Table of Contents

The Kerala Bank Assistant Manager Syllabus 2023-2024 is officially announced. In this blog, we provide Kerala Bank Assistant Manager Syllabus 2023-2024 which covers a wide range of topics. Applicants should familiarize themselves with the exam pattern and weightage of each section to create a well-rounded study plan. Additionally, practicing previous years’ question papers and taking mock tests is essential for exam readiness. A strong grasp of these subjects is vital for those aiming to secure the role of Assistant Manager in the prestigious Kerala Bank.

KERALA BANK ASSISTANT MANAGR COACHING – GET A FREE DEMO

Kerala Bank Assistant Manager Syllabus 2023 Highlight

| Name of the Authority | Kerala Public Service Commission (PSC) |

| Name of the Bank | Kerala Bank |

| Post Name | Assistant Manager |

| Total No of Vacancies (society+general) |

200 |

| Application Mode | Online |

| Exam Type | Written Examination |

| Scale {Per Month} | Rs. 24,060 – 69,610 |

| Online Apply Start | 30 October 2023 |

| Online Apply Last Date | 29 November 2023 |

| Exam date | Prelims: April-June (Tentative) Mains: August-October (Tentative) |

| Admit Card | Yet Not Published |

| Official Website | keralapsc.gov.in |

Ace your preparation for Kerala bank assistant manager Exam! Get Free Demo Here!

Kerala Bank Assistant Manager Exam Syllabus 2023 PDF Released

Candidates who are applied for Kerala Bank Kerala Assistant Manager Exam can get the syllabus from here. Without having knowledge of the Kerala CSEB Syllabus 2023 Exam, individuals cannot clearly crack the written examination. In this section, we provide the topic wise Syllabus for Assistant Manager Exam 2023. Also, begin your preparation now itself as there is a huge syllabus to cover for the exam.

Kerala Bank Assistant Manager Exam Syllabus 2023-2024

Kerala Bank Assistant Manager selection process consists of two stages of written exam – prelims and Mains. The syllabus for both prelims and mains are officially announced by Kerala PSC. Check out exam pattern and detailed syllabus below.

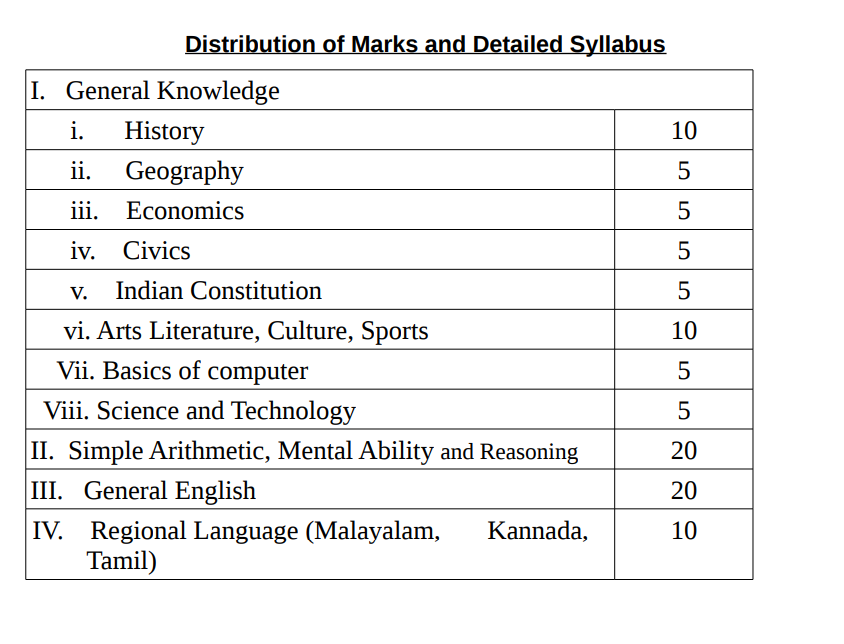

Kerala Bank Assistant Manager Prelims Syllabus 2023-2024

Kerala Bank Assistant Manager Prelims Exam Pattern 2023-2024

DETAILED SYLLABUS FOR DEGREE LEVEL COMMON PRELIMINARY EXAMINATION

HISTORY

1. KERALA – Arrival of Europeans-Contributions of Europeans- History of Travancore from Marthanda Varma to Sree Chithirathirunnal- Social and Religious Reform movement- National movement in Kerala- Literary Sources of Kerala History- United Kerala Movement- Political and Social History of Kerala after 1956.

2. INDIA – Medieval India – Political History-Administrative reforms- Contributions – Establishment of the British- First War of Independence – Formation of INC- Swadeshi Movement- Social Reform movement- Newspapers – Literature and Art during the freedom struggle –Independent Movement & Mahatma Gandhi- Extremist Movement in India – India’s independent- Post independent period-State reorganization – Development in Science, Education, and Technology – Foreign policy- Political History after 1951.

3. WORLD – Great revolution in England- American War of Independence – French revolution- Russian Revolution – Chinese revolution- Political History after second World war- UNO and other International Organization

+ CURRENT AFFAIRS related to relevant topic

GEOGRAPHY

1. Basics of Geography – Earth Structure – Atmosphere –Rocks – Landforms- Pressure Belt and Winds- Temperature and Seasons- Global Issues- Global warming- various forms of Pollutions – Maps- Topographic Maps and Signs – Remote Sensing

– Geographic Information System-Oceans and its various movements – Continents – World Nations and its specific features.

2. INDIA – Physiography- States and Its features- Northern Mountain Region – Rivers- Northern Great Plain – Peninsular Plateau- Costal Plain – Climate – Natural Vegetation- Agriculture – Minerals and Industries- Energy Sources- Transport system

– Road- Water- Railway- Air.

3. Kerala- – Physiography- Districts and Its features- Rivers- Climate – Natural Vegetation- Wild life- Agriculture and research centers – Minerals and Industries- Energy Sources- Transport system – Road- Water- Railway- Air.

+ CURRENT AFFAIRS related to relevant topic

ECONOMICS

National Income – Per Capita Income – Factors of Production- Economic Sectors of Production – Indian Economic Planning- Five Year Plans- NITI Aayog – Types and Functions of Economic Institutions – Reserve Bank & Functions – Public revenue – Tax and Non Tax revenue – Public Expenditure – Budget – Fiscal Policy – Consumer Protection & Rights

+ CURRENT AFFAIRS related to relevant topic

CIVICS

Public Administration – Bureaucracy –Features and Function – Indian Civil Service – State Civil Service – E_Governance – Information Commission and Right to information Act – Lokpal & Lokayuktha – Government – Executive, Judiciary, Legislature. Election – Political Parties. Human Rights – Human Rights Organizations. Act and Rules regarding Consumer Protection, Watershed Management – Labour and Employment, National Rural Employment Policies, Land Reforms, Protection of women, Children, and Old age People, Social Welfare, Social Security. Socio-Economic Statistical Data.

+ CURRENT AFFAIRS related to relevant topic

INDIAN CONSTITUTION

Constituent Assembly – Preamble – Fundamental Rights – Directive principles – Fundamental Duties – Citizenship – Constitutional Amendments – Panchayath Raj – Constitutional Institutions and their Functions – Emergency- Union List- State List – Concurrent List

+ CURRENT AFFAIRS related to relevant topic

ARTS, SPORTS & LITERATURE

കല

കേരളത്തിലെല പ്രധാന ദൃശ്യ-ശ്രാവ്യകലകള് ivayude ഉദ്ഭവം, വ്യാപനം, പരിശീലനം എന്നിവകൊണ്ട്

– പ്രശ്സ്തമായ സ്ഥലങ്ങള്

– പ്രശ്സ്തമായ സ്ഥാപനങ്ങള്

– പ്രശ്സ്തരായ വ്യക്തിലകള്

– പ്രശ്സ്തരായ കലാകാരന്മാര്

– പ്രശ്സ്തരായ എഴുത്തുകാര്

കായികം

1. കായികരംഗത്ത് വ്യക്തിലമുദ്രപതിലപ്പിലച്ച കേരളത്തിന്റെയും ഇടയിടേയും ലോകത്തിന്റെയും പ്രധാന കായിലകതാരങ്ങള്,

2. പ്രധാന അവാർഡുകൾ – അവാർഡ് ജേതാക്കൾ

3. പ്രധാന ട്രോഫികൾ – ബന്ധപ്പെട്ട മത്സരങ്ങൾ/ കായിക ഇനങ്ങൾ

4. പ്രധാന കായിക ഇനങ്ങള് – പങ്കെടുക്കുന്ന കായിക താരങ്ങൾ

5. കാലികള്ക്കുമായി ബന്ധപ്പെട്ട പ്രധാന പദങ്ങള് (Terms)

6. ഒളിമ്പിക്സ്

-അടിസ്ഥാന വിവരങ്ങൾ

– പ്രധാന വേദികൾ / രാജ്യങ്ങൾ

– പ്രശ്സ്തമായ vijayangal / കായിക താരങ്ങള്

വിന്റർ ഒളിമ്പിക്സ്

– പാരഒളിമ്പിക്സ്

7. ഏഷ്യൻ ഗെയിമിംസ് , ആഫ്രോ ഏഷ്യൻ ഗെയിമിംസ് , കോമൺവെൽത് ഗെയിമിംസ്, സാഫ് ഗെയിമിംസ്

-വേദികൾ

– രാജ്യങ്ങൾ

– ഇന്ത്യയുടെ ശ്രേദ്ധേയ പ്രകടനങ്ങൾ

– ഇതര വസ്തുതകൾ

8. ദേശിയ ഗെയിമിംസ് (National Games)

9. ഗെയിമിംസ് ഇനങ്ങള് – മത്സരങ്ങൾ

– താരങ്ങള്, നേട്ടങ്ങള്

10. ഒരോ രാജ്യത്തിന്റെയും ദേശിയ കായിക ഇനങ്ങൾ / വിനോദങ്ങൾ

സാഹിത്യം

1. മലയാളത്തിലെല പ്രധാന സാഹിത്യ പ്രസ്ഥാനങ്ങള് – ആദ്യ കൃതികൾ, കര്ത്താക്കള്

2. ഓരോ പ്രസ്ഥാനത്തിന്റെയും പ്രധാന കൃതികൾ കർത്താക്കൾ

3. എഴുത്തുകാര് – തൂലിക നാമങ്ങൾ, അപരനാമങ്ങള്

4. കഥാപാത്രങ്ങൾ-കൃതികൾ

പ്രശസ്തമായ വരികൾ – കൃതികൾ – എഴുത്തുകാർ

മലയാള പത്ര പ്രവർത്തനത്തിന്റെ ആരംഭം, തുടക്കം കുറിച്ചവർ, ആനുകാലികങ്ങൾ

പ്രധാനപ്പെട്ട അവാർഡുകൾ / ബഹുമതികൾ

അവാർഡിന് അർഹരായ എഴുത്തുകാർ

കൃതികൾ

ജ്ഞാനപീഠം നേടിയ മലയാളികൾ – അനുബന്ധ വസ്തുതകൾ

മലയാള സിനിമയുടെ ഉദ്ധഭവം, വളർച്ച, നാഴികക്കല്ലുകൾ, പ്രധാന സംഭാവന നൽകിയവർ, മലയാള സിനിമയും ദേശിയ അവാർഡും.

സംസ്കാരം

കേരളത്തിലെ പ്രധാന ആഘോഷങ്ങൾ, ആഘോഷങ്ങളുമായി ബന്ധപ്പെട്ട സ്ഥലങ്ങൾ പ്രശസ്തമായ ഉത്സവങ്ങൾ

കേരളത്തിലെ സാംസ്കാരിക കേന്ദ്രങ്ങൾ, ആരാധനാലയങ്ങൾ, സാംസ്കാരിക നായകർ, അവരുടെ സംഭാവനകൾ

+ CURRENT AFFAIRS related to relevant topic

COMPUTER SCIENCE

Basics of Computer

• Hardware

o Input Devices (Names and uses)

o Output Devices (Names and uses/features)

o Memory devices – Primary and Secondary (Examples, Features)

• Software

o Classification – System software and Application software

o Operating System – Functions and examples

o Popular Application software packages – Word processors, Spreadsheets, Database packages, Presentation, Image editors (Uses, features and fundamental concepts of each)

o Basics of programming – Types of instructions (Input, Output, Store, Control transfer) (Languages need not be considered)

• Computer Networks

o Types of networks – LAN, WAN, MAN (Features and application area)

o Network Devices – Media, Switch, Hub, Router, Bridge, Gateway (Uses of each)

• Internet

o Services – WWW, E-mail, Search engines (Examples and purposes)

o Social Media (Examples and features)

o Web Designing – Browser, HTML (Basics only)

• Cyber Crimes and Cyber Laws

o Types of crimes (Awareness level)

o IT Act and Other laws (Awareness level)

+CURRENT AFFAIRS related to relevant topic

SCIENCE AND TECHNOLOGY

1. Science and Technology: Nature and scope of Science and Technology, Relevance of S&T, National policy on S&T and innovations, Basics of everyday science, Human body, Public Health and Community Medicine, Food and Nutrition, Health Care. Institutes and Organization in India promoting integration of S&T and Innovation, their activities and contributions, Contribution of Prominent Indian Scientists.

2) Technology in Space and Defence: Evolution of Indian Space Programme, ISRO – it’s activities and achievements, various Satellite Programmes – DRDO-vision, mission and activities.

3) Energy requirement and efficiency: India’s existing energy needs and deficit, India’s energy resources and dependence, Renewable and Non-renewable energy resources, Energy Policy of India – Govt. Policies and Programmes, Energy Security and Nuclear Policy of India.

4) Environmental Science : Issues and concerns related to environment, its legal aspects, policies and treaties for the protection of environment at the National and the International level, Environment protection for sustainable development.

Biodiversity – its importance and concerns, Climate change, International initiatives (Policies, Protocols) and India’s commitment, Western Ghats, Features, Characteristics and issues. Forest and wildlife – Legal framework for Forest and Wildlife Conservation in India. Environmental Hazards, Pollution, Carbon Emission, Global Warming.

Developments in Biotechnology, Green Technology and Nanotechnology.

+ Current Affairs

GENERAL ENGLISH

A. English Grammar

1. Types of Sentences and Interchange of Sentences.

2. Different Parts of Speech.

3. Agreement of Verb and Subject.

4. Confusion of Adjectives and Adverbs.

5 Comparison of Adjectives

6. Adverbs and Position of adverbs

7. Articles – The Definite and the Indefinite Articles.

8. Uses of Primary and Model Auxiliary Verbs

9. Tag Questions

10. Infinitive and Gerunds

11. Tenses

12. Tenses in Conditional Sentences

13. Prepositions

14. The Use of Correlatives

15. Direct and Indirect Speech

16. Active and Passive voice

17. Correction of Sentences

B. Vocabulary

1. Singular & Plural, Change of Gender, Collective Nouns

2. Word formation from other words and use of prefix or suffix

3. Compound words

4. Synonyms

5. Antonyms

6. Phrasal Verbs

7. Foreign Words and Phrases

8. One Word Substitutes

9. Words often confused

10. Spelling Test

11. Idioms and their Meanings

12. Translation of a sentence/ proverb in to Malayalam

Kannada

1) Word Purity / Correct Word

2) Correct Sentence

3) Translation

4) One Word / Single Word / One Word Substitution

5) Synonyms

6) Antonyms

7) Idioms and Proverbs

8) Equivalent Word

9) Join the Word

10) Feminine Gender, Masculine Gender

11) Number

12) Sort and Write

Tamil

1) Correct Word

2) Correct Structure of Sentence

3) Translation

4) Single Word

5) Synonyms

6) Antonyms / Opposite

7) Phrases and Proverbs

8) Equal Word

9) Join the Word

10) Gender Classification – Feminine, Masculine

11) Singular, Plural

12) Separate

13) Adding Phrases

Kerala Bank Assistant Manager Mains Syllabus 2023-2024

Kerala Bank Assistant Manager Exam Pattern and Detailed Syllabus

| I. General Knowledge | |

| i. History | 5 |

| ii. Geography | 5 |

| iii. Economics | 5 |

| iv. Indian Constitution | 5 |

| v. Kerala – Governance and System of Administration | 10 |

| vi. Life Science and Public Health | 6 |

| vii. Physics | 3 |

| viii. Chemistry | 3 |

| ix. Arts, Literature, Culture, Sports | 5 |

| x. Basics of Computer | 3 |

| xi. Important Acts | 5 |

| II. Current Affairs | 15 |

| III. Simple Arithmetic, Mental Ability and Reasoning | 10 |

| IV. General English | 10 |

| V. Regional Language (Malayalam, Kannada, Tamil) | 10 |

Click to join Kerala Bank Assistant Manager Exam Coaching !

Mains Detailed Syllabus

- GENERAL KNOWLEDGE

- HISTORY (5 Marks)

- KERALA – Arrival of Europeans-Contributions of Europeans- History of Travancore from Marthanda Varma to Sree Chithirathirunnal- Social and Religious Reform movement- National movement in Kerala- Literary Sources of Kerala History- United Kerala Movement- Political and Social History of Kerala after 1956.

- INDIA – Political History- Establishment of the British- First War of Independence – Formation of INC- Swadeshi Movement- Social Reform movement- Newspapers – Literature and Arts during the freedom struggle – Independence Movement & Mahathma Gandhi – India’s independent – Post independent period – State reorganization – Development in Science, Education, and Technology – Foreign policy.

- WORLD – Great Revolution in England- American War of Independence – French Revolution- Russian Revolution – Chinese Revolution- Political History after Second World War- UNO and other International Organizations

ii) GEOGRAPHY (5 Marks)

Basics of Geography – Earth Structure – Atmosphere, Rocks, Landforms, Pressure Belt and Winds, Temperature and Seasons, Global Issues- Global Warming- Various forms of Pollution, Maps- Topographic Maps and Signs, Remote Sensing – Geographic Information System, Oceans and its various movements – Continents, – Nations and their specific features.

INDIA – Physiography- States and its features, Northern Mountain Region, Rivers, Northern Great Plain, Peninsular Plateau, Coastal Plain, Climate – Natural Vegetation – Agriculture – Minerals and Industries- Energy Sources, Transport system – Road- Water- Railways- Air.

Kerala – Physiography- Districts and its features – Rivers- Climate – Natural Vegetation – Wild life – Agriculture and research centers – Minerals and Industries – Energy Sources – Transport system – Road – Water- Railway- Air

(iii)ECONOMICS(5 Marks)

India : Economy, Five Year Plans, New Economic Reforms, Planning Commission and Niti Aayog, Financial Institutions, Agriculture – Major Crops, Green Revolution, Minerals. Direct and indirect taxes in India, GST in India- rationale and structure of GST, benefits of GST.

(iv)INDIAN CONSTITUTION(5 Marks)

Constituent Assembly-Preamble-Citizenship- Fundamental Rights, Writs

-Habeas Corpus, Mandamus, Prohibition, Certiorari and Quo warranto. Directive Principles of State Policy- Fundamental Duties- Structure of Governments- Union Executive, Parliament and Judiciary- State Executive, Legislature and Judiciary- Local Self Government Institutions (LSGIs)- Important Constitutional Amendments (42, 44, 52, 73, 74, 86, 91, 97, 101, 102, 103, 104)- Constitutional Authorities and their functions – Comptroller and Auditor General, Attorney General, Advocate General, Election Commission of India, State Election Commission, Union Public Service Commission, State Public Service Commission- Finance Commission- State Finance Commission- GST Council- Distribution of legislative powers- Union List- State List- Concurrent List- Services under the Union and the States- Tribunals-National Commission for Scheduled Castes- National Commission for Scheduled Tribes-

National Commission for Backward Classes- Official Language-Regional Languages-Language of the Supreme Court, High Courts, etc-Special directives relating to languages

(v)Kerala Governance and System of Administration – (10 Marks)

Kerala State Civil Service- Quasi-judicial bodies, various Commissions, Basic facts of socio-economic development- Planning Board-Commercial Planning and Policies- Disaster Management- Watershed Management- Employment and Labour-National Rural Employment Programmes- Land Reforms- Social Welfare and Security- Protection of Women, Children and Senior Citizens- Population, Literacy, E-governance, Delegated Legislation and its controls- Legislative and Judicial controls- Constitutional law remedies against Administrative Arbitrariness- Administrative Discretion and its Controls- Administrative Adjudication-Principles of Natural Justice.

(vi)Life Science and Public Health(6 Marks)

- Basic facts of Human Body

- Vitamins and Minerals and their Deficiency Diseases

- Communicable Diseases and Causative Organisms, Preventive and Remedial Measures

- Kerala – Welfare activities in Health Sector

- Lifestyle

- Basic Health Facts

- Environment and Environmental Hazards

Physics (3 Marks)

- Branches of Physics –Matter – Units, Measurements – Physical

- Motion – Newton’s Laws of Motion – Third law – Momentum – Projectile Motion – Uses of Third Law – Achievements in space missions in India-

- Light- Lens, Mirrors – Problems based on r = 2f – Different phenomena of Light – Rainbow – Colours of different materials – Electromagnetic Spectrum – IR rays- UV rays – X rays – Photoelectric Effect.

- Sound – Different types of Waves – Velocity of Sound in different media – Resonance – Reverberation.

- Force – Different types of Forces – Friction – Advantages and disadvantages of Friction – Liquid Pressure – Buoyant Force – Archimedes Principle – Pascal’s law – Density – Relative density- Adhesive Cohesive forces- Capillarity – Viscous force – Surface tension.

- Gravitation – Centripetal Force – Centrifugal Force – Escape Velocity, Satellites – Escape Velocity – Weight Mass – value of ‘g’- ‘g’ in different

- Heat – Temperature – Different types of thermometers – Humidity – Relative Humidity.

- Work – Energy – Power – Simple problems relating to Work, Energy, Power, Levers – Different types of Levers.

(viii)Chemistry (3 Marks)

- Atom – Molecule – States of Matter – Allotropy – Gas laws – Aqua

- Elements – Periodic Table-Metals &Non metals-Chemical Physical changes- Chemical reactions-Solutions, Mixtures, Compounds.

- Metals-Non metals – Alloys – Acids, Bases – pH value –

-

Arts, Sports, Literature and Culture (5 Marks)

Arts

- Important Audio Visual Art Forms of Kerala- Famous Places, Institutions,

Personalities, Artistes and Writers related to origin, development, extension, and practice of these Art Forms.

Sports

- Famous Sports personalities of Kerala, India and World – their Sports Events, achievements and awards.

- Important Awards – Corresponding Fields , Winners

- Famous Trophies – Related Events and Sports

- Number of Players in Important Sports

- Important Terms associated with various Sports and

- Olympics – Basic Facts, Venues / Countries, Famous Performances and Personalities- India in Olympics-Winter Olympics & Para Olympics.

- Asian Games, Afro-Asian Games, CommonWealth Games, SAF Games – Venues, Countries, Performance of India, other facts.

- National

- Games – Events, Players,

- National Sports / Games , Events of various Countries

Literature

- Malayalam – Important Literary Movements – Icons and their first

- Main works of Literature related to each movement and their

- Writers – Pen name and Nick

- Famous Works and

- Famous Quotes – Books and

- Beginning of Journalism in Kerala – Pioneers, Journals and

- Famous Awards/ Honours – Writers and their

- Malayalam Writers who won the Jnanpith Award and related

- Malayalam Cinema – Origin, Development, Milestones, Pioneers, National

Culture

- Kerala – Important Celebrations -Places associated with such Celebrations, Important Festivals.

- Kerala – Cultural Centres, Worship Places, Cultural Leaders and their

(x)Basics of Computer(3 Marks)

- Hardware

- Input Devices (Names and uses)

- Output Devices (Names and uses/features)

- Memory devices – Primary and Secondary (Examples, Features)

2. Software

- Classification – System software and Application software

- Operating System – Functions and examples

- Popular Application software packages – Word processors, Spreadsheets, Database packages, Presentation, Image editors (Uses, features and fundamental concepts of each)

- Basics of programming – Types of instructions (Input, Output, Store, Control, Transfer) (Languages need not be considered)

3. Computer Networks

- Types of networks – LAN, WAN, MAN (Features and application area)

- Network Devices – Media, Switch, Hub, Router, Bridge, Gateway (Uses of each)

4. Internet

- Services – WWW, E-mail, Search engines (Examples and purposes)

- Social Media (Examples and features)

- Web Designing – Browser, HTML (Basics only)

5. Cyber Wrongs (Awareness Level)

- Types of Cyber Wrongs (Awareness level)

- Information Technology Act, 2000 (Awareness level)

Important Acts (5 Marks)

-

- Right to information: Right to Information Act, 2005- information exempted- third party information- constitution of Information Commissions-powers and functions

- Right to public services: The Kerala State Right to Service Act, 2012

- Protection of consumers: Consumer Protection Act, 2019- rights of consumers

- Protection of vulnerable sections: Protection of Civil Rights Act,

1955- SC & ST (Prevention of Atrocities) Act, 1989- The Kerala State Commission for the Scheduled Castes and the Scheduled Tribes Act, 2007- Kerala State SC/ST Commission- Protection of Human Rights Act, 1993- National Human Rights Commission and State Human Rights Commission- Maintenance and Welfare of Parents and Senior Citizens Act, 2007– The Rights of Persons with Disabilities Act, 2016- The Transgender Persons (Protection of Rights) Act, 2019

- Protection and Safeguarding of Women: Offences against women,

Offences affecting public decency and morality, Dowry Prohibition Act, 1961- National Commission for Women Act, 1990- Kerala Women’s Commission Act, 1991- National and State Commission for Women- Protection of Women from Domestic Violence Act, 2005- The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

- Protection and Safeguarding of Children- Offences against children

Protection of Children from Sexual Offences Act, 2012 (POCSO)- Juvenile Justice (Care and Protection of Children) Act, 2015

- Prevention of corruption and mal-administration- The Prevention of

Corruption Act, 1988- The Central Vigilance Commission Act, 2003- The Lokpal and Lokayuktas Act, 2013- The Kerala Lok Ayukta Act, 1999

- Public servant: Definition – Offences by/against public servants

- The Administrative Tribunals Act, 1985- Central Administrative Tribunal- Kerala Administrative Tribunal – Composition- Powers Current Affairs (15 Marks)

III. Simple Arithmetic, Mental Ability and Reasoning

(i). Simple Arithmetic(5 Marks)

- Numbers and Basic Operations

- Fraction and Decimal Numbers

- Percentage

- Profit and Loss

- Simple and Compound Interest

- Ratio and Proportion

- Time and Distance

- Time and Work

- Average

- Laws of Exponents

- Mensuration

- Progressions

(ii). Mental Ability & Reasoning(5 Marks)

- Series

- Problems on Mathematical Signs

- Verifying

- Analogy- Word Analogy, Alphabet Analogy, Number Analogy

- Odd man out

- Numerical Ability

- Coding and Decoding

- Family Relations

- Sense of Direction

- Time and Angles

- Time in a clock and its reflection

- Date and Calendar

- Clerical Ability

GENERAL ENGLISH

- English Grammar ( 5 Marks)

- Types of Sentences and Interchange of

- Different Parts of

- Agreement of Subject and

- Articles – Definite and Indefinite

- Uses of Primary and Modal Auxiliary Verbs

- Question Tags

- Infinitive and Gerunds

- Tenses

- Tenses in Conditional Sentences

- Prepositions

- The Use of Correlatives

- Direct and Indirect Speech

- Active and Passive voice

- Correction of Sentences

- Degrees of Comparison

ii Vocabulary (5 Marks)

- Singular & Plural, Change of Gender, Collective Nouns

- Word formation from other words and use of prefix or suffix

- Compound words

- Synonyms

- Antonyms

- Phrasal Verbs

- Foreign Words and Phrases

- One Word Substitutes

- Words often confused

- Spelling Test

- Idioms and their Meanings

- Expansion and meaning of Common Abbreviations

REGIONAL LANGUAGE ( 10 Marks)

Malayalam

- പദശുദ്ധി

- വാക്യശുദ്ധി

- പരിഭാഷ

- ഒറ്റപ്പദം

- പരയായം

- വിപരീത പദം

- ൈശൈലിക്ള് പഴഞ്ചൊല്ഞ്ചാല്ലുക്ള്

- സമാനപദം

- േചേര്ത്തൊല്ത്തെഴുതുക്

- സ്ത്രീലിംഗം പുല്ലിംഗം

- വചേനം

- പിരിൊല്ച്ചെഴുതല്

- ഘടക് പദം (വാക്യം േചേര്ത്തൊല്ത്തെഴുതുക്)

Kannada

- Word Purity / Correct Word

- Correct Sentence

- Translation

- One Word / Single Word / One Word Substitution

- Synonyms

- Antonyms

- Idioms and Proverbs

- Equivalent Word

- Join the Word

- Feminine Gender, Masculine Gender

- Number

- Sort and Write

Tamil

- Correct Word

- Correct Structure of Sentence

- Translation

- Single Word 5)Synonyms

- Antonyms / Opposite

- Phrases and Proverbs

- Equal Word

- Join the Word

- Gender Classification – Feminine, Masculine

- Singular, Plural

- Separate

- Adding Phrases

********

NOTE: – It may be noted that apart from the topics detailed above, questions from other topics prescribed for the educational qualification of the post may also appear in the question paper. There is no undertaking that all the topics above may be covered in the question paper.

Kerala Bank Assistant Manager – Finance & Management – Model Exams

| Model Exam | Download PDF |

| Model Exam 1 | |

| Model Exam 2 | |

| Model Exam 3 | |

| Model Exam 4 | |

| Model Exam 5 |

KSCB Assistant Manager Application Process

The applications for KSCB Assistant Manager Recruitment must be submitted online. The steps to apply online are as follows:

Step 1. Visit the KSCB official website.

Step 2. Go to the Careers page. Click on the link to apply for KSCB Assistant Manager Recruitment.

Step 3: Register yourself by providing the required details.

Step 4: Login and fill out the KSCB Assistant Manager online application form. Then upload the documents required.

Step 5: Pay the application fee.

Step 6: Submit the application form and take a printout of the same for reference.

Ace your preparation for kerala Bank Assistant Manager Exam! Get Free Demo Here!

KSCB Assistant Manager Application Fee

All candidates applying for the KSCB Assistant Manager Recruitment are exempted from the payment of the application fee.

KSCB Assistant Manager Selection Process

The selection of candidates for the KSCB Assistant Manager Recruitment is likely to be based on the following stages:

- Online examination – Prelims and Mains

- Interview.

KSCB Assistant Manager Eligibility Criteria

Candidates applying for the recruitment must ensure that they fulfill the following KSCB Assistant Manager Eligibility Criteria in terms of their age, qualification, etc., in order to avoid disqualification of their applications.

KSCB Assistant Manager Qualifications

To be eligible for the KSCB Assistant Manager recruitment, applicants must have the following qualifications:

| Category | Qualifications |

| General |

|

| Society |

|

KSCB Assistant Manager Age Limit

The age of the candidates must be within the following limit:

| Category | Age Limit |

| General |

|

| Society |

|

Best of luck with your preparation for your upcoming exam!

| Kerala PSC Kerala Bank Assistant Manager Exam Information Links | |

| KSCB Assistant Manager Recruitment | Kerala Bank Recruitment Rules |

| KSCB Assistant Manager, PSO Notification | KSCB Assistant Manager Model Questions |

| KSCB Assistant Manager Exam Date | KSCB Assistant Manager Study Materials |

| KSCB Assistant Manager Application Form | KSCB Assistant Manager Interview Questions |

| KSCB Assistant Manager Vacancy | KSCB Assistant Manager Job Profile |

| KSCB Assistant Manager Admit Card | KSCB Assistant Manager Salary |

| KSCB Assistant Manager Study Plan | KSCB Assistant Manager Preparation Tips |

| KSCB Assistant Manager Best Books | KSCB Assistant Manager Result |

| KSCB Assistant Manager Eligibility | KSCB Assistant Manager Cut Off |

| KSCB Assistant Manager Selection Process | KSCB Assistant Manager Exam Analysis |

| KSCB Assistant Manager Mock Test | KSCB Assistant Manager Answer Key |

Frequently Asked Questions

Q1. When was Kerala Bank Assistant Manager Notification Published?

Ans: Kerala Bank Assistant Manager Notification was published on 30th October.

Q2. What is the Salary of Assistant Manager Post?

Ans: The pay scale of Assistant Manager post is Rs. 22,200- 48,000/-.

Q3. What is the last date to apply online?

Ans: Last date to apply online is November 29.

Q4. What is the exam pattern for KSCB Assistant Manager exam?

Ans: KSCB Assistant Manager prelims and mains exams consist of 100 marks each and Interview is conducted for 20 marks

Q5. What is the selection process for KSCB Assistant Manager exam?

Ans: KSCB Assistant Manager exam consist of two stages of written examination – prelims and mains and Interview