Table of Contents

The banking industry has witnessed a massive shift over the last decade, transitioning from traditional brick-and-mortar operations to fast, convenient digital solutions. As we approach 2025, the pace of technological innovation in banking is accelerating like never before. The future of digital finance is not only about online transactions but also about intelligent automation, seamless customer experience, advanced security, and sustainable practices. In this blog, we will explore the top Banking Technology Trends in 2025 that are reshaping the digital finance ecosystem.

Prepare strategically for the Bank exam! Get Free Demo Classes Here!

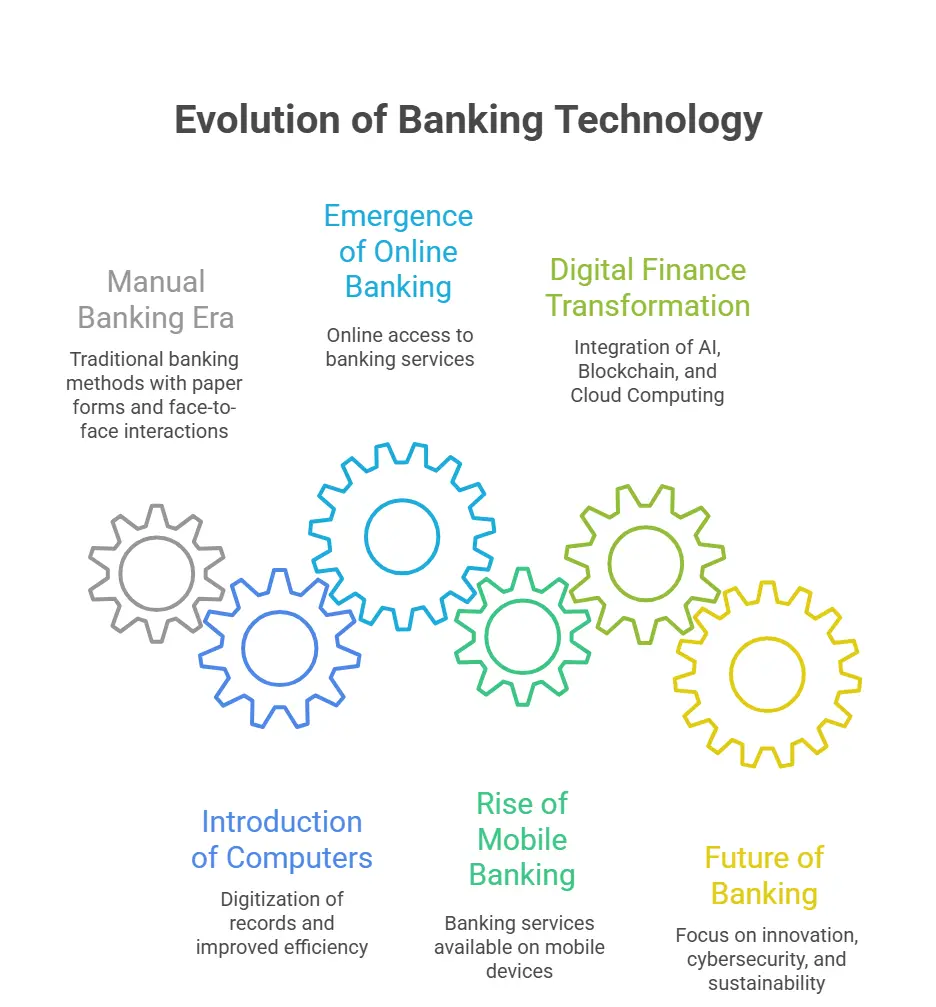

Introduction: The Evolution of Banking Technology

Banking technology has undergone a remarkable transformation over the years. In the past, banking was entirely manual—customers visited branches, filled out paper forms, and interacted face-to-face with bank staff for every transaction. Ledgers, physical cash, and manual bookkeeping were the backbone of financial services.

With the rise of computers in the late 20th century, banks began digitizing records, improving efficiency and accuracy. The early 2000s saw the emergence of online banking, allowing customers to check balances, transfer money, and pay bills from home. Mobile banking apps soon followed, making banking services accessible anytime, anywhere.

Today, the shift has accelerated towards fully digital finance. Advanced technologies such as Artificial Intelligence, Blockchain, Cloud Computing, and APIs now power the financial ecosystem. Customers expect instant payments, 24/7 support, smart insights, and personalized services, all at their fingertips.

As we approach 2025, staying ahead in banking technology is no longer optional—it’s essential. Financial institutions must continuously innovate to meet evolving customer demands, tackle cybersecurity threats, and comply with stricter regulations. The banks that adopt intelligent automation, sustainable practices, and seamless digital experiences will lead the industry into the future of finance.

AI and Machine Learning in Banking

1: What does the acronym "ATM" stand for in banking?

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the way banks operate, making services smarter, faster, and more personalized. Here’s how these technologies are reshaping digital banking:

1. Personalized Banking Experiences

Gone are the days when banking was the same for every customer. Today, AI helps banks understand individual needs by analyzing customer behavior, transaction history, and spending patterns.

For example, if you often spend on groceries and restaurants, the bank’s app can suggest cashback offers, personalized budgeting tips, or credit card options tailored just for you. These AI-driven recommendations make banking not only more helpful but also more relevant.

2. Fraud Detection & Risk Management

Security is a major concern in digital banking. Machine Learning algorithms play a key role in keeping your money safe by constantly monitoring transactions for unusual activities.

For instance, if there’s a sudden large withdrawal from your account in a location you don’t usually visit, the system detects this anomaly and flags it instantly. Some banks even send instant alerts or temporarily block suspicious transactions to prevent fraud.

Unlike traditional rule-based systems, machine learning keeps improving by learning from past data, making fraud detection faster and more accurate over time.

3. Chatbots & Virtual Assistants

Need quick help with your banking needs without waiting on hold? AI-powered chatbots and virtual assistants make customer support available 24/7.

These digital helpers answer common questions like checking account balance, transferring money, or setting up automatic payments. They use natural language processing (NLP) to understand and respond in simple, human-like language.

For more complex issues, they can route you to a human agent, but for most tasks, they provide instant solutions, saving time and effort.

BANKING MONTHLY MAGAZINE – FREE PDF

Enroll in Kerala's Top-rated Bank Coaching Program!

Are you ready to take your banking career aspirations to new heights? Join Entri App's Bank Exam Coaching program to kickstart your preparations!

Join Now!Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are powerful innovations that are revolutionizing the way banks manage transactions and data. These technologies offer more security, transparency, and efficiency in banking operations, making them a key part of the digital finance future.

🟧Secure & Transparent Transactions

- Traditional banking transactions often involve multiple intermediaries, which can slow down processes and increase the risk of errors or fraud. Blockchain changes this by using a decentralized ledger—a digital record that is shared across many computers, or “nodes.”

- Every transaction is recorded in a block and linked to the previous one, forming a secure chain of information that cannot be altered or deleted. This makes every transaction transparent and traceable.

- For example, when transferring money between countries, blockchain reduces processing time from several days to just a few minutes, while also lowering fees. Both banks and customers can easily verify transactions in real-time, ensuring full transparency.

- Because the data is stored in multiple locations and secured with encryption, it becomes nearly impossible for hackers to manipulate the system, which greatly reduces fraud and errors.

🟧Smart Contracts

- Smart contracts are self-executing digital agreements programmed on a blockchain. They automatically carry out specific actions when pre-set conditions are met, removing the need for manual processing or intermediaries.

- For instance, if a customer applies for a loan, a smart contract can automatically release funds once their identity is verified and all required documents are submitted. Similarly, insurance companies can use smart contracts to automatically process claims when the conditions are satisfied, speeding up payouts and reducing paperwork.

- This automation helps banks operate faster, reduces human errors, lowers operational costs, and provides customers with quicker and more reliable services.

🟧Decentralized Finance (DeFi)

- Decentralized Finance, or DeFi, is an emerging system where financial services—like loans, savings, and asset trading—are provided through decentralized platforms built on blockchain.

- Unlike traditional banking, which relies on central authorities (banks or financial institutions), DeFi platforms use smart contracts and open-source code to offer financial services directly to consumers.

- This creates exciting opportunities, especially for people who don’t have access to traditional banks. Anyone with an internet connection can participate in DeFi services, opening the door to financial inclusion.

- Moreover, DeFi eliminates many fees and delays associated with traditional systems, allowing instant peer-to-peer transactions and innovative products like yield farming or decentralized lending platforms.

Digital Payments and Fintech Innovations

Digital payments and fintech innovations are transforming the way we handle money. Gone are the days when carrying cash or writing checks was the norm. In 2025, faster, safer, and more convenient payment solutions are taking over, making transactions easier than ever before.

1. Contactless Payments & Mobile Wallets

🔶The Rise of Contactless Payments

Contactless payments have become increasingly popular, especially after the COVID-19 pandemic accelerated the need for safer, touch-free transactions. Instead of inserting a card or entering a PIN, customers can now simply tap their card or smartphone against a payment terminal.

🔶Mobile Wallets Are Everywhere

Apps like Google Pay, Apple Pay, and Samsung Pay let you store your debit or credit cards in your phone. In 2025, mobile wallets are expected to become the preferred method of payment, especially for small, everyday purchases like coffee, groceries, or public transport. These wallets not only speed up the checkout process but also keep your payment details secure through tokenization, replacing sensitive data with unique codes.

2. Cross-Border Payment Solutions

🔶Traditional vs. Modern Methods

Sending money abroad used to be slow and expensive, often taking several days and charging high fees. Traditional banks required multiple intermediaries, increasing both time and costs.

🔶Blockchain-Based Solutions

Today, fintech companies use blockchain technology to streamline cross-border payments. Solutions like Ripple and Stellar allow near-instant transactions at a fraction of the cost.

🔶Benefits for Individuals and Businesses

Whether you’re sending remittances to family in another country or paying an overseas supplier, these new solutions offer speed, affordability, and transparency. In 2025, cross-border payments are expected to become faster, cheaper, and more widely used, helping people and businesses connect globally with ease.

3. Buy Now, Pay Later (BNPL)

🔶What Is BNPL?

Buy Now, Pay Later is a service that lets customers purchase goods and pay for them over time in easy installments, often without interest. Instead of paying the full amount upfront or using a credit card, consumers can split payments into small, manageable chunks.

🔶Why Is It Popular?

This option has become extremely popular, especially among younger generations, because it offers flexibility and avoids the high-interest rates associated with traditional credit cards.

🔶How It Works

At checkout, shoppers select BNPL as a payment option. After a quick approval process, they can complete the purchase and pay later in weekly or monthly installments.

🔶Impact on Consumer Behavior

BNPL is changing how people shop. It encourages more spending while making purchases feel more affordable and less stressful. In 2025, more retailers and online stores are expected to offer BNPL options, making it a mainstream way to pay.

Cloud Computing in Banking

Cloud computing is rapidly changing the banking industry by providing flexible, efficient, and cost-effective solutions. As banks move away from traditional on-premise systems, cloud technology helps them deliver faster services, manage data securely, and adapt to changing customer needs. Here’s a closer look at the main benefits of cloud computing in banking.

1. Core Banking Modernization – Cloud-Based Banking Systems

Traditional core banking systems are often outdated, slow, and expensive to maintain. These systems require a lot of hardware, software updates, and manual effort, which makes innovation difficult. With cloud computing, banks can modernize their core systems by moving them to the cloud. Cloud-based core banking systems allow banks to manage customer accounts, process transactions, and handle deposits in a faster, more efficient way.

This modernization means banks can quickly launch new digital products and services, like instant loans or personalized savings accounts, without the need for expensive infrastructure upgrades. It makes banking smoother and more responsive to customer demands.

2. Scalability & Flexibility – Supporting Digital Transformation

One of the biggest advantages of cloud computing is scalability. As the number of customers and transactions grows, banks can easily scale their cloud resources up or down based on demand. For example, during peak times such as salary days or festive seasons, the cloud provides extra computing power to handle high transaction volumes without slowing down services.

Flexibility is another major benefit. Banks no longer need to invest heavily in physical data centers or worry about hardware failures. Instead, they can focus on improving digital banking apps, integrating APIs, or offering advanced analytics, knowing the cloud will support these changes seamlessly. This flexibility helps banks stay agile in a fast-changing market and keeps costs predictable, as they pay only for the resources they use.

3. Enhanced Security & Data Compliance – Managing Sensitive Financial Data

Banks deal with highly sensitive data, such as customer personal information and financial transactions. Cloud providers offer advanced security features like multi-layered encryption, intrusion detection systems, and continuous monitoring.

Moreover, major cloud providers have data centers located in different regions, helping banks meet local data residency requirements and regulatory standards such as GDPR or RBI guidelines. Cloud systems also support automated backups and disaster recovery, ensuring that customer data is safe and accessible even in case of system failures. Regular security updates and patches are automatically applied by cloud providers, reducing the risk of vulnerabilities and freeing banks from complex manual maintenance.

Enroll in Kerala's Top-rated Bank Coaching Program!

Are you ready to take your banking career aspirations to new heights? Join Entri App's Bank Exam Coaching program to kickstart your preparations!

Join Now!Cybersecurity in Digital Finance

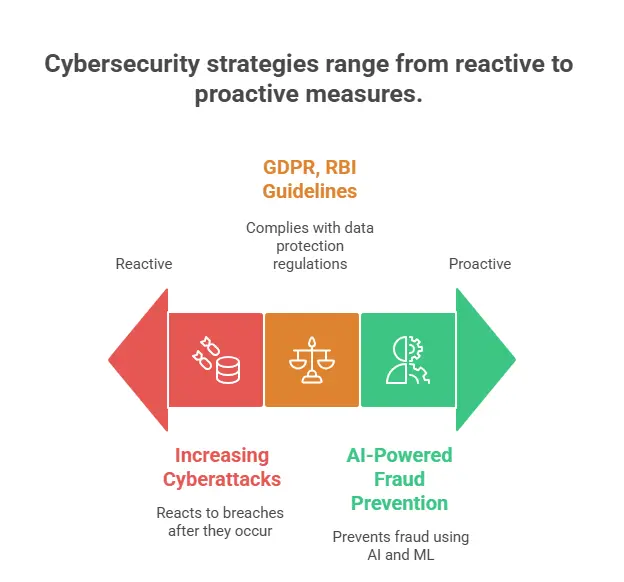

As banking becomes more digital, protecting financial data and transactions has never been more important. Cybersecurity in digital finance is a top priority for banks, fintech companies, and customers alike. Every day, the number and sophistication of cyberattacks increase, making it critical to stay ahead with strong security solutions and compliance measures.

1. Emerging Threats & Challenges – Increasing Cyberattacks

With more people using online banking, mobile apps, and digital payment methods, the number of cyber threats is growing rapidly. Hackers use advanced methods like phishing, ransomware, malware, and man-in-the-middle attacks to target bank systems and customer accounts.

Phishing emails trick customers into giving away their login details, while ransomware locks banks’ systems until a ransom is paid. In some cases, hackers exploit software vulnerabilities or weak passwords to gain access to sensitive financial data.

The biggest challenge is that cyberattacks are becoming more sophisticated. Attackers use machine learning and automation to scan thousands of potential targets in seconds, increasing the risk of data breaches. For customers, this means potential risks to their personal and financial information. For banks, a single breach can damage their reputation, result in financial loss, and lead to strict penalties from regulators.

2. Next-Gen Security Solutions – AI-Powered Fraud Prevention

To fight these threats, banks and fintech companies are turning to next-generation security solutions powered by Artificial Intelligence (AI) and Machine Learning (ML). These technologies analyze millions of transactions in real time to detect unusual patterns that may indicate fraud. For example, if a customer’s card is suddenly used in a foreign country or for an unusually large purchase, AI systems flag it as suspicious. The system can then automatically block the transaction or alert the customer for verification.

AI-based solutions don’t just detect fraud—they learn from every transaction. The more they analyze, the smarter they become at spotting new and evolving threats. Another advanced solution is behavioral biometrics, which monitors how a customer types, swipes, or holds their phone. If the behavior doesn’t match the customer’s usual pattern, additional authentication steps may be required. These smart solutions help prevent fraud before it happens, reduce false alarms, and improve the overall security experience for customers.

3. Regulatory Compliance – GDPR, RBI Guidelines, and More

In addition to strong security measures, banks must also follow strict regulations to protect customer data and privacy. Regulations like the General Data Protection Regulation (GDPR) in Europe and RBI (Reserve Bank of India) guidelines in India set clear rules about how financial institutions must handle personal and financial data. These regulations require banks to store customer data securely, obtain consent before processing personal information, and provide easy ways for customers to access or delete their data.

For example, under GDPR, customers have the right to know what data a bank holds about them and can request that their data be deleted at any time. Banks also need to perform regular security audits, report any data breaches to authorities, and maintain strict records of how data is processed and stored. Failing to comply with these regulations can result in heavy fines and loss of customer trust.

Open Banking and API Ecosystems

Open Banking and API ecosystems are transforming the financial world by making banking services more connected, innovative, and customer-friendly. At the heart of this transformation is the idea that banks no longer need to do everything themselves. Instead, they can share their infrastructure securely with third-party developers through APIs (Application Programming Interfaces). This creates a powerful ecosystem where new financial services can be built faster and more flexibly.

🔷Banking as a Service (BaaS) – Expanding Banking Services through APIs

Banking as a Service (BaaS) allows fintech companies and other third-party providers to access a bank’s infrastructure via APIs. This means that instead of building everything from scratch, a fintech startup can offer services like payments, loans, or account management by tapping into a bank’s existing systems.

For example, a small fintech app can let customers open a bank account or transfer money without needing to become a licensed bank itself. This makes it much easier for innovative financial products to reach customers, speeding up the digital transformation of the industry.

🔷Data Sharing & Collaboration – Benefits for Consumers and Fintechs

Open Banking encourages banks to securely share customer financial data (with consent) with third-party providers. This allows fintech companies to develop tools that help customers manage their finances more effectively.

For example, personal finance apps can aggregate data from multiple bank accounts, giving customers a complete picture of their spending habits. With smarter insights and tailored recommendations, customers can better manage their budgets, save more, or choose the right financial products for their needs. This collaborative approach benefits both consumers and fintechs, as it drives innovation and competition in the market while offering customers more choice and better services.

🔷Innovation in Customer Services – Third-Party Financial Services Integration

Open Banking fosters innovation by integrating third-party solutions directly into the banking experience. Rather than using separate apps for different services, customers can now enjoy a unified platform where everything is connected.

For instance, a banking app might integrate investment advisory services, insurance products, or personalized loan offers, all powered by APIs from third-party providers. This creates a seamless, one-stop financial ecosystem that is easy to use and highly personalized.

Internet of Things (IoT) in Banking

The Internet of Things (IoT) is revolutionizing the banking industry by connecting physical devices to the internet and enabling real-time data exchange. In 2025, IoT plays a major role in making banking smarter, faster, and more convenient, improving customer experience and operational efficiency.

1. Smart ATMs & Branch Automation

Traditional ATMs and bank branches are being upgraded with IoT technology to offer more advanced services. Smart ATMs are equipped with sensors and connected devices that monitor their performance, detect maintenance needs, and even improve security.

For example, IoT sensors can detect when cash levels are low or when a component is malfunctioning. This information is automatically sent to the bank’s central system, helping service teams fix problems before customers are affected.

Similarly, branch automation uses IoT devices to monitor customer flow, temperature, lighting, and security systems. This not only improves energy efficiency but also enhances customer experience by reducing wait times and ensuring the branch environment is comfortable and secure. With IoT, banks can shift from reactive maintenance to predictive maintenance, cutting costs and improving uptime.

2. IoT-Enabled Payments – Wearables and Connected Devices

IoT is changing the way we make payments. Instead of carrying cash or cards, customers can now use wearables like smartwatches, fitness bands, or even connected rings to make quick and secure payments.

For example, when you want to pay at a store, you simply tap your smartwatch on the payment terminal. Behind the scenes, the device communicates securely with your bank account using tokenization, which keeps your sensitive card information private and safe.

Connected devices such as smart refrigerators, cars, or home assistants are also starting to enable payments. Imagine your fridge automatically ordering groceries when supplies run low and paying for them directly through an IoT payment system. These connected payments are fast, convenient, and reduce the need for physical interaction, which is especially important in today’s contactless economy.

3. Risk Monitoring & Asset Management

IoT plays a crucial role in risk monitoring and asset management for banks and their customers. For example, when banks offer loans backed by physical assets like vehicles or industrial machinery, IoT sensors can track the asset’s real-time condition, location, and usage. If a car used as collateral is involved in suspicious activity or not being used as expected, the bank can be notified instantly. This helps banks manage risks more effectively and take preventive actions if necessary.

Additionally, IoT devices can monitor environmental factors such as temperature and humidity for assets that require special care, like valuable documents or sensitive equipment. Any deviation from safe conditions triggers an automatic alert, reducing the risk of damage or loss.

Prepare systematically for Banking Exam! Get Free Demo Here!

Voice and Biometric Banking

As digital banking evolves, customers are seeking faster, easier, and more secure ways to access their financial services. Voice and biometric technologies are emerging as key tools that not only enhance security but also make banking more convenient and personal.

🔶Voice Authentication – Secure Banking via Voice Commands

Voice authentication is one of the most user-friendly and secure ways to access banking services. Instead of typing passwords or using PINs, customers can simply speak to their banking app or virtual assistant to perform tasks such as checking account balances, transferring funds, or paying bills. What makes voice authentication secure is its use of advanced voice recognition technology that analyzes unique features of a person’s voice, such as tone, pitch, and speech patterns. These features are difficult to replicate, making it harder for hackers to gain unauthorized access.

For example, when you say “Check my account balance,” the system recognizes your voice and verifies it against your stored voice profile before providing the information. This hands-free method is especially useful for people on the go, visually impaired users, or customers who prefer quick interactions without typing.

🔶Biometric Verification – Fingerprints, Facial Recognition, Retina Scans

Biometric verification is already a common feature in many smartphones, and banks are integrating it into their systems to enhance security. Fingerprint scanning, facial recognition, and retina scans are now widely used to authenticate users quickly and securely.

For instance, when you open your banking app, you can simply scan your fingerprint or look at your phone’s camera for facial recognition instead of entering a password. These methods are fast, convenient, and provide a high level of security because biometric data is unique to each individual.

Unlike passwords, which can be stolen or guessed, biometric data is nearly impossible to fake. Retina scans offer even higher accuracy by analyzing patterns in the eye, making them ideal for highly secure transactions. Biometric verification is used not just for login but also for authorizing high-value transactions or changes to account settings, adding an extra layer of security.

🔶Enhanced Customer Experience – Convenience and Security

Combining voice and biometric technologies makes banking smoother and safer for customers. There’s no need to remember complicated passwords or carry physical tokens. Instead, customers can access accounts and authorize transactions quickly using their voice or fingerprint.

This enhances the overall banking experience by making it more personal, efficient, and secure. Whether it’s a quick balance check during a busy day or a secure fund transfer from a wearable device, customers enjoy seamless interactions with their banks. Moreover, banks benefit from lower fraud rates and fewer support calls related to password resets or account recovery, making operations more efficient.

Green & Sustainable Banking Technology

As the world focuses more on sustainability and protecting the environment, the banking industry is also shifting towards greener practices. Green and sustainable banking technology helps reduce the environmental impact of financial services while supporting eco-friendly investments and regulatory compliance. Here’s how technology is making banking more sustainable in 2025.

1. Eco-Friendly Digital Solutions – Paperless Banking and Green Fintech

One of the simplest yet most effective steps toward sustainability is reducing paper usage. Today, banks are moving toward fully paperless operations by offering digital account statements, online loan applications, and e-receipts.

- Instead of printing physical documents, customers can view and download statements, agreements, and transaction records from mobile apps or websites. This not only reduces paper waste but also speeds up processes and improves convenience.

- Green fintech companies are also developing apps and platforms that help customers track their carbon footprint. For example, some apps analyze spending habits and show how purchases contribute to carbon emissions, helping users make eco-conscious decisions.

- By integrating eco-friendly solutions into daily banking services, financial institutions are reducing their carbon footprint while promoting digital-first habits among customers.

2. Sustainable Investments – Tech-Driven ESG Solutions

Sustainable investing is gaining huge popularity as more people want their money to contribute to environmental and social good. Banks and fintech platforms are now using technology to help customers invest in ESG (Environmental, Social, Governance)-focused funds.

- AI-powered investment platforms analyze companies based on ESG criteria and automatically suggest sustainable investment portfolios that align with a customer’s financial goals and values.

- For example, a customer interested in green energy can invest in renewable energy projects or sustainable startups directly from their banking app. This tech-driven approach makes sustainable investing easier, more accessible, and more transparent for everyone.

- In 2025, banks will continue expanding their ESG product offerings, powered by advanced data analysis tools that help assess and track the sustainability impact of investments in real time.

3. Regulatory Push for Sustainability – How Tech Aids Compliance

Governments and regulators around the world are increasingly demanding that banks take responsibility for sustainability. Regulations such as the EU Sustainable Finance Disclosure Regulation (SFDR) or India’s ESG reporting requirements push financial institutions to disclose their environmental impact and ensure sustainable practices.

- Technology helps banks meet these requirements by automating ESG reporting and tracking. Cloud-based solutions collect and store data from across the organization and generate real-time reports that show how the bank performs against sustainability benchmarks.

- IoT devices, for example, help monitor energy usage in bank branches, while data analytics platforms track the environmental impact of investment portfolios.

- By using technology, banks can stay compliant without manual effort, ensuring transparency and reducing the risk of penalties.

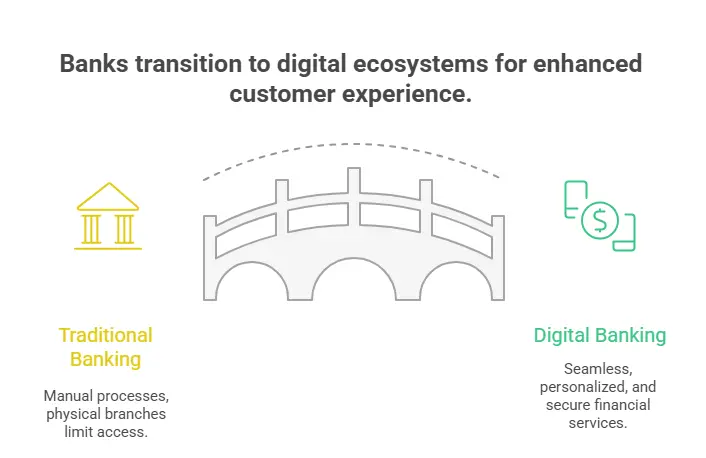

Future Outlook: Banking in 2030

As we approach 2030, the banking industry is expected to undergo a major transformation, moving toward fully digital, highly automated, and customer-centered ecosystems. The future of banking will no longer rely on physical branches or manual processes. Instead, advanced technologies will drive faster, smarter, and more secure financial services, offering customers a seamless and personalized banking experience.

🟫Predictions on Fully Digital Banks

By 2030, many banks are predicted to operate entirely in the digital space, with few or no physical branches. These fully digital banks, often called “neobanks,” will provide all services through mobile apps, websites, or voice-based assistants. Customers will be able to open accounts instantly, apply for loans within minutes, and access financial advice powered by AI—all from their smartphones or wearables. No more waiting in long queues or filling out paperwork.

AI algorithms will anticipate individual needs by analyzing spending habits, offering personalized financial products automatically. This shift will make banking faster, more convenient, and much more customer-friendly, especially for younger generations who prefer digital-first interactions.

🟫Role of Emerging Technologies like Quantum Computing

Quantum computing is one of the most exciting technologies on the horizon for the financial industry. Unlike classical computers, quantum computers can process huge volumes of data and solve complex problems in seconds.

By 2030, banks will likely use quantum computing for tasks like risk analysis, fraud detection, and portfolio optimization. For example, quantum algorithms could analyze thousands of market variables in real time, providing better investment advice or identifying financial threats before they happen. This power will help banks manage vast amounts of data securely and perform advanced simulations that were previously impossible. Quantum computing will push the boundaries of efficiency, security, and decision-making in digital finance.

🟫How Consumers and Banks Adapt to Exploring Career Opportunities in Banking and FinanceThese Changes

For consumers, the future of banking means more convenience, speed, and personalization. With digital wallets, voice banking, biometric authentication, and AI-driven financial assistants, managing money will be as easy as talking to your phone or smartwatch. However, as these technologies advance, consumers will also need to become more tech-savvy. They will need to understand digital security basics, such as using strong biometric authentication and recognizing safe digital platforms.

Banks, on the other hand, will shift their focus from owning physical infrastructure to managing digital ecosystems. They will invest more in cloud computing, cybersecurity, data privacy, and partnerships with fintech startups. The role of human bank employees will also evolve. Instead of handling routine tasks, employees will focus on providing expert financial advice, solving complex problems, and guiding customers through technology-driven services.

Conclusion

As we advance into the digital era, technologies like AI, blockchain, cloud computing, IoT, and sustainable banking are reshaping finance. These innovations make banking faster, safer, and more customer-friendly while promoting eco-friendly practices and global transactions. Open banking drives collaboration, offering more choices and boosting fintech innovation. Banks must embrace digital transformation to stay competitive, improve security, and cut costs. Meanwhile, consumers should adopt digital tools for easier, safer financial management. Together, they can create a smarter, sustainable, and efficient financial future.

Prepare systematically for Bank Exam! Get Free Demo Here!

Enroll in Kerala's Top-rated Bank Coaching Program!

Are you ready to take your banking career aspirations to new heights? Join Entri App's Bank Exam Coaching program to kickstart your preparations!

Join Now!Frequently Asked Questions

What is driving the shift towards digital banking in 2025?

The shift is driven by customer demand for convenience, faster transactions, improved security, and personalized services. Emerging technologies like AI, blockchain, IoT, and cloud computing are key enablers of this transformation.

How does AI improve banking services?

AI enhances banking by providing personalized recommendations, automating customer support with chatbots, detecting fraud in real time, and analyzing large data sets to offer smarter financial insights.

What role does blockchain play in digital finance?

Blockchain enables secure, transparent, and tamper-proof transactions. It reduces fraud and errors, automates contracts through smart contracts, and supports decentralized finance (DeFi) services.

How does IoT benefit banking customers?

IoT connects devices like smart ATMs, wearables, and connected appliances to banking systems, enabling contactless payments, real-time asset monitoring, automated maintenance, and improved customer convenience.

Why is sustainability important in modern banking technology?

Sustainable banking reduces environmental impact through paperless solutions, eco-friendly fintech apps, and ESG-driven investments. It helps banks comply with regulations while promoting responsible financial practices for a greener future.