Table of Contents

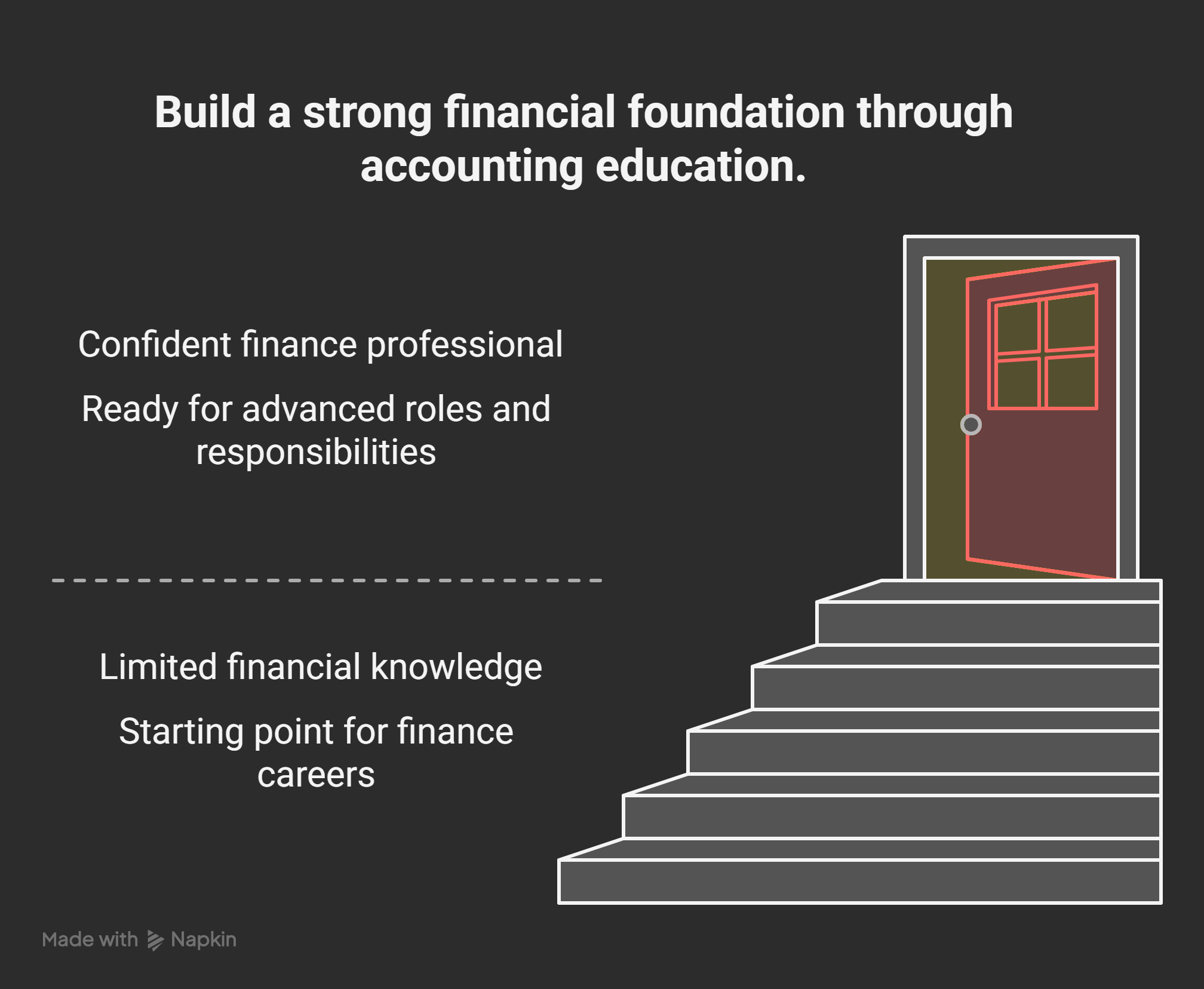

Many learners look for a simple career beginning. Some feel unsure about choosing the right finance path. The field can seem confusing for new students. Clear basics can make everything feel more manageable. Accounting Course to Enter a Financial Career builds confidence. It explains concepts in a practical and easy way. Learners understand how money moves within a business. This starting point helps you follow the blog better. A steady foundation will guide your learning journey smoothly. Simple ideas will make financial topics feel more familiar. Regular practice helps you understand real business tasks clearly. Clear examples in this blog will support your progress. These explanations will make finance roles feel more approachable. The structure will keep your reading flow comfortable. Continue reading to explore your best finance pathway.

Become an Accounting Pro – Learn from Industry Experts!

Introduction

Starting a career in finance can feel overwhelming. Many beginners struggle to choose the right entry point. The field appears wide with many specializations. Some roles need strong technical foundations. Others demand deep analytical skills. In both cases, clarity is important. A simple learning path helps build that clarity. An accounting course gives this clarity to beginners. It explains money flow in a business. It also builds basic financial understanding. These basics support further finance learning. They also make advanced concepts easier later.

An accounting background strengthens decision-making skills. It improves how learners read financial statements. It helps them understand business performance better. This understanding supports many finance roles. It also builds confidence for interviews. Many companies prefer candidates with accounting knowledge. It shows discipline and financial awareness.

Below are key points that explain why accounting helps:

- Accounting builds strong financial fundamentals.

- It improves understanding of business processes.

- It supports advanced finance qualifications later.

- Accounting creates opportunities for entry-level jobs.

- It boosts confidence for real workplace tasks.

- It helps learners adapt to financial tools easily.

- Accounting makes career growth smoother over time.

Overall, accounting provides a reliable first step into finance.

What Does “Career in Finance” Actually Mean?

1: Accounting provides information on

A career in finance covers many different roles. Each role deals with money in some form. Some jobs focus on planning. Some jobs focus on analysis. Others focus on records and compliance. Every role needs clear financial understanding. This makes the field broad and flexible.

Finance work supports business decisions. It helps companies manage money better. It also guides future business actions. Finance teams track costs and income. They review performance and risks. This team prepares key financial reports. They support leaders with clear insights.

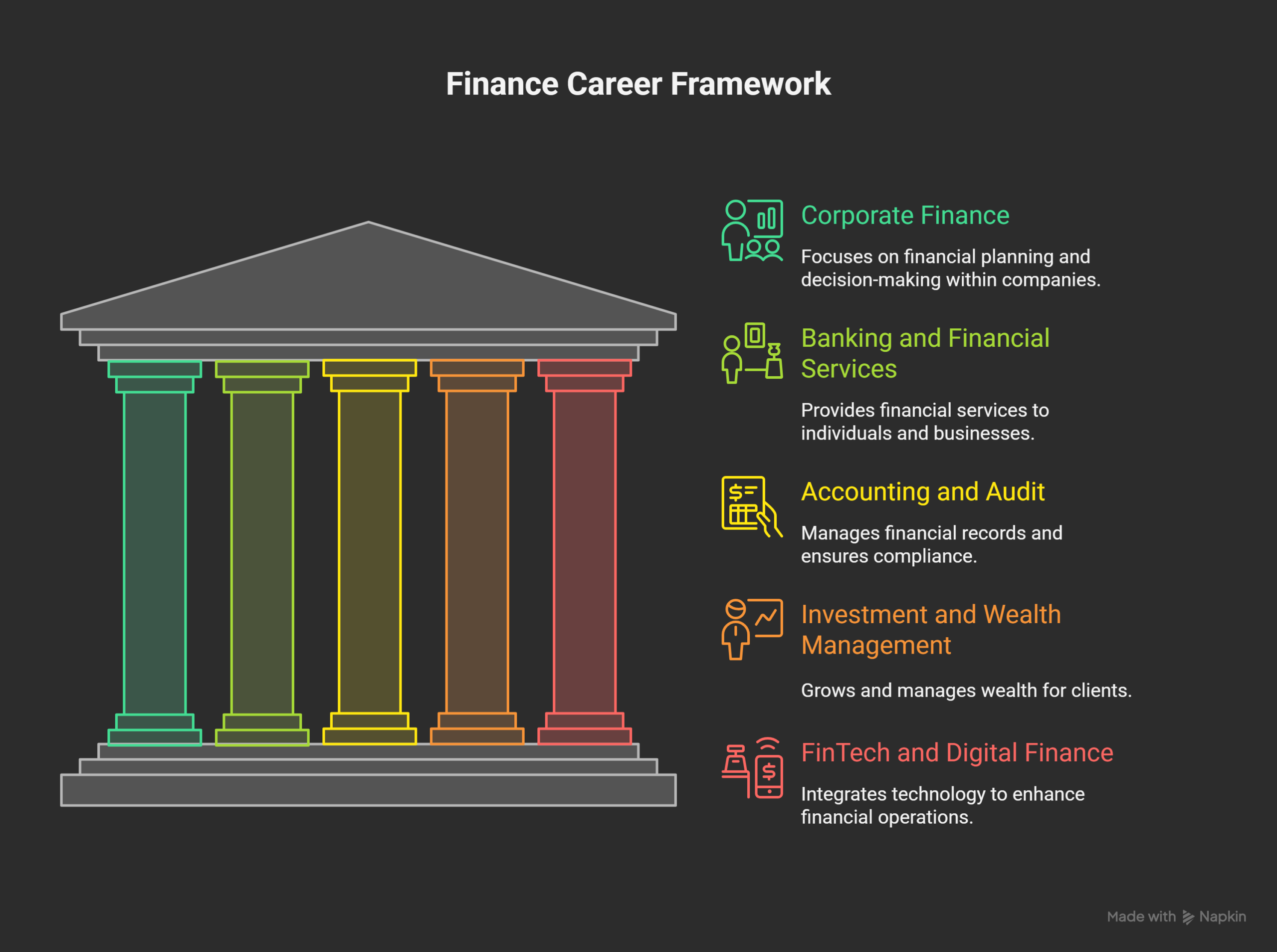

Main Areas in a Finance Career

1. Corporate Finance

Corporate finance helps companies plan money use.

- Budget planning supports business goals.

- Forecasting predicts future financial results.

- Cost analysis checks spending patterns.

- Investment decisions guide business growth.

2. Banking and Financial Services

This area supports customer and business money needs.

- Retail banking handles personal finance tasks.

- Credit analysis checks loan eligibility.

- Financial services manage savings and insurance.

3. Accounting and Audit

This area manages business records.

- Bookkeeping maintains daily transactions.

- Audit checks accuracy and compliance.

- Reporting shares business health clearly.

4. Investment and Wealth Management

This field grows money for clients.

- Portfolio management balances risk factors.

- Market research tracks price movements.

- Advisory services guide smart investments.

5. FinTech and Digital Finance

Technology improves financial operations greatly.

- Automation reduces manual work.

- Digital tools improve reporting speed.

- ERP systems support large business finance.

- Many learners begin with Accounting Course to Enter a Financial Career.

Table: Common Finance Fields and Core Focus

| Finance Field | Main Focus | Typical Tasks |

|---|---|---|

| Corporate Finance | Planning | Budgets, forecasts, reports |

| Banking Services | Customer finance | Loans, savings, credit checks |

| Accounting & Audit | Records | Books, audits, compliance |

| Investment Management | Growth | Research, portfolios, advisory |

| FinTech | Technology | ERP, automation, analytics |

Why Understanding Finance Definition Matters

Clear knowledge guides better career choices. It helps learners select the right path. It builds realistic job expectations early. This knowledge helps students decide required skills faster.

Understanding finance roles helps beginners learn smart. It also provides direction for future growth. This clarity supports a confident entry into finance.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!How Accounting Skills Help in a Finance Career

Accounting skills support almost every finance role today. They help learners understand business money clearly. These skills build strong financial thinking. They improve accuracy in daily financial work. Accounting skills guide decisions with clear number insights. They also strengthen confidence in financial conversations. This foundation supports steady career growth.

Finance teams rely on accurate records always. Accounting helps create those accurate records. It explains how money enters a business. It also explains how money leaves a business. This clarity improves analysis and planning. It also reduces costly financial errors. Every finance role benefits from such clarity.

Core Ways Accounting Supports Finance

1. Understanding Financial Statements

Strong statement knowledge improves finance performance.

- Balance sheets show business position clearly.

- Income statements show profit trends easily.

- Cash flow reports show money movement well.

- Notes explain deeper financial details clearly.

2. Improving Financial Analysis Skills

Analysis becomes easier with accounting basics.

- Accounting guides ratio understanding well.

- Trends become easier to identify.

- Variations become simpler to track.

- Results become quicker to explain.

3. Strengthening Compliance Knowledge

Finance requires strong compliance awareness.

- Accounting teaches key financial rules.

- It explains tax ideas clearly.

- Accounting improves audit understanding overall.

- It builds discipline in financial tasks.

4. Enhancing Business Understanding

Accounting reflects business health accurately.

- It shows real cost patterns clearly.

- It highlights revenue strengths well.

- Accounting reveals spending issues early.

- It supports strategic planning decisions.

5. Building Technical Finance Strength

Many finance tools need accounting skill.

- ERP tools use accounting logic daily.

- Excel analysis needs accounting basics.

- Reporting tools require structured data.

- Automation tools follow accounting rules.

Table: Accounting Skills and Their Finance Impact

| Accounting Skill | Finance Impact | Example Use |

|---|---|---|

| Ledger knowledge | Accurate records | Payable checks |

| Statement reading | Better analysis | Monthly reports |

| Compliance basics | Risk control | Tax review |

| Cost understanding | Smarter planning | Budget checks |

| Reporting skill | Clear insights | Management updates |

Why Accounting Skills Matter in Finance

They build confidence for new finance learners. They improve speed in financial tasks. Accounting skills reduce errors in key reports. They create strong value in companies.

Accounting skills guide smart financial actions. They help professionals handle complex work easily. They shape a strong and stable finance career.

Benefits of Taking an Accounting Course as a Starting Point

An accounting course offers great support for beginners. It gives clear financial understanding from day one. It helps learners understand business money easily. The accounting course also builds confidence for finance tasks. Many students start finance careers through accounting. These basics make further learning much smoother. This strong beginning supports long-term growth.

Accounting courses teach practical skills first. These skills help in real workplace settings. They improve accuracy in daily financial work. They also create discipline in financial routines. Many companies value these skills highly. They see accounting learners as reliable candidates. This increases employability for new learners.

Key Benefits for Finance Beginners

1. Strong Financial Foundation

Clear basics support every finance role well.

- Concepts become easy to understand.

- Statements feel simple to read.

- Techniques become faster to learn.

- Mistakes become easier to avoid.

2. Easier Entry-Level Opportunities

Accounting improves job opportunities quickly.

- Roles welcome accounting learners happily.

- Tasks feel manageable for beginners.

- Interviews become easier with basics.

- Employers trust accounting knowledge more.

3. Better Support for Advanced Courses

Accounting helps in future qualifications greatly.

- Basics support ACCA learning.

- Skills help CMA progress too.

- Concepts help SAP FICO study.

- Foundation helps CFA understanding.

4. Practical Skill Development

Courses teach skills useful daily.

- Bookkeeping strengthens financial accuracy.

- GST updates improve tax understanding.

- Payroll ideas improve compliance knowledge.

- Budget basics support planning tasks.

5. Higher Confidence for Finance Growth

Confidence grows with stronger skills.

- Learners feel ready for new tasks.

- They handle pressure more calmly.

- They communicate better with teams.

- Learners adapt faster to new tools.

Table: Benefit Areas and Their Practical Value

| Benefit Area | Practical Value | Example Outcome |

|---|---|---|

| Foundation | Clear basics | Strong statements understanding |

| Job Access | Easy entry | Quick placement chances |

| Advanced Study | Smooth progress | Easier ACCA or CMA learning |

| Practical Skills | Better accuracy | Reliable daily tasks |

| Confidence | Strong presence | Better interview performance |

Why These Benefits Matter

They give beginners a clear starting point. They help learners grow with steady progress. These benefits reduce confusion in financial learning. They create strong future opportunities.

These benefits support a confident finance journey. They guide learners toward better roles.They help shape a successful finance career.

When an Accounting Course Alone May Not Be Enough

An accounting course builds a strong starting base. It helps learners understand business money clearly. It supports early career roles in finance. However, it may not meet all career goals. Higher roles need deeper financial knowledge. They also need stronger technical expertise. This is where extra qualifications become essential.

Some finance fields demand advanced skills. These skills go beyond basic accounting lessons. They include global rules and complex tools. Many companies expect wider financial knowledge. They want professionals with specialised training. This makes additional courses very valuable. They strengthen long-term career growth.

Why Accounting Alone May Fall Short

1. Limited Scope for Advanced Roles

Higher positions need deeper understanding.

- Analysis roles need complex evaluation skills.

- Planning roles need strong forecasting talent.

- Strategy roles need broader financial knowledge.

- Global roles need international standards understanding.

2. Need for Advanced Certifications

Some careers require global recognition.

- ACCA helps with international finance knowledge.

- CMA builds strong management accounting skills.

- CPA strengthens audit and tax areas.

- CFA helps with investment domain growth.

3. Need for ERP and Technical Skills

Modern finance requires stronger tech training.

- SAP FICO supports corporate finance work.

- ERP tools manage large business processes.

- Automation tools improve finance accuracy.

- Data tools support strong financial analysis.

4. Need for Specialised Industry Knowledge

Different fields need deeper expertise.

- Banking roles need credit understanding.

- Investment roles need market knowledge.

- Audit roles need compliance expertise.

- Finance teams need strategic finance skills.

Table: Requirement and Recommended Upgrade

| Career Goal | Missing Skill | Suggested Course |

|---|---|---|

| Global finance | International rules | ACCA |

| Management finance | Planning skills | CMA |

| Corporate finance | ERP knowledge | SAP FICO |

| Investment roles | Market expertise | CFA |

| Audit careers | Deep compliance | CPA |

Why Additional Courses Matter

They increase confidence for complex roles. They open doors to global opportunities. Additional courses improve problem-solving in finance tasks. They create stronger value for employers.

More skills build a competitive advantage. They support faster career progression. They help shape a strong finance future.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Who Should Definitely Consider an Accounting Course?

An accounting course suits many types of learners. It supports beginners entering the finance field. This course helps students build strong financial basics. It also supports professionals changing careers. Many groups gain clear benefits from accounting. These groups find the learning simple and helpful. This makes accounting a smart first step.

Some learners need structured financial guidance. They need clearer understanding of business money. They need simple steps before advanced learning. Accounting gives these steps very effectively. It builds confidence for further progress. It improves understanding of financial tasks. Accounting course prepares learners for steady career growth.

Groups That Benefit the Most

1. Students Planning a Finance Career

These students need strong basics first.

- B.Com learners need accounting clarity.

- BBA students benefit from financial understanding.

- Economics students gain practical insight.

- Beginners understand statements more easily.

2. Fresh Graduates Seeking Entry-Level Jobs

Graduates need practical skills quickly.

- Accounting improves job readiness fast.

- It helps them learn key workplace tasks.

- It boosts confidence for interviews.

- It improves employability across industries.

3. Career Switchers from Non-Finance Fields

Professionals need simple finance entry points.

- Accounting helps them learn essential skills.

- It reduces fear of financial terms.

- It guides them through business basics.

- Accounting makes finance roles more approachable.

4. Learners Planning Advanced Qualifications

These learners need strong foundations.

- ACCA needs accounting basics first.

- CMA becomes easier with good fundamentals.

- SAP FICO needs accounting knowledge.

- CFA requires financial understanding early.

5. Small Business Owners and Entrepreneurs

Owners need clarity on money management.

- Accounting helps track daily expenses.

- It guides profit checks effectively.

- It improves financial control overall.

- Accounting supports stronger business decisions.

Table: Learner Type and Main Benefit

| Learner Type | Main Need | Key Benefit |

|---|---|---|

| Students | Basics | Clear understanding |

| Graduates | Job skills | Quick readiness |

| Career switchers | Simple start | Easy entry |

| Advanced learners | Foundation | Faster progress |

| Business owners | Money control | Better decisions |

Why These Groups Should Choose Accounting

They gain clarity through structured learning. They understand financial tasks more easily. These groups build confidence for future growth. They create stronger career direction early.

Accounting supports different learners effectively. It teaches skills useful in many roles. It helps build a stable finance career.

Become an Accounting Pro – Learn from Industry Experts!

How to Choose the Right Accounting Course

Choosing the right accounting course needs careful thinking. Different learners need different learning paths. Each course offers unique strengths and outcomes. Some focus on basics for beginners. Others focus on advanced industry skills. A good match depends on goals and experience. Clear selection makes learning smooth and helpful.

Many learners feel confused by too many options. They need guidance to pick the right course. Learners should check course content carefully. They should check teaching methods and support. They should match goals with course benefits. This helps them make a smart learning decision. It also ensures long-term growth and confidence.

Key Steps to Select the Right Course

1. Understand Your Learning Goal

Goals help guide your course choice.

- Beginners need basic accounting topics.

- Job seekers need practical training modules.

- Career switchers need simple starting lessons.

- Advanced learners need specialised programs.

2. Check Course Curriculum Carefully

Quality curriculum ensures better learning.

- Look for strong accounting fundamentals.

- Check if statements are clearly covered.

- Review GST or taxation modules too.

- Ensure practical tasks are included.

3. Review Trainer Experience and Support

Good trainers improve learning quality.

- Trainers should have industry experience.

- They should explain topics clearly.

- Trainers should support doubts quickly.

- They should guide career choices well.

4. Evaluate Practical Learning and Tools

Practical work improves real skills.

- Look for ERP exposure opportunities.

- Check for finance tool training sessions.

- Ensure hands-on assignments are given.

- Practice must be consistent and useful.

5. Consider Duration and Learning Format

Format should match your schedule.

- Short courses suit busy learners.

- Long courses suit deep learners.

- Online helps flexible learning hours.

- Offline helps interactive learning style.

6. Check Placement or Career Support

Good support improves job readiness.

- Resume help boosts confidence quickly.

- Mock interviews prepare learners well.

- Placement guidance improves outcomes.

- Industry links help job search faster.

Table: Course Type and Best Fit

| Course Type | Best For | Key Advantage |

|---|---|---|

| Basic Accounting | Beginners | Strong foundation |

| Tally + GST | Job seekers | Practical skills |

| SAP FICO | Corporate roles | ERP exposure |

| ACCA Pathway | Global learners | International recognition |

| CMA Pathway | Management roles | Planning expertise |

Why Smart Course Selection Matters

It helps learners start with clear direction. It reduces confusion during the journey. Smart course builds confidence in every learning stage. It supports long-term career stability.

Right selection leads to meaningful progress. It improves job readiness and skills quickly. It helps shape a strong finance future.

Career Outcomes & Growth Path

An accounting course creates many strong career openings. It prepares learners for entry-level finance roles. An accounting career builds skills needed across many industries. It also supports progress into advanced positions. The growth path becomes clear with consistent learning. Each stage adds new responsibilities and skills. This creates stable and long-term career development.

Many learners begin with simple finance tasks. These tasks build accuracy and confidence early. With experience, learners move to advanced roles. They handle deeper analysis and decision support. They manage reports, budgets, and business insights. Their value increases with skill expansion. This steady rise shapes a strong finance career.

Common Career Outcomes After an Accounting Course

1. Entry-Level Opportunities

These roles suit beginners and fresh learners.

- Accounts assistant handles basic records.

- Junior accountant supports daily entries.

- Billing executive manages invoices smoothly.

- Payroll assistant handles salary processes.

2. Mid-Level Finance Roles

These roles need strong financial understanding.

- Accountant manages statements and reports.

- Finance executive supports planning activities.

- Audit assistant checks accuracy and compliance.

- Cost analyst supports budgeting tasks.

3. Advanced Finance Roles

These roles need deeper expertise.

- Senior accountant manages entire accounts.

- Financial analyst supports smart decisions.

- Internal auditor checks complex systems.

- Budget analyst guides spending plans.

4. Specialised Career Growth Paths

These paths suit learners with extra training.

- SAP FICO roles support ERP systems.

- ACCA roles suit global finance domains.

- CMA roles support management planning.

- Tax analyst roles need deep compliance knowledge.

Typical Growth Path in Finance

| Career Stage | Experience Needed | Role Examples |

|---|---|---|

| Beginner | 0–2 years | Accounts assistant, billing staff |

| Intermediate | 2–5 years | Accountant, audit assistant |

| Advanced | 5–8 years | Senior accountant, analyst |

| Specialist | 5+ years + certification | CMA, ACCA, SAP roles |

Why Career Growth Is Strong in Finance

Finance roles remain stable across industries. Financial skills stay valuable for years. Growth depends on consistent learning efforts. Specialisation creates stronger career advantage.

A clear path helps learners grow faster. Advanced training opens high-paying roles. This journey leads to a successful finance career.

Conclusion

A strong career needs the right beginning. Your choices shape growth. Every learner needs direction and confidence. This blog offers clear guidance. It explains key decisions simply. It shows real opportunities ahead. This blog also highlights essential skills for growth. So read the blog fully today.

Your future needs smart planning. Your goals deserve proper guidance. An Accounting Course to Enter a Financial Career supports real progress. It helps you build lasting confidence. It opens strong professional pathways. So explore every section carefully. Understand each point clearly. Let this guide shape your journey.

Placement Oriented PWC Business Accounting Course

PWC Certified Business Accounting Course by Entri App: Master in-demand skills, ace interviews, and secure top-tier jobs.

Join Now!Frequently Asked Questions

Is an accounting course enough to start a finance career?

An accounting course offers a strong foundation because it teaches essential concepts like bookkeeping, financial reporting, budgeting, and compliance, all of which are directly used in finance roles, but for long-term growth in competitive fields like investment management, corporate finance, or financial analysis, you may need advanced qualifications such as ACCA, CMA, or SAP FICO training along with practical exposure.

What job roles can I apply for after completing an accounting course?

You can apply for roles such as Accounts Assistant, Junior Accountant, Billing Executive, AP/AR Executive, Payroll Assistant, GST Assistant, and Finance Associate, and with experience, you can progress to positions like Senior Accountant, Financial Analyst, Cost Analyst, SAP FICO Consultant, and Finance Manager depending on your further studies and skill upgrades.

Do I need a commerce background to learn accounting?

No, a commerce background is not mandatory because modern accounting courses start from very basic principles, explaining concepts like debits, credits, ledgers, and financial statements in an easy-to-understand manner, enabling even students from science or arts backgrounds to build strong accounting skills with consistent practice.

Should I choose offline or online accounting courses?

Both formats can be effective, but online courses offer greater flexibility, recorded sessions, self-paced learning, and access to digital tools, whereas offline classes offer direct classroom interaction and immediate doubt clearance, so the right choice depends on your schedule, learning style, and career goals.

How do accounting skills support long-term finance growth?

Accounting skills form the backbone of finance because every financial decision depends on accurate numbers, clean statements, and reliable reports, so professionals who understand accounting can interpret data better, evaluate company performance more effectively, and make smarter decisions in roles like analysis, planning, and budgeting.

Can I transition to advanced finance roles after starting with accounting?

Yes, many top finance professionals begin with basic accounting roles and later shift to advanced paths like investment banking, taxation, financial modelling, auditing, or ERP consulting, and this transition becomes easier when you upgrade your skills through certifications such as ACCA, CMA, CFA, or SAP FICO.

How long does it take to complete an accounting course?

Most entry-level accounting courses take 2–6 months depending on the syllabus depth, practical training hours, and the pace of learning, and advanced certifications like CMA or ACCA may take longer but offer higher career value and global recognition.

Is SAP FICO necessary for a strong finance career?

SAP FICO is not mandatory for everyone, but it is extremely valuable for those aiming to work in corporate finance, MIS reporting, budgeting, and large-scale enterprise environments because SAP is used by top companies globally and creates strong opportunities for higher-paying roles.

Will an accounting course improve my salary prospects?

Yes, because companies value professionals who understand financial statements, manage accounts accurately, and support financial operations, and skilled accounting learners usually earn better salaries compared to freshers without financial knowledge, especially when combined with tools like Excel, Tally, or SAP.

What additional skills should I learn along with accounting?

Along with accounting, you should consider learning Excel, financial analysis basics, taxation concepts, Tally ERP, SAP FICO, and practical reporting skills because these tools make you job-ready, improve your efficiency, and help you stand out in competitive finance job markets.