Table of Contents

Managing Goods and Services Tax (GST) may be overwhelming for many companies, particularly with constant updates and strict filing deadlines. Staying compliant is not just about paying taxes – it’s about maintaining proper records, retaining right information, filing on time and avoiding penalties

In this blog, we will discuss about simple GST compliance checklist that all businesses should follow. From registration and invoicing to return filing and records reconciliation, these steps will helps you to stay prepared, compliant and stress-free throughout the financial year.

Key Takeaways

- GST compliance ease companies to hold sincerity, avoid penalties and ensure smooth tax operations.

- Register your enterprise under GST in case your annual turnover crosses the crossses the limit.

- Always issue GST compliant invoices with accurate info like GSTIN, bill or invoice number, date and tax amount.

- File GST returns regularly – monthly, quarterly or annually to confirm and claim input tax credit.

- Should maintain proper financial and tax records for at least six years to facilitate audits and settlement.

- Validate sales and purchase data regularly to ensure accuracy and avoid any tax credit mismatches.

- Stay up-to-date with GST rules and regulations to hold your business sync with the latest compliance requirements.

- By the use of reliable GST accounting software or consulting tax professionals, compliance can be performed efficiently.

Become an Accounting Pro – Learn from Industry Experts!

Introduction

1: Accounting provides information on

Running a business in India means dealing with many legal and financial obligations, the most important of which is GST compliance. The Goods and Services Tax (GST) has simplified the indirect tax structure, but it also requires businesses to stay organized and up-to-date with regular filing and proper documentation.

Many business owners often find GST compliance challenging – from understanding the registration requirements to filing monthly and annual returns correctly. But with the right method and a clear checklist, compliance turns much easier and stress-free.

GST compliance doesn’t simply mean paying taxes on time; It is about preserving accurate records, issuing right invoices, reconciling incoming tax deductions and submitting debts before the deadline. When executed effectively, GST compliance allows organizations avoid penalties, build consumer self-confidence and make sure smooth financial operations.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!What is GST Compliance?

GST compliance refers to the process of following all the rules, regulations, and procedures under the Goods and Services Tax (GST) system. It ensures that a commercial enterprise efficiently collects, will pay, and report GST to the authorities. Being compliant means the way you’re preserving transparency, avoiding penalties, and maintaining your business financially healthful.

Understanding GST Compliance

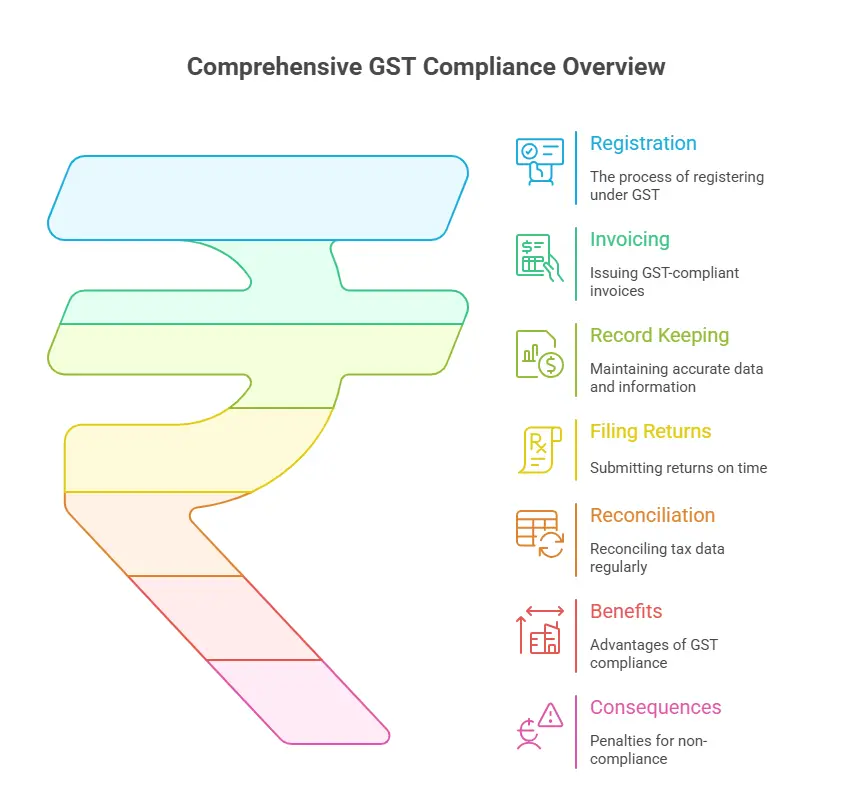

The Goods and Services Tax (GST) was introduced to simplify India’s oblique tax structure by merging more than one taxes like VAT, service tax, and excise duty into one. However, this simplification additionally introduced certain obligations for corporations. Every registered business need to observe GST regulations, together with registering under GST, issuing GST-compliant invoices, preserving accurate data and information, filing returns on time, and reconciling tax data regularly. GST compliance means following the whole technique efficiently—from the moment a sale is made to the time the tax is filed.

Why GST Compliance Matters

When GST become introduced, it changed many oblique taxes like VAT, excise duty, and service tax. The goal turned into to create a single, transparent tax system that benefits both the business and government. However, additionally business must take responsibility for reporting their transactions properly.

- A GST compliant business experiences several benefits – claiming input tax credits, improved cash flow and improved business credibility. Otherwise, non-compliance may result in penalties, blocking of ITC, or perhaps cancellation of GST registration.

- Being GST compliant increases client trust, avoids legal issues and ensures the smooth running of your business. Failure to follow will result in penalties, interest charges and loss of input tax credits. More importantly, the GST compliance reflects professionalism and financial duty.

Learn GST like a pro with Entri. Enrol now!!

Key Requirements for GST Compliance

To stay GST compliant, corporations have to observe certain policies and techniques mentioned under India’s Goods and Services Tax system. These requirements ensure that taxes are paid efficiently, records are maintained correctly, and filings are accomplished on time. Following them not only avoids penalties but also helps in smooth business operations.

1. GST Registration

The first step in GST compliance is registration. Any commercial business with a turnover above the prescribed limit (₹40 lakh for items and ₹20 lakh for services, depending on the country and state) need to register under the GST system. Once registered, the business gets a GSTIN (Goods and Services Tax Identification Number), which should be used on all invoices and tax files.

Eligibility for Registration

- Businesses with turnover above the GST limit

- E-commerce sellers and service providers

- Businesses dealing in interstate supply

Documents Required

- PAN of the business or proprietor

- Proof of business address

- Bank account details

- Digital signature (DSC) for companies

How to Register

Visit the official GST portal (gst.gov.in), fill out the online form, upload documents, and once verified, you’ll receive your GSTIN — your business’s unique tax identity.

2. Issuing GST-Compliant Invoices

Every registered enterprise must issue right GST invoices for each sale or service supplied. These invoices should contain important details like the GSTIN, invoice number, date, customer info, HSN/SAC codes, and the applicable GST charges. A systematic bill helps both client and seller claim input tax credit (ITC) without any mistakes.

3. Filing GST Returns on Time

Every business enterprise have to file their GST returns regularly—monthly, quarterly, or yearly, depending on their registration type. Common return forms include GSTR-1 (outward resources), GSTR-3B (summary return), and GSTR-9 (annual return). Timely submitting or filing returns helps to avoid penalties and claim input tax credit smoothly.

4. Maintaining Proper Records

Under GST, businesses are required to keep detailed information of their sales, purchases, input tax credits, stock, and tax bill payments for minimum of six years. Keeping those statistics prepared makes audits easier and helps to resolve if any issues arises quickly.

5. Claiming Input Tax Credit (ITC)

One of the biggest benefits of GST is the Input Tax Credit system. Businesses can claim credit for the GST paid on purchases or expenses used for commercial enterprise purposes. However, to claim ITC, the provider or supplier should have filed their GST returns well, and the details need to match in the GST portal.

6. Timely Tax Payments

Businesses must pay their GST liabilities on time. Delays in payment can entice interest and penalties. Regular settlement between purchase and income records allows accurate tax calculation and payment processing easily.

7. Responding to Notices and Audits

If the GST department sends any notices or conducts audits, companies must respond directly. Quick and accurate replies shows honest and help to avoid furthur complications.

GST compliance is all about accuracy, consistency, and timely action. By following these key requirements, corporations can build trust, maintain legal status, and make error-free tax process.

GST Compliance Checklist for Businesses

Managing GST (Goods and Services Tax) can experience complex for many business, however with a clear checklist, staying compliant becomes easier. The GST compliance is all approximately following the proper steps — from registration to return filing — to make sure that your business meets all legal requirements without any difficulties.

1. Register Your Business Under GST

If your business turnover exceeds the limit provided by the government (typically ₹40 lakh for goods and ₹20 lakh for other services), you have to register under GST. Once you registered, you’ll acquire a completely unique GSTIN (Goods and Services Tax Identification Number) that identifies your commercial employer for all GST-associated purposes.

2. Use Proper GST Invoices

Every sale or service provided by a GST-registered enterprise need to be supported by a GST-compliant invoice. This invoice should have information including your business name, GSTIN, bill number, date, tax rate, and amount charged. Clear and accurate invoices make record keeping and filing easier.

3. File GST Returns Regularly

Businesses must submit their GST returns on a monthly, quarterly, or annual basis, depending on their category. Common return types include GSTR-1, GSTR-3B, and GSTR-9. Timely filing ensures your business avoids penalties or other due charges and provide eligibility for input tax credits.

4. Keep Proper Records

Good recordkeeping is one of the most important elements of GST compliance. You should preserve organized records of all invoices, receipts, buy bills, and tax bills for at least six years. These documents are beneficial throughout audits or reconciliations.

5. Claim Input Tax Credit (ITC) Correctly

You can reduce your usual tax liability through claiming Input Tax Credit on purchases made for enterprise purposes. However, to claim ITC, make sure your suppliers also are GST-compliant and have filed their returns correctly.

6. Reconcile Data Regularly

Regular reconciliation of sales and purchase data helps you spot mismatches early. It ensures that your return filings are accurate and that you don’t lose eligible credits.

7. Stay Aware of GST Updates

GST rules and filing dates can change. Always stay informed by checking the authentic GST portal or consulting a tax expert. Keeping updated to ensure smooth compliance and fprevent mistakes.

By following this checklist, your business can stay organized, penalty-free, and absolutely GST-compliant, making your financial management easier and more dependable.

Become a GST practitioner with Entri! Enroll now!!

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Common GST Compliance Mistakes to Avoid

Even the well-structured business can make small GST mistakes that lead to penalties, notices, or blocked credits. The proper information is — most of those mistakes are easy to fix as soon as you make better decision. Below we are providing some of the most common GST compliance mistakes and how to prevent them.

1. Missing Filing Deadlines

One of the biggest and common GST mistakes is missing return filing deadlines. Under GST law, business enterprise are required to file returns like GSTR-1, GSTR-3B, and GSTR-9 within the due dates. When you miss those deadlines:

- You end up paying late fees and interest on unpaid taxes.

- Your Input Tax Credit (ITC) may get blocked until you file the pending returns.

- Repeated delays can even trigger departmental notices or audits.

How to avoid it:

- Mark filing dates on your business calendar or use reminders on your accounting software.

- Automate your GST return filing if possible.

- Always reconcile and prepare returns a few days before the due date instead of waiting till the last minute.

2. Incorrect Invoice Formats

Your GST invoice is prior to just a bill — it’s an official tax document that serves as proof of deliver. However, many small corporations make errors like:

- Missing mandatory fields (like GSTIN, invoice number, or HSN/SAC codes)

- Using incorrect tax rates

- Not mentioning the breakup of CGST, SGST, and IGST

- Forgetting to issue e-invoices when required

Such errors can lead to rejected invoices, loss of ITC for customers, and even penalties during audits.

How to avoid it:

- Use GST-compliant invoicing software that automatically includes all mandatory fields.

- Regularly update your system with the latest GST rate changes.

- If your turnover requires e-invoicing (currently ₹5 crore and above), ensure you’re generating invoices through the GST portal correctly.

3. Not Reconciling ITC Regularly

Input Tax Credit (ITC) is one of the biggest benefits under GST — but only if it’s claimed correctly. Many businesses fail to reconcile their purchase records with the GSTR-2B or supplier data, which causes:

- Claiming of ineligible or mismatched ITC

- Reversal of credit in later months

- Penalties and interest due to overclaimed credit

How to avoid it:

- Reconcile your ITC every month before filing GSTR-3B.

- Verify that all suppliers have filed their GSTR-1 so that your input credit reflects in your GSTR-2B.

- Maintain neat and correct purchase recordsin your accounting software.

Think of reconciliation as a monthly “health check” on your GST compliance — it ensures you’re claiming every eligible credit while avoiding future problems.

4. Ignoring Notifications and Portal Updates

GST is an evolving system — the government frequently issues new notifications, circulars, and amendments. Ignoring those updates can result in non-compliance without you even understanding it.

For example:

- You might miss a change in tax rates or filing format.

- You may be unaware of new return forms or due date extensions.

- You could continue using outdated practices that are no longer valid.

How to avoid it:

- Regularly visit the GST portal (gst.gov.in) for information and bulletins.

- Subscribe to reliable tax update newsletters or observe GST specialists onlline.

- Use accounting software program that automatically displays current rule adjustments.

Staying informed helps you avoid curiosities and ensures your business is constantly aligned with the latest GST rules.

Become an Accounting Pro – Learn from Industry Experts!

Conclusion

Staying GST compliant doesn’t need to be complicated. By following a good checklist and maintaining your records well-prepared, you could minimize errors, penalties, and last-minute stress during tax filing. Regularly updating your invoices, filing returns on time, and reconciling data along with your suppliers ensures your commercial enterprise runs easily and stays on the right aspect of the law. Think of GST compliance as a part of your business routine— not only a tax requirement. With right planning and timely actions, you can save time, preserve transparency, and build a strong recognition for your business.

|

Related Articles |

||

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

What is GST compliance and why is it important?

GST compliance means following all the rules and procedures set under the Goods and Services Tax system, such as timely filing of returns, maintaining records, and paying taxes correctly. It’s important because non-compliance can lead to penalties, legal issues, and loss of input tax credit.

Who needs to be GST compliant?

Any business whose annual turnover exceeds the prescribed limit (₹40 lakh for goods and ₹20 lakh for services, depending on the state) must register and comply with GST regulations. Even smaller businesses can register voluntarily to claim input tax credits and improve credibility.

What documents are required for GST compliance?

Businesses need to maintain accurate records such as invoices, purchase orders, credit/debit notes, payment receipts, and tax return filings. Proper documentation helps in audits, reconciliations, and claiming input tax credits without errors.

How often should GST returns be filed?

GST returns are usually filed monthly, quarterly, or annually depending on the type of business and its turnover. For example, regular taxpayers must file GSTR-1, GSTR-3B, and GSTR-9 returns on time to stay compliant.

What happens if a business fails to comply with GST rules?

Non-compliance can result in financial penalties, interest charges, and even cancellation of GST registration. Delayed filings may also block your input tax credit, which affects cash flow and business operations.

How can I make GST compliance easier for my business?

You can simplify GST compliance by using GST software, hiring a tax consultant, or setting reminders for return deadlines. Keeping digital records and reconciling invoices monthly can also save time and prevent errors.

Can small businesses manage GST compliance on their own?

Yes, small businesses can handle GST compliance independently by learning the basics of invoicing, return filing, and tax payments. However, using a professional accountant or GST portal is recommended to ensure accuracy and avoid mistakes.

What are the key steps in a GST compliance checklist?

A complete GST compliance checklist includes registration, issuing correct invoices, maintaining records, filing returns, reconciling input tax credits, and responding to GST notices on time. Following these steps helps businesses stay fully compliant and avoid legal issues.