details:

Stock Symbols and Listing

- BSE: MUTHOOTFIN

- NSE: MUTHOOTFIN

Listing on both exchanges allows you to buy and sell shares easily and have transparency and regulatory control.

Share Price History

Muthoot Finance’s share has been growing steadily over the years as the company is stable and strong. Key factors that affect share price are:

- Gold Prices: As gold is the main collateral for loans, gold price fluctuations directly impact revenue and investor sentiment.

- Interest Rates: RBI and NBFC interest rates affect profitability.

- NBFC Sector Trends: Overall NBFC sector and economic conditions impact stock.

Market Capitalization

As per the latest reports Muthoot Finance has a market cap of around ₹16,000–18,000 crore, one of the top NBFCs in India. Market cap is an important parameter for investors to assess the company size, stability and investment potential.

Financial Performance Overview

Muthoot Finance’s financial trajectory is characterized by consistent expansion and profitability. Key indicators include:

- Revenue Growth – Year on year growth in revenues, led by gold loan demand.

- Profit Margins: Strong margins from low overhead and loan volumes.

- Asset Quality: Robust asset management, with high recovery rates on loans.

- Market Cap: One of the leading financial companies in India from investors perspective.

This fiscal prudence has made the company weather market cycles, economic turmoil, and regulatory shifts with aplomb.

Challenges and Risk Management

Even though it has done well, Muthoot Finance confronts the kind of trouble that financial services companies usually encounter.

- Gold Price Volatility: As collateral is in gold, changing prices affect both loan value and risk.

- Threat from competitors: Other NBFCs, banks are foraying into gold loan space.

- Regulatory developments: RBI policies on NBFC loans, interest rates, and capital norms need adherence and adjustment.

Muthoot Finance counters these risks by diversification, cautious lending, insurance and real-time tracking of gold prices.

Effect on Kerala and the Indian economy

Employment Generation

Muthoot Finance has generated thousands of employment opportunities, right from branch functions to corporate positions, especially in Kerala.

Financial Inclusion

It is also driving inclusion by offering easily accessible loans to largely semi-urban and rural population, allowing small businesses and households to easily access credit.

Role in Gold Economy

India has a rich tradition of gold. With organized gold loans, Muthoot Finance formalized the financial sector’s relationship with household gold.

Lessons from Muthoot Finance’s Success

Muthoot Finance’s journey lays out some important entrepreneurial takeaways.

- Capitalize on Local Competencies: Begin with a strong grasp of local markets and culture.

- Foster Confidence: Honest policies and consumer-friendly support establish lasting trust.

- Evolve and Innovate: Technology and process innovation are key to remaining competitive.

- Diversify: Multiple revenue streams reduce dependence on a single business line.

- Strong Leadership: Visionary leadership straddles tradition and modern corporate governance.

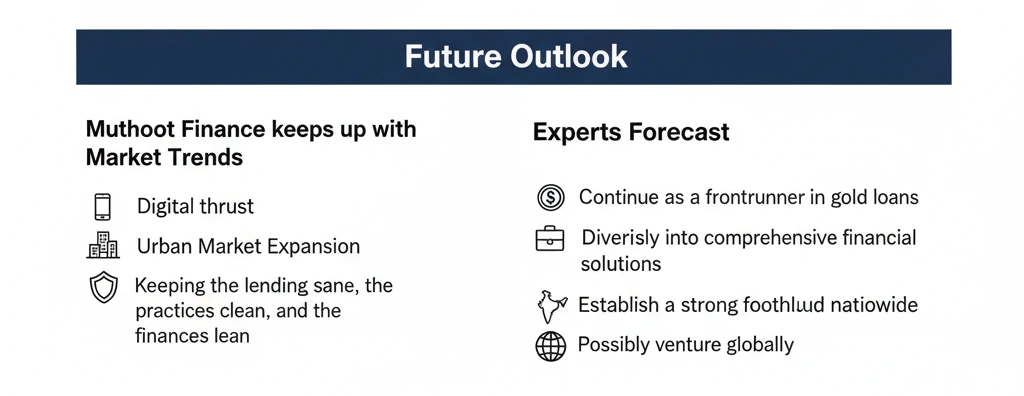

Future Outlook

Muthoot Finance keeps up with Market Trends

- Digital thrust: Further expansion of mobile apps, online gold loans, and digital financial services.

- Urban Market Expansion: Focusing on city-based customers for asset management and risk coverage.

- Keeping the lending sane, the practices clean, and the finances lean.

Experts forecast Muthoot Finance to continue as a frontrunner in gold loans, diversify into comprehensive financial solutions, establish a strong foothold nationwide, and possibly venture globally.

Conclusion

Muthoot Finance Ltd’s journey from a small Kerala-based company to India’s No.1 gold financing company is a story of vision, customer trust, good management, and growth. It’s proof that local businesses can go national if they have strong leadership and innovation.

For individuals, entrepreneurs, and financial professionals, Muthoot Finance is a case study on growth, diversification, and market leadership. As the company adopts technology and financial innovation, it will continue to grow in India’s fast-paced financial sector.

Muthoot Finance not only changed the gold loan industry but also contributed to financial inclusion, employment, and economic growth. It’s the power of entrepreneurship driven by vision from local roots.

Stock Market Training Reviewed & Monitored by SEBI Registered RA

Trusted, concepts to help you grow with confidence. Enroll now and learn to start investing the right way.

Know moreFrequently Asked Questions

What is Muthoot Finance Ltd?

Muthoot Finance Ltd is India’s largest Non-Banking Financial Company (NBFC) focused on gold loans, headquartered in Kochi, Kerala.

Who is the current Chairman of Muthoot Finance Ltd?

The current Chairman is George Jacob Muthoot, who leads The Muthoot Group of Companies.

Who is the Managing Director of Muthoot Finance Ltd?

George Alexander Muthoot is the Managing Director, steering the company’s operations and growth strategy.

What is the market cap of Muthoot Finance Ltd in 2025?

As of 2025, Muthoot Finance Ltd has a market capitalization of approximately ₹59,000+ crore.

Why is Muthoot Finance Ltd’s share popular among investors?

Its strong financials, dominance in gold loans, steady dividends, and robust expansion strategy make it a popular stock.

How has Muthoot Finance Ltd grown over the years?

The company grew from a small family-run gold loan business in Kerala into India’s largest gold loan NBFC, with thousands of branches nationwide.

What sectors does Muthoot Finance operate in apart from gold loans?

Apart from gold loans, Muthoot offers personal loans, housing finance, microfinance, foreign exchange, and wealth management.

What is the future outlook for Muthoot Finance Ltd share?

With India’s increasing gold demand, financial inclusion push, and expansion into other financial services, Muthoot Finance Ltd’s share has strong growth potential.