Table of Contents

Introduction

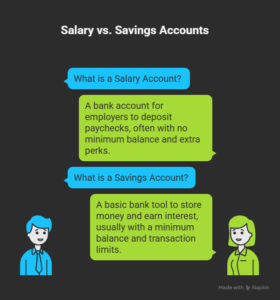

Imagine this, you get your paycheck each month. It lands in a bank account, but is that the best spot for it? Many people mix up salary accounts and savings accounts. They think both hold money the same way, and that’s not true. This post clears up the mix-up, and it shows the key differences. You will learn when to pick one over the other. You might save cash or earn more interest. The keyword here is Savings and Salary Account. Let’s jump in.

What is a Salary Account?

1: Accounting provides information on

A salary account is a bank account for employers that deposit the monthly paycheck. Banks offer these accounts to companies and employees receive them from employer-provided workers. Most salary accounts have no minimum balance requirements and you will be able to keep the balance at zero without fees. The advantage of this feature is that bankers use it to attract corporate clients.

The accounts often include small extras. You may be offered free ATM access and more withdrawal limits, or basic insurance, such as insurance for accidents or illness. Account-provider debit card may also provide rewards like cash back on shopping or fuel.

Salary accounts connect directly to the company’s payroll system. This means that when your employer pays your paycheck, it comes directly to your account. This system allows you to spend money less quickly, so you can pay bills or spend money in the process.

Regardless of the circumstances, bank accounts are treated differently. Some may require a minimum wage, of instance more than $2,000. If your income falls below that amount, the bank may transfer the account into a regular savings account and charge fees.

Most people with steady jobs and regular deposits are better off with a salary account. If you have changed employers, if you have to, you can also change your name or set up a new salary account with new company.

Banks offer salary accounts for convenience, which help build long-term relationships. These accounts are often linked to credit accounts, and banks may lend loans based on the salary history.

Simplely, a salary account is intended to receive your monthly income. It ensures the smooth functioning of transactions. It gives you some benefits as well for keeping the same bank.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!What is a Savings Account?

Money saved and interest earned via a savings account is a basic banking utility. If it pays a tiny amount on your balance, the bank takes a bite out of it and over time the money increases.

You can open a savings account yourself without employer involvement. Select the bank that suits your needs. Most savings accounts have some rules, such as keeping a minimum balance. If the balance below is below that, the bank may charge you a fee.

It’s about the interest you pay. Bank rates are typically between 0.5% to 4% per year and interest is compounded monthly or quarterly. This allows your money to grow at a very minimal cost.

There are limits to how often you can withdraw money from savings accounts. In some states, federal restrictions restrict withdrawing six withdrawals per month. Excessive charges may result from exceeding that limit. These restrictions are designed to save rather than spend.

You’ll usually have a debit card or ATM but the account isn’t for everyday transactions. It is better for emergencies or savings goals, like buying a car. For example, online banks often offer higher interest rates because they are outside of the physical banking chain and traditional banks offer lower rates but more in-person services.

Savings accounts also teach good financial habits. Setting up automatic transfers from your existing account will ensure savings run smoothly and make steep.

You are insured as well. The U.S. deposit protection can extend to $250,000. per account, providing security in case the bank fails.

In short, a savings account is a safe place to save money and earn little interest in the future, if you plan to survive in the future.

Key Differences Between Salary Account and Savings Account

Salary and savings accounts serve different goals. One handles income, and the other grows wealth. Here is a clear table to show the main points side by side.

| Feature | Salary Account | Savings Account |

| Purpose | Receives paychecks from employer | Stores spare money and earns interest |

| Interest Rate | Usually none or very low | Pays interest (0.5% to 4% per year) |

| Minimum Balance | Often zero or waived | Required; fees if balance drops low |

| Transaction Limits | Few restrictions | Caps at six withdrawals per month |

| Perks | Free ATM, insurance, overdraft | Focus on interest and safety |

| Opening Process | Set up by employer | Opened by individual |

| Conversion Risk | May change if salary stops | Stays the same |

| Fees | Fewer charges | Penalties for low balance or extra moves |

| Linked Services | Payroll loans, quick credit | Investments, goal tracking |

| Accessibility | Suits daily spending | Best for long-term hold |

| Tax Treatment | Deposits are income | Interest is taxable |

| Portability | Tied to job; update on switch | Stays with you always |

| Security | Insurance plus fraud alerts | Standard insurance up to $250,000 |

| Support | Priority due to corporate tie | Standard service |

These points guide your choice. Pick based on your money needs.

Pros and Cons of Salary Accounts

Salary accounts offer several practical advantages.

The biggest benefit is the no minimum balance rule, which helps you avoid fees even when your balance is low. Your salary also gets credited on time, so you don’t have to deal with delays or manual transfers. Many banks add small perks like free checkbooks or free ATM withdrawals, which can cut routine costs.

Most salary accounts also come with an overdraft facility, allowing you to handle shortfalls by borrowing small amounts at a low interest rate. Some banks include accidental insurance coverage at no extra cost. Debit cards linked to salary accounts often provide reward points on everyday spending, such as groceries or travel. Because banks can see your income history, loan approvals are usually faster. In many cases, the account opening fees are completely waived for corporate employees.

However, there are drawbacks.

Salary accounts usually offer very low or no interest, so your money does not grow. If your salary stops for any reason, the account may convert to a regular savings account, which can bring new fees or balance requirements. You are also limited to the bank chosen by your employer, which reduces flexibility and may restrict the features you prefer.

These accounts can become dormant if you stop using them, leading to freezes or extra steps to reactivate them. Withdrawal fees abroad are often higher, making them less convenient for international travel. There is also the obvious dependency on continued employment—once you leave the job, many benefits end.

Overall, for someone with a stable job and regular income, the advantages of a salary account usually outweigh the limitations.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Pros and Cons of Savings Accounts

Savings accounts are useful because they let you earn interest on your money. To borrow an emergency fund, you make a gradual increase in balance; they are suitable for building an emergency fund. They provide shelter for unexpected expenses.

Most banks make it very simple, whether you open the account online or not. You can deposit money at any moment and many banks will transfer money from your checking account to help you save with a regular savings account. Online banks often have higher interest rates and are able to offset inflation. Some banking apps also have goal tracking features that show you how far you have been over time.

There are downsides too. Some banks require minimum balance fees, some branches can get so low that they could dwarf inflation with little difference. For more frequent access, withdrawal limits may be difficult to reach. Your total gain is not taxed because you earned interest. If inflation increases faster than the interest rate on your account, the real value of your money declines. The opening of an account is also done through paperwork and ID verification, some banks require bank visiting to do so. Savings accounts also tend to offer smaller benefits than salary accounts.

But, such disadvantages still make savings accounts, even as they are very useful to most people who want a safe route to raise their money.

When to Choose a Salary Account?

- Pick a salary account if you have a steady job. It handles monthly pay well.

- Choose it for zero balance freedom, no worry about fees.

- Go for it if perks matter. Free ATM or insurance.

- Select when the employer mandates that many companies require it.

- Opt in for quick loans based on salary proof.

- Choose if you spend most income, no need for interest.

- Pick for ease. Auto-deposits from work.

- Select if changing banks is hard. Stick with the corporate tie-up.

- Go for it in your early career to build banking history.

- Choose when travel perks help some cards offer lounge access.

- Pick if overdraft is key to cover pay gaps.

- Select for family benefits. Some extend to spouses.

In these cases, a salary account fits best.

When to Choose a Savings Account?

- Opt for savings if you want interest to grow your money.

- Choose it for extra cash storage beyond daily needs.

- Pick when no job tie-up, freedom to select a bank.

- Go for it to build habits; auto-transfers help.

- Select for emergencies, quick access with limits.

- Choose if rates are high, online banks offer more.

- Opt in for goals like vacations or homes.

- Pick when the minimum balance is easy and avoid fees.

- Go for it, post-job change, convert the salary account.

- Select for kids and teach saving early.

- Choose if investing is linked and easy fund transfers.

- Pick for retirement, prepare for long-term growth.

Key Takeaways

If your paycheck feels too small and disappears by the 10th, a salary account can make monthly money management easier. It offers free transfers, no-fee debit cards, and access to instant loans. There’s also no minimum balance requirement, so you aren’t penalised during tighter months.

A savings account works differently. It earns daily interest and helps your money grow, but it usually requires a minimum balance. If you fall below that limit, the bank may charge fees. Salary accounts keep your cash flexible for rent, bills, and everyday spending, while savings accounts are better for building funds for goals like a home, an emergency cushion, or a big trip.

Choose a salary account when you want smooth transactions throughout the month. Choose a savings account when you want your extra money to grow over time. And for people focused on long-term goals, the advantages of a savings account often outweigh the restrictions.

Conclusion

Both a savings account and a salary account are different, and understanding that difference can help you manage your money better. Use all four accounts to understand what it means, rather than mixing up them. You choose what suits your needs. If you have an understanding of how these work, you better make a financially smart decision and will stay in control of your money.

SALARY ACCOUNT OR SAVINGS ACCOUNT ? ഏതാണ് നല്ലത്, വിശദമായി മനസിലാക്കാം !

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What exactly makes a salary account different from a regular checking account, and how does the employer’s role change the game for everyday banking?

A salary account starts as a special checking account that banks create just for company payroll. The employer picks the bank, signs a deal, and tells the bank to open accounts for all workers. This setup gives the account its power. Banks drop the minimum balance need because they want the firm’s business, not your small fees. Your paycheck drops in on the same day each month with no hold time. You get a debit card right away, often with higher spend limits than a normal checking account. Free ATM pulls from any machine, no matter the network, become standard. Some banks toss in free demand drafts or wire transfers that cost money elsewhere. The employer’s tie-in means the bank sees steady cash flow and offers overdraft lines without much paperwork. If you use a plain checking account instead, you pay for those extras and fight balance rules. The salary account turns your job into a banking advantage.

Can a salary account ever earn interest like a savings account, or is the trade-off always zero growth for zero fees?

Most salary accounts pay no interest or a tiny rate under 1%. Banks skip interest to cover the free perks they give. They make money from the company relationship, not your balance. A few banks now blend the two worlds. They offer “high-yield salary accounts” that pay 2% to 3% if your monthly credit stays above a set mark, say $3,000. These remain rare. The core trade-off stays the same: you pick convenience and no fees over growth. If you want both, open a separate savings account and sweep extra cash there each month. Keep the salary account for bills and daily spends. This way you grab the job perks without losing interest on idle funds.

What happens to a salary account if I quit my job or get laid off—does it vanish, turn into a savings account, or just start charging fees?

The account does not close on its own. It stays open, but the magic fades. Banks watch for salary credits. If no deposit hits for 45 to 90 days, they send a notice. The zero-balance perk ends. The account shifts to a regular savings or checking type. Minimum balance rules kick in, often $1,000 to $5,000. Drop below, and monthly fees start, $10 to $25 each time. Free ATM use shrinks to the bank’s own machines. Overdraft lines freeze or shrink. You can keep the account and add your own funds, but it loses its shine. Many people close it and move money to a personal savings account they control. Check the bank’s terms when you open the account to know the exact trigger period.

How do withdrawal limits on savings accounts actually work in real life, and what tricks can I use to avoid fees without breaking rules?

Federal rules in the US cap “convenient” withdrawals at six per month from savings accounts. Convenient means online transfers, phone transfers, or debit card swipes. ATM pulls and teller window cash-outs do not count toward the limit. Go over six, and the bank charges $5 to $15 per extra move or blocks the seventh. Some banks convert the account to checking after repeated breaches. To stay safe, plan big transfers once a month. Use your salary account for daily bills. Set up auto-pays from checking, not savings. Keep a buffer in checking to cover surprises. If you need cash fast, walk to the branch and pull from the teller. This keeps you under the cap and fee-free.

Are the insurance perks bundled with salary accounts real protection, or just marketing fluff that never pays out?

Salary accounts often include group insurance at no cost to you. Common covers are accidental death up to $500,000, hospital cash of $1,000 per day, or critical illness lumps of $100,000. The bank buys a master policy for all salary holders and lists you as a beneficiary. Claims pay out if you meet the terms, like death in a train crash or heart attack diagnosis. Payouts happen fast because the bank handles paperwork. Real people have collected six-figure sums after accidents. Read the fine print. Exclusions apply for suicide, war, or pre-existing illness. Coverage ends when salary credits stop. Treat it as a bonus, not your main policy. Buy separate term life and health plans for full safety.

If I freelance or run my own business, can I still open a salary account, or am I stuck with savings accounts forever?

Pure salary accounts need an employer to credit pay regularly. Freelancers miss out on the zero-balance deal. Some banks now offer “salary-like” accounts for self-employed people. You prove income with tax returns or bank statements for the past six months. The bank sets a monthly transfer rule, say $2,000 from your business account into this new account. Meet the rule, and you keep zero-balance status plus some perks. If cash flow varies, pick a savings account with no minimum or a low-fee checking account. Online banks often waive fees for direct deposits of any kind. Route client payments there to mimic salary credits.

How much can compound interest in a savings account really add up over five years if I park $200 every month and never touch it?

Start with $0. Add $200 monthly at 3% annual interest compounded monthly. After one year, you have $2,400 deposited plus $39 interest, total $2,439. Year two adds $2,400 more plus $116 interest on the growing balance, ending at $4,955. By year five, you deposit $12,000 total. Interest earned hits $1,005. Final balance reaches $13,005. Bump the rate to 4%, and interest climbs to $1,360 for a total of $13,360. Shop high-yield online savings for 4% or more. The key is steady deposits and no withdrawals. Small rates turn into real money over time.

Do salary accounts give better loan terms than savings accounts, and how big is the difference when I apply for a car or home loan?

Banks love salary accounts because they see your cash flow each month. This proof cuts risk. You often get personal loans at 1% to 2% lower rates than walk-in customers. Processing fees drop from 1% to 0.5% or zero. Car loans might start at 7% instead of 9%. Home loan rates can shave 0.25% to 0.50%. Pre-approved limits appear in your net banking without asking. Savings accounts show lumps, not flow. The bank asks for more papers and charges higher rates. One large salary account holder got a $20,000 loan at 8% while a savings-only customer paid 10.5% for the same amount. Steady credits build trust fast.

What hidden fees lurk in salary accounts that people miss until the statement hits, and how do I spot them early?

Free perks grab attention, but fine print hides costs. International ATM pulls cost $3 to $5 plus 3% currency markup. Dormant accounts after one year trigger $10 monthly fees. SMS alerts switch to paid after a free period. Replacement debit cards run $5 to $15. Failed auto-pay attempts cost $25 each. Cash deposits over $2,000 per month may add 0.5% fee. Read the schedule of charges when you open the account. Turn off paid alerts in the app. Use only local ATMs. Set up email alerts for free. Check statements monthly. Ask the bank to waive fees if your salary stays high.

If I have both a salary account and a savings account, what is the smartest way to split my money each month to maximize perks and growth without triggering fees?

Treat the salary account as your spending hub. Route all bills, groceries, and daily costs there. Keep one month’s expenses as buffer, say $2,000. Set a rule: any balance over $2,500 at month-end sweeps to savings automatically. This keeps the salary account active for perks and zero fees. The savings account gets the excess and earns full interest. Example: $5,000 salary hits. You spend $3,000 on life. $2,000 stays. Auto-sweep moves $0 since buffer is met. Next month $5,000 arrives, total $7,000. Spend $3,000, leave $2,000 buffer, sweep $2,000 to savings at 4%. Over a year, $24,000 moves to savings and earns $500 interest. You keep all salary perks and grow wealth. Adjust the buffer to match your real costs.