Table of Contents

SAP FICO is a module in SAP ERP that helps businesses manage financial data. This module requires expertise in financial accounting, business process analysis, integration skills, etc. If you are preparing to appear for the SAP FICO interview, you have come to the right place. In this article, we will discuss SAP FICO interview questions and answers, we will go through basic, intermediate, and advanced levels of questions.

Join Entri’s SAP FICO Training Course today!!

Introduction

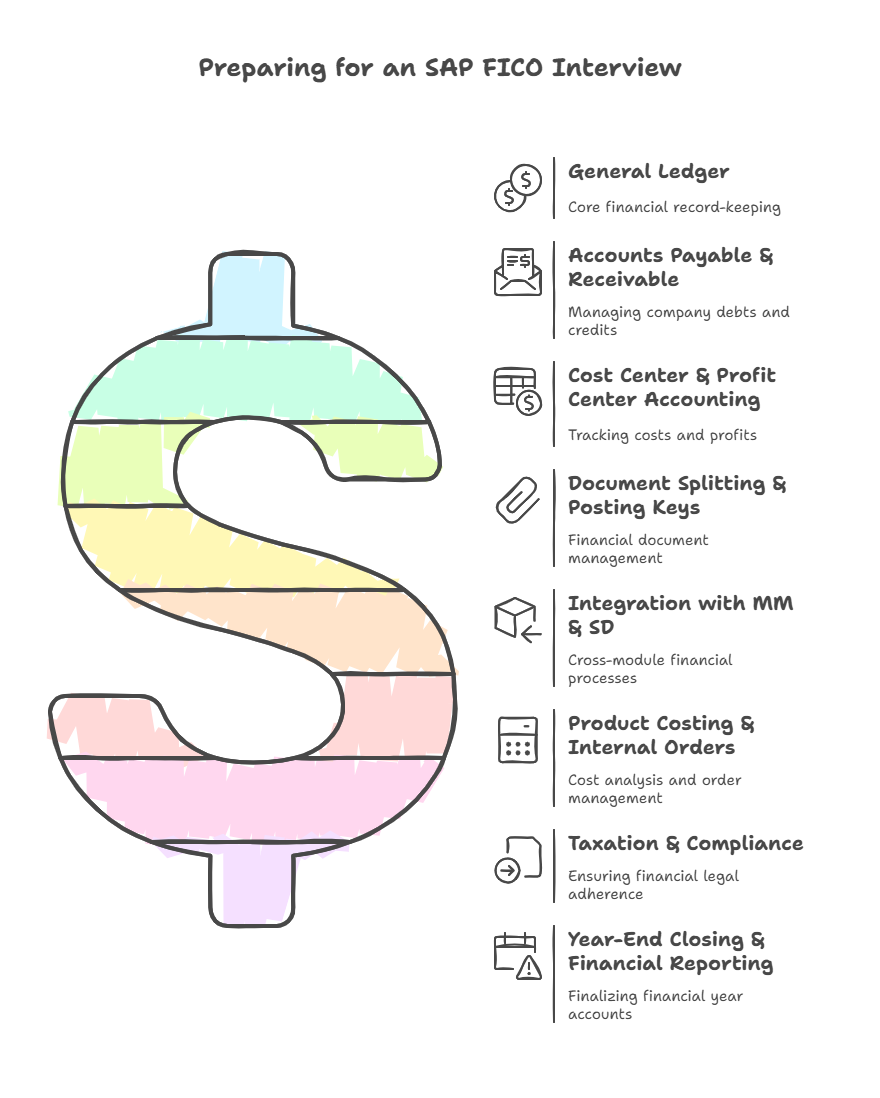

SAP FICO (Financial Accounting and Controlling) is a core module in SAP ERP that helps organizations manage financial transactions, reporting, and internal controls. Businesses rely on SAP FICO for accurate financial data and compliance with accounting standards. Given its importance, interviews for SAP FICO roles require a strong understanding of financial processes, system configuration, and integration with other SAP modules. The image bellow lists a few of the important topics you should study for your interview.

Why SAP FICO is Important?

- It ensures accurate:

- financial reporting

- compliance

- It integrates seamlessly with other SAP modules like:

- MM

- SD

- HR

- It plays a key role in decision-making through analysis of:

- cost

- profitability

- It enhances career opportunities in:

- finance

- SAP consulting

To help you prepare, we’ve compiled a list of commonly asked SAP FICO interview questions along with their answers.

SAP FICO Interview Questions and Answers

SAP FICO Interview Questions and Answer: Basic Level

1. What is SAP FICO?

SAP FICO is a crucial module in SAP ERP that consists of two main components:

- Financial Accounting (FI): Focuses on external financial reporting, ensuring compliance with legal requirements and standards.

- Controlling (CO): Handles:

- internal cost control

- financial planning

- monitoring of business operations

Together, these components help businesses maintain financial transparency, streamline processes, and make informed decisions.

2. What are the main components of SAP FI?

| Component | Function |

|---|---|

| General Ledger (GL) | Records all financial transactions in real-time. |

| Accounts Payable (AP) | Manages vendor transactions and payments. |

| Accounts Receivable (AR) | Tracks customer transactions and incoming payments. |

| Asset Accounting (AA) | Maintains records of fixed assets and depreciation. |

| Bank Accounting | Handles transactions related to bank accounts. |

3. What are the main components of SAP CO?

| Component | Function |

| Cost Element Accounting (CEA) | Categorizes revenue and cost elements for analysis. |

| Cost Center Accounting (CCA) | Tracks costs incurred within departments. |

| Profit Center Accounting (PCA) | Evaluates business unit profitability. |

| Product Cost Controlling (PCC) | Manages costing of manufactured goods. |

4. What is a Company Code in SAP?

A Company Code represents an independent legal entity within SAP FI. It is used for external financial reporting, including:

- Generating balance sheets and profit & loss statements.

- Defining local currency and fiscal year settings.

5. What is the purpose of the Fiscal Year Variant?

The Fiscal Year Variant defines the posting periods for financial reporting. Types include:

- Calendar Year (Jan–Dec): Common for most companies.

- Non-Calendar Year: Custom fiscal periods (e.g., April–March).

6. What are Posting Keys in SAP FICO?

Posting Keys determine how transactions are posted:

| Posting Key | Account Type | Debit/Credit |

| 40 | General Ledger | Debit |

| 50 | General Ledger | Credit |

| 31 | Vendor | Credit |

| 01 | Customer | Debit |

7. What is Document Splitting in SAP FICO?

Document Splitting ensures financial transparency by dividing accounting transactions into multiple segments based on predefined rules. This is useful for segment-wise reporting and compliance.

Key Features:

- Enhances detailed financial reporting by business area, segment, or profit center.

- Ensures correct financial statement presentation for regulatory compliance.

- Helps track expenses and revenue accurately across different business units.

8. What is the Chart of Accounts (CoA) in SAP?

The Chart of Accounts is a list of all general ledger accounts used by a company. It can be categorized as:

- Operating CoA (For daily transactions)

- Group CoA (For consolidated reporting)

- Country-Specific CoA (For legal compliance)

Join Entri’s SAP FICO Training Course today!!

SAP FICO Interview Questions and Answer: Intermediate Level

9. How does SAP FI integrate with other SAP modules?

SAP FI integrates with:

- SAP MM: For invoice verification and inventory accounting.

- SAP SD: For revenue postings.

- SAP PP: For production cost tracking.

- SAP HR: For payroll and benefits accounting.

10. What is Automatic Payment Program (APP) in SAP?

APP is used to process bulk payments to vendors and customers efficiently by automating:

- Payment selection

- Payment scheduling

- Bank transactions

11. What is a Reconciliation Account?

A Reconciliation Account is a general ledger account that consolidates transactions from sub-ledgers like Accounts Payable and Accounts Receivable into the main GL.

Purpose:

- Ensures real-time integration between sub-ledgers and the general ledger.

- Prevents direct manual postings, maintaining data consistency.

- Helps generate accurate financial statements.

12. What is a Special GL Transaction in SAP FICO?

Special GL Transactions are used for unique accounting scenarios such as:

- Down payments

- Guarantees

- Bill of exchange processing

13. How does SAP FICO handle foreign currency transactions?

SAP FICO handles currency fluctuations using:

- Exchange Rate Types (for different valuation methods)

- Currency Translation Settings (for reporting in multiple currencies)

14. What is an Internal Order in SAP CO?

An Internal Order is a cost object used to track expenses related to specific projects or temporary activities.

Types of Internal Orders:

- Real Orders: Used for capital investments and projects that settle costs.

- Statistical Orders: Used for reporting purposes but do not settle costs.

Key Benefits:

- Helps track and control project-specific costs.

- Enables better cost monitoring for short-term initiatives.

15. What is Parallel Accounting in SAP FICO?

Parallel Accounting allows businesses to maintain multiple financial ledgers simultaneously based on different accounting principles (e.g., IFRS, GAAP, local regulations).

Methods to Implement Parallel Accounting:

- Ledger Approach: Maintains separate ledgers for different accounting standards.

- Accounts Approach: Uses different accounts for each accounting principle.

Key Benefits:

- Enables multi-standard financial reporting.

- Ensures compliance with different regulatory frameworks.

16. What is the Year-End Closing Process in SAP FICO?

Key steps include:

- Clearing open items

- Running depreciation for assets

- Carrying forward balances

- Generating financial reports

SAP FICO Interview Questions and Answer: Advanced Level

17. What are Cost Centers and Profit Centers?

| Feature | Cost Center | Profit Center |

| Purpose | Tracks department-level expenses | Tracks business unit profitability |

| Usage | Internal cost control | Revenue and profit analysis |

| Reporting | Cost-based | Profit-based |

18. What is Activity-Based Costing (ABC)?

Activity-Based Costing (ABC) assigns costs based on business activities rather than traditional cost centers, improving cost accuracy.

Key Steps:

- Identify cost-driving activities.

- Assign costs based on activity consumption.

- Allocate costs to products/services more precisely.

Advantages:

- Improves cost transparency.

- Helps eliminate non-value-added activities.

- Enhances profitability analysis.

19. What is Product Cost Controlling (PCC)?

PCC helps determine the cost of manufacturing goods by tracking:

- Material Costs

- Overhead Costs

- Work in Progress (WIP)

20. What is the significance of the Field Status Group?

Field Status Group controls field settings in financial postings, defining which fields are:

- Required

- Optional

- Hidden

21. How do you configure Tax Calculation in SAP FICO?

SAP FICO handles tax configuration using:

- Tax Codes

- Tax Procedures

- Automatic Tax Calculation Rules

22. What is the Credit Control Area?

A Credit Control Area is used to manage and monitor customer credit limits across company codes.

Key Features:

- Controls credit exposure to reduce financial risks.

- Allows classification of customers into risk categories.

- Automates credit limit checks during sales order processing.

Example: If a customer’s outstanding balance exceeds their credit limit, SAP can block new sales orders until payment is received.

23. What are the steps in SAP FICO implementation?

- Requirement gathering

- System design and configuration

- Data migration

- Testing and validation

- End-user training

- Go-live and support

24. What are the types of Depreciation in Asset Accounting?

- Ordinary Depreciation (Standard wear and tear)

- Special Depreciation (Legal requirements-based)

- Unplanned Depreciation (Unexpected loss)

Join Entri’s SAP FICO Training Course today!!

Master SAP with Expert-Led Courses

Unlock your potential with our comprehensive SAP courses! Learn essential modules like SAP MM (Materials Management), SAP SD (Sales and Distribution), and SAP FICO (Financial Accounting and Controlling) from industry experts.

Know MoreConclusion

Mastering SAP FICO is essential for finance professionals aiming to enhance business processes and ensure compliance. A few key takeaways:

- It is crucial to understand concepts like:

- company codes

- posting keys

- financial reporting structures

- Integration with other SAP modules like MM, SD, and HR enhances overall business processes.

- Real-world practice of SAP transactions will improve interview performance.

- Staying updated with financial regulations and SAP updates is vital for success.

By preparing thoroughly and practicing real-world scenarios, you can confidently tackle SAP FICO interviews and advance your career in financial and SAP consulting.

Master SAP with Expert-Led Courses

Unlock your potential with our comprehensive SAP courses! Learn essential modules like SAP MM (Materials Management), SAP SD (Sales and Distribution), and SAP FICO (Financial Accounting and Controlling) from industry experts.

Know MoreFrequently Asked Questions

What is SAP FICO used for?

SAP FICO is used to manage financial transactions, reporting, and internal accounting in organizations. It consists of Financial Accounting (FI) for external reporting and Controlling (CO) for internal cost management. Businesses use it to track financial data, generate statements, and comply with regulations. It integrates with other SAP modules like MM, SD, and HR for seamless operations. SAP FICO ensures transparency, accuracy, and efficiency in financial processes.

How does SAP FICO integrate with other SAP modules?

SAP FICO integrates with SAP MM for inventory and invoice management, SAP SD for sales and revenue tracking, and SAP HR for payroll processing. This integration ensures real-time financial updates across departments. For example, when a purchase is made in SAP MM, it automatically reflects in SAP FI as a financial transaction. Such integration reduces manual work and errors. It also improves financial control and decision-making.

What is the difference between SAP FI and SAP CO?

SAP FI focuses on external financial reporting, such as balance sheets and profit/loss statements. SAP CO deals with internal cost management, including budgeting and profitability analysis. While FI ensures compliance with accounting standards, CO helps in making cost-based business decisions. Both modules work together to provide a complete financial overview. They support businesses in maintaining financial health and efficiency.

What are some key features of SAP FI?

SAP FI includes General Ledger (GL) for financial transactions, Accounts Payable (AP) for vendor payments, and Accounts Receivable (AR) for customer invoices. It also supports Asset Accounting (AA) for managing fixed assets and Bank Accounting for tracking bank transactions. The module ensures accurate financial reporting and legal compliance. It enables businesses to generate reports required for audits and tax filing. Additionally, SAP FI supports multiple currencies and parallel accounting.

What are the main components of SAP CO?

SAP CO consists of Cost Element Accounting (CEA) to categorize costs, Cost Center Accounting (CCA) to monitor departmental expenses, and Internal Orders to track project-based costs. It also includes Profit Center Accounting (PCA) for business unit profitability and Activity-Based Costing (ABC) to allocate costs based on resource consumption. CO provides businesses with insights into their cost structure. It helps in identifying areas to reduce expenses and improve profitability. The module supports real-time cost tracking and financial planning.

What is document splitting in SAP FICO?

Document splitting allows automatic distribution of financial transactions across different segments, business areas, or profit centers. It helps in generating more detailed and structured financial statements. This feature ensures compliance with accounting regulations like IFRS and GAAP. For example, if an expense is shared between two departments, document splitting ensures accurate allocation. This enhances reporting accuracy and internal cost tracking.

What is an internal order in SAP CO?

An internal order is a temporary cost object used to track expenses related to specific activities, projects, or tasks. It helps businesses allocate costs properly and control budgets. Internal orders can be real (settle to cost objects) or statistical (used only for reporting). They provide a clear view of project-related expenses, making financial tracking more precise. At the end of the project, costs can be transferred to relevant cost centers or assets.

What is parallel accounting in SAP FICO?

Parallel accounting allows companies to maintain multiple sets of financial records based on different accounting principles, such as IFRS, US GAAP, or local standards. It ensures compliance with different financial regulations across countries. Businesses implement it using multiple ledgers or different accounts for each accounting standard. This feature is useful for multinational companies operating under various financial jurisdictions. It enables businesses to generate reports according to different regulatory frameworks.

What is the credit control area in SAP FICO?

The credit control area in SAP FICO is used to monitor and manage customer credit limits to reduce financial risk. It ensures that customers do not exceed their credit limits while making purchases. Businesses can assign credit limits based on customer risk categories. If a customer’s outstanding amount surpasses the allowed credit, SAP can block further sales orders. This helps organizations maintain healthy cash flow and minimize bad debts.

Why is SAP FICO important for finance professionals?

SAP FICO is widely used in industries for financial management, making it a valuable skill for finance professionals. It helps in maintaining accurate records, managing costs, and generating financial reports. Knowledge of SAP FICO improves job opportunities in accounting, finance, and SAP consulting. Companies prefer professionals who can efficiently handle financial transactions and compliance requirements. Mastering SAP FICO can enhance career growth and expertise in enterprise financial management.